Physical platinum ownership

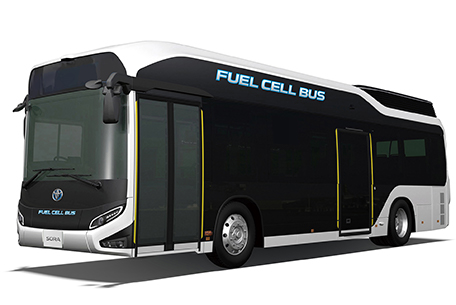

Platinum is valued not only for its industrial applications like fuel-cell components, but also its precious metal status. Savvy Japanese investors know that adding platinum to an investment portfolio can have diversification benefits, reducing volatility, especially for portfolios with significant equity and real estate exposure.

Retail investors in Japan have been investing in precious metals for decades, with the purchase of kilogram and smaller platinum ingots produced by Japanese precious metals refiners and, more latterly, through exchange traded funds.

The demand for physical platinum was further fuelled by the introduction of Platinum Accumulation Plans (PAPs) in the early 1980s. Unique to Japan, PAPs enable individuals to pay a monthly amount into an account in order to purchase platinum, a core part of their retirement savings.

Each month their balance of physically-owned platinum accrues, although they are free at any time to sell all or part of their balance, or withdraw it in the form of bullion, coins or jewellery.

With the highest per capita consumption of platinum jewellery globally, platinum accounts for over 50 per cent of jewellery sold in Japan and recent developments in its jewellery market have seen platinum continuing to take market share over white gold.

Platinum is well established as the metal of choice in the bridal sector, as well as through the sale of ‘kihei’ chains, a heavy type of men’s chain that is purchased for investment purposes.