12 February 2026: Factors underpinning platinum’s all time high price remain entrenched: After a final 25% surge, which lasted only three weeks, the record platinum price rally reset between 29 January and 02 February 2026 before finding support levels that lifted platinum back above US$2,000/oz. Platinum’s fundamentals have not changed with a shortage of metal still evident by high lease rates and strong OTC backwardation.

Platinum Perspectives

WPIC® research is free of charge. It can be consumed by asset managers under MiFID II

15 January 2026: Some exchange stock unwinding possible on US S232 carrot before stick approach, although trade risks persist: Some exchange stock unwinding possible on US S232 carrot before stick approach, although trade risks persist: A US presidential review of the Section 232 (S232) investigation into critical minerals concludes that action is needed to protect national security. In a softer approach than seen previously, the initial focus is on trade negotiations, while retaining the option to bring in tariffs or quotas. This may present an opportunity to take advantage of the international market tightness by unwinding some of the excess platinum warehouse inventories. However, the capricious nature of the current US administration and uncertain timeline means assuming future metal imports will be unencumbered comes with risks.

6 January 2026: PEM capacity growth revised downward in IEA update, dampening platinum demand despite rising electrolysis : Downward revisions to PEM capacity in the International Energy Agency’s (IEA) updated hydrogen outlook reduce near-term platinum demand but reinforce platinum’s long-term role in hydrogen: This Platinum Perspectives reviews the 2025 IEA electrolyser update, which shows downward revisions to medium-term capacity additions and modestly reduced PEM deployment. Combined, these reduce the probability adjusted electrolysis demand for platinum by 12% through 2030.

4 December 2025: Fear of Section 232 outcome in the US is key to PGM trade uncertainty and the availability of exchange stocks: The Section 232 investigation in the US is key to PGM trade uncertainty and the availability of exchange stocks: Our base case assumption is that the US chooses not to enact tariffs or trade quotas on PGMs. However, the threshold for an S232 recommendation affirming a threat to national security is relatively low, meaning that PGM tariffs or import quotas cannot be totally ruled out. Fear of such actions may reduce the availability of CME warehouse stocks and their ability to help ease tight markets and soften high lease rates.

25 November 2025: Launch of GFEX platinum and palladium futures and options supports China demand growth: Launch of GFEX platinum and palladium futures and options supports China demand growth: Physically settled platinum and palladium futures will begin trading on the GFEX on 27 November. These contracts should help grow platinum demand in China due to improved price risk management, increased investment and greater liquidity, as well as raising the influence of China’s future demand expectations on global price discovery.

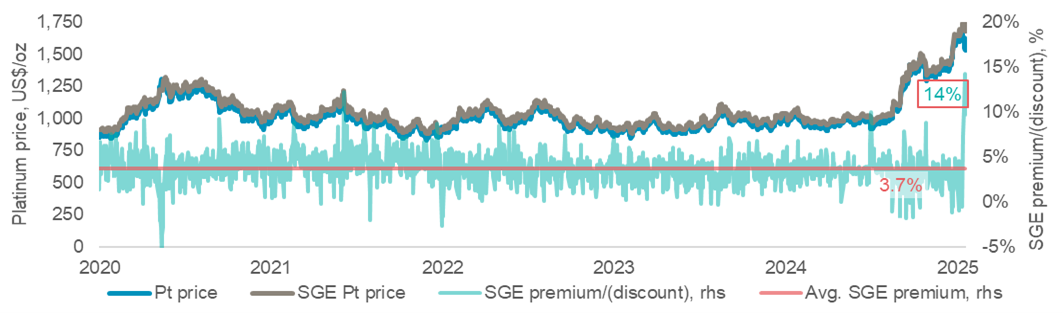

22 October 2025: The removal of VAT exemptions on platinum imports will increase the cost of platinum in China: The removal of VAT exemptions on platinum imports will increase the cost of platinum in China: China has announced amendments to Value-Added Tax (VAT) policies. The amendments include the cancellation of the 13% VAT exemption on platinum imports from 1 November 2025. Cancelling platinum imports’ VAT exemption will put upward pressure on Shanghai Gold Exchange (SGE) platinum quotes which may, in turn, negatively impact China’s historically price sensitive platinum demand.

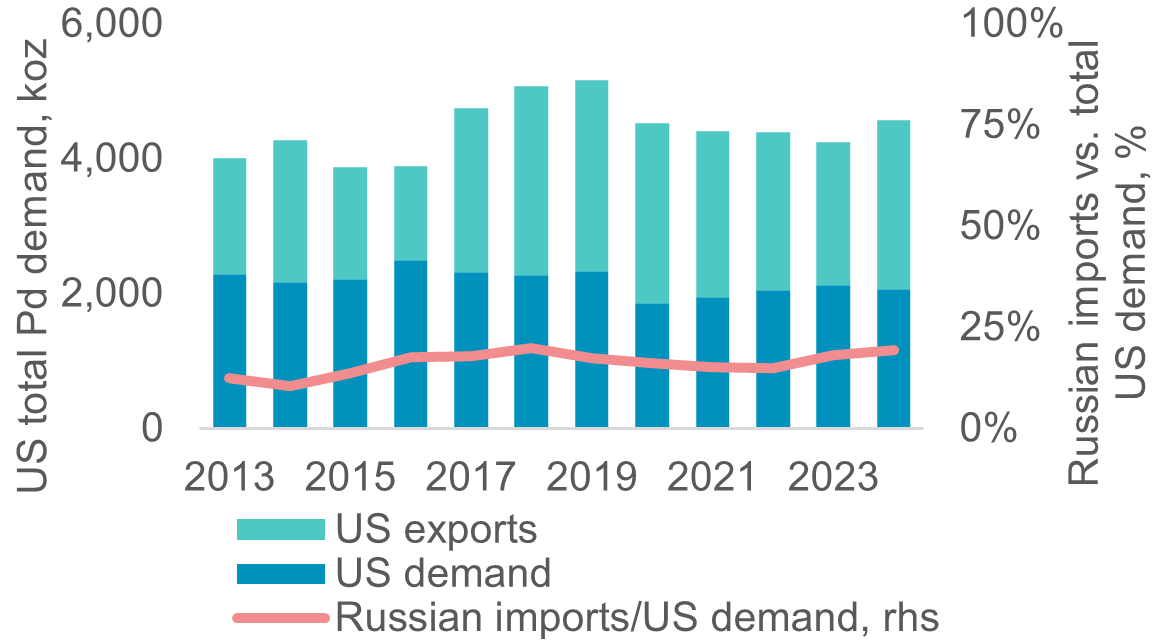

17 October 2025: US trade action on Russian palladium aims to protect domestic producers but may tighten supply and lift prices: US trade action on Russian palladium aims to protect domestic producers but may tighten supply and lift prices: Sibanye-Stillwater together with the United Steelworkers union have filed antidumping and countervailing duty petitions against Russian unwrought palladium imports. Duties on Russian palladium will likely restrict imports and tighten domestic markets since higher US domestic production and trade re-routing will take time to implement. Accordingly, US palladium prices could experience some continued upward pressure on exacerbated trade restrictions.

12 August 2025: Platinum ETF selling after c.50% price increase, offset by strength in bar and coin, jewellery, and exchange stocks: Platinum ETF selling after c.50% price increase, offset by strength in bar and coin, jewellery, and exchange stocks: The strong year-to-date platinum price increase of ~50% has led to some selling by exchange traded fund (ETF) investors. In our view, ETF outflows are unlikely to materially narrow the substantial platinum market deficit forecast for 2025 since, 1) Chinese jewellery and bar and coin investment demand has been stronger than anticipated through H1 2025 and 2) tariff risks have led to a re-accumulation of metal into NYMEX exchange stocks.

5 August 2025: Deregulating US emissions legislation intends to remove EV mandates and should not negatively impact PGMs: Deregulating US emissions legislation intends to remove EV mandates and should not negatively impact PGMs: The US’ Environmental Protection Agency (with probable Whitehouse influence) has proposed repealing greenhouse gas emissions standards for vehicles. Our view is that these actions reflect moves against electric vehicle mandating, further slowing BEV adoption, but with the agency simultaneously noting that legislation regulating criteria pollutants (NOx, CO, etc.) will be unaffected. Accordingly, as catalytic convertors support the reduction of criteria pollutants, PGM demand should be unaffected.

29 July 2025: Platinum market tightness persists, despite ETF and exchange stock outflows: Platinum market tightness persists, despite ETF and exchange stock outflows: The over 50% year-to-date increase in the platinum price, together with easing tariff fears (albeit temporary) have resulted in almost 300 koz coming out of ETFs and exchange stocks, since the start of Q2 2025. Despite this significant injection of metal supply, lease rates remain elevated. Strong imports into China and some reemergence of tariff risks are keeping markets tight. At current prices, this may only be solved by a shift to purchasing instead of leasing by end-users and/or increased recycling or mine supply.