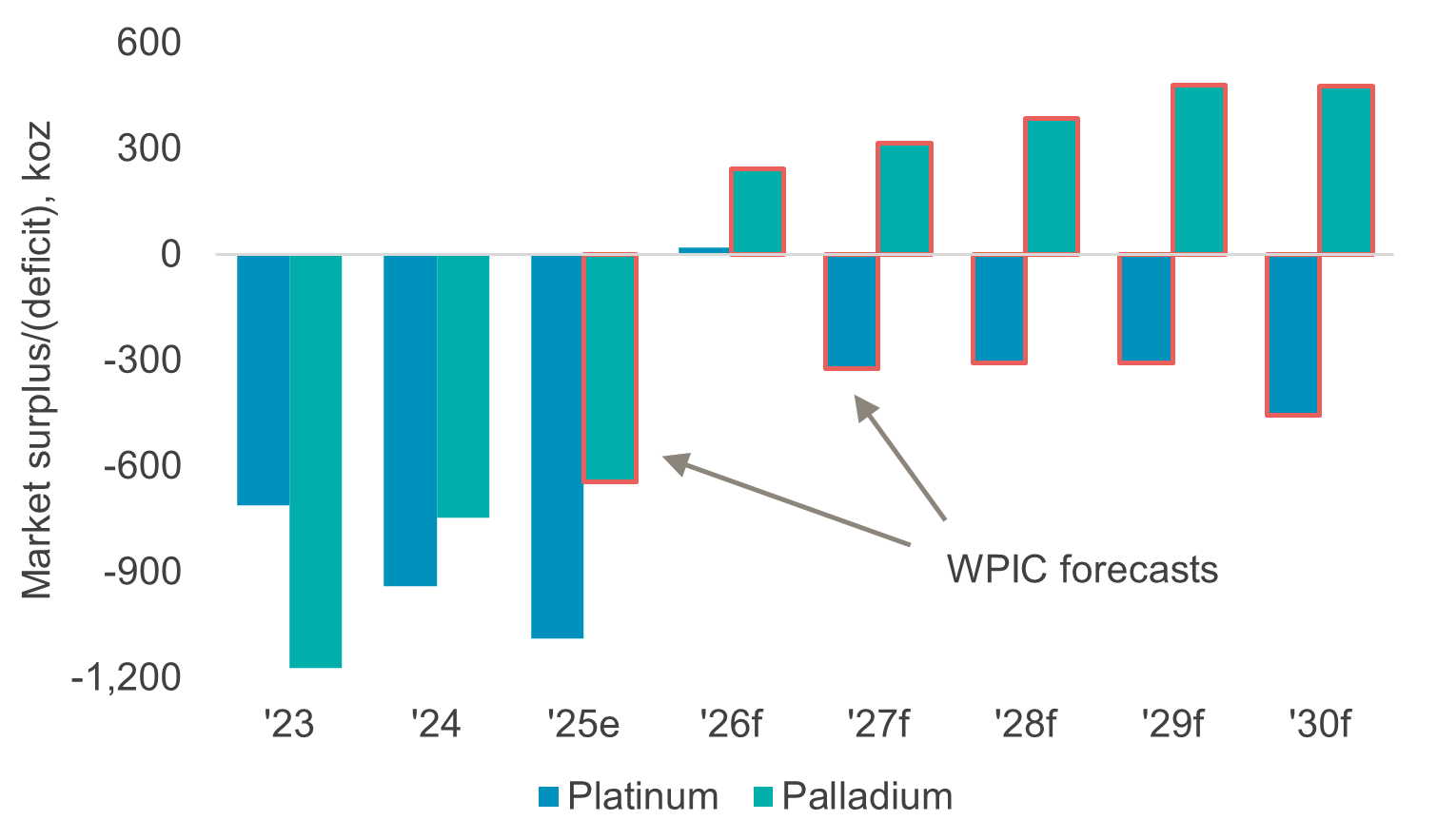

22 January 2026: January 2026 five-year supply/demand outlook; market deficits to narrow compared to the past three years. Five-year supply/demand outlook; market deficits to narrow compared to the past three years. This Platinum Essentials leverages market developments seen during 2025 into our medium-term supply/demand outlook while including a first forecast for 2030f for the platinum and palladium markets. The key feature of 2025 was platinum’s strong price performance (+127%) which was underpinned by both macropolitical and fundamental market factors. In 2026, the investment outlook for platinum along with the broader precious metals’ asset class remains compelling given persistent external shocks. However, platinum’s price increase, if sustained, will impact the longer-term supply demand outlook by supporting supply and eroding some demand at the margins. We now expect platinum market deficits to average 348 koz from 2027f to 2030f, which equates to ~4% of demand and less than the ~8% previously forecast.

Platinum Essentials

Platinum is the world’s most precious metal.

Now more accessible and attractive to investors than ever beforeTrevor Raymond, CEO,

World Platinum Investment Council

6 November 2025: Sustainable Aviation Fuel (SAF) growth positions platinum as a key driver of the aviation energy transition. Sustainable Aviation Fuel (SAF) is emerging as a major driver of long-term platinum demand as the aviation sector decarbonises: SAF pathways - including Hydroprocessed Esters and Fatty Acids (HEFA), Fischer-Tropsch (FT), and Power-to-Liquid (PtL) - rely on platinum for isomerisation and as a promoter in cobalt catalysts, with PtL being the most platinum-intensive. SAF production is expected to scale from less than 0.2% of global jet fuel today to over 25% (~140 Mt p.a.) by 2050f, driving annual platinum demand from SAF to rise nearly ninefold to over 260 koz. Overall, SAF more than offsets the expected longer-term decline in petroleum refining-related platinum use, reinforcing platinum’s importance to the energy transition.

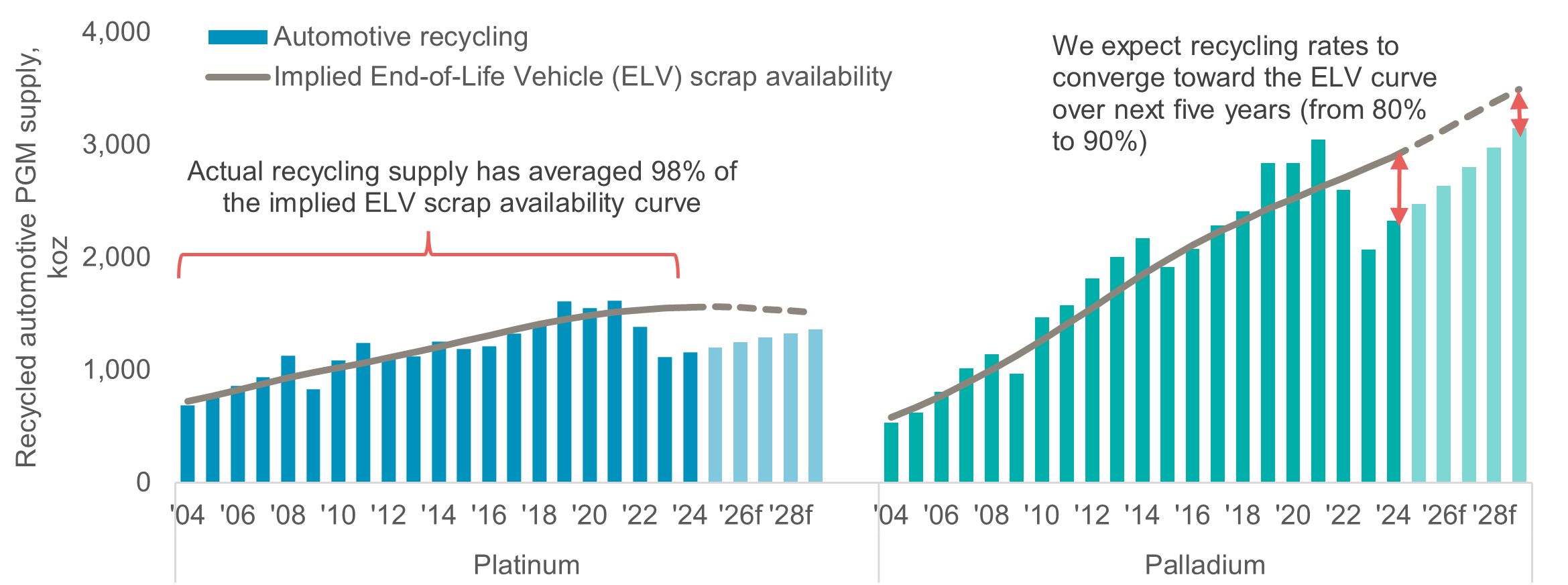

20 August 2025: End of life autocatalysts are a key source of recycling supply, however, only at economically viable PGM prices. End of life autocatalysts are a key source of recycling supply, however, only at economically viable PGM prices: We assess the value chain associated with recycling platinum group metals (PGMs) within the automotive industry. Recycled automotive PGM supply has recently been more price elastic than traditionally believed, explaining why recycling supply forecasts heavily undershot from 2022 to 2024. Higher PGM prices in 2025 should stimulate supply growth but we expect platinum automotive recycling supply to remain below the peak levels reported in 2021. Overall, we expect supply limitations to contribute to platinum remaining in a deficit through 2029f.

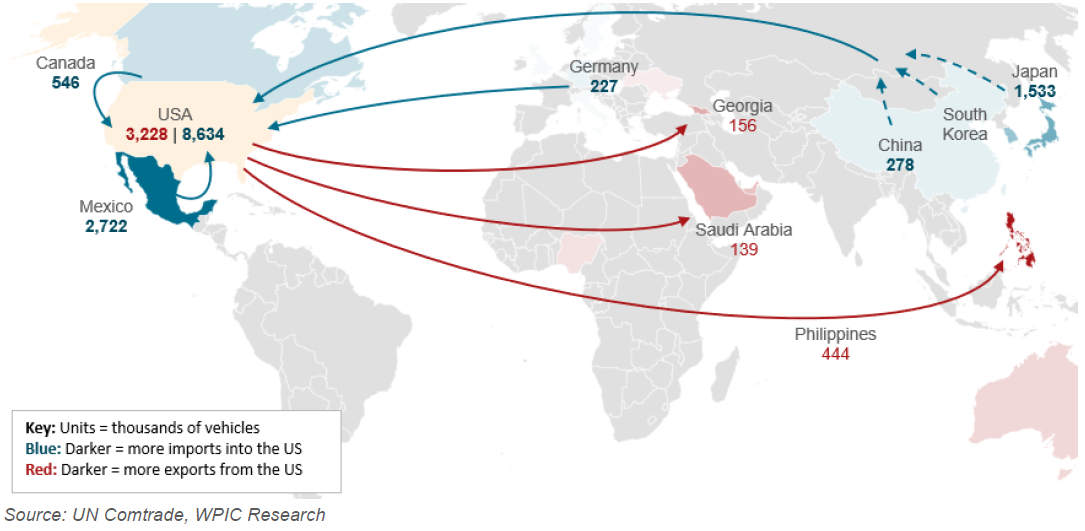

31 March 2025: US vehicle tariffs are modestly negative for PGM demand, but contagion may aggravate tight Pt market conditions. US vehicle tariffs are modestly negative for PGM demand, but contagion may aggravate tight Pt market conditions: The US is the second largest automotive market globally and is served by an international supply chain. Tariffs of 25% on automotive imports could negatively impact annual vehicle sales by 1.7 million units which translates to only 70 koz of platinum and 269 koz of palladium. Lower PGM recycled supply could further reduce the net impact of tariffs, which suggests underling PGM market balances are unlikely to materially change. Fears of further tariffs on PGM imports could have a more significant near-term effect.

16 January 2025: Jewellery market growth returns as China’s decline halts, strong ex-China growth continues and platinum’s discount to gold results in price parity with white gold. Jewellery market growth returns as China’s decline halts, strong ex-China growth continues and platinum’s discount to gold results in price parity with white gold: After a decade of declining platinum jewellery demand, the market appears to have troughed and we are forecasting future growth in demand at a 2% CAGR through 2028. Furthermore, several emerging factors add upside potential to demand. These include price linked switching from white-gold, which is approaching price parity with platinum at the consumer level, technology advancements in platinum alloys lowering production costs, and the increasing availability of price risk management tools.

29 October 2024: WPIC’s platinum price attribution model examines the factors that establish platinum value in the market. WPIC’s platinum price attribution model examines the factors that establish platinum value in the market: A key question market participants are asking is why hasn’t the platinum price reacted to recent market deficits? In response the WPIC has developed a Platinum Price Attribution Model to explain what key observable variables can be utilised as indicators to explain price movements. The key conclusions are that the main price influencing factors evolve over time, and that since 2011, market-economic and sentiment factors have had higher influence than fundamentals. Looking ahead, we expect underlying fundamentals, reflected as market deficits, to return to being the most important price setting factor.

31 July 2024: The slowdown in BEV market growth is driving investor interest in platinum on a higher-for-longer ICE automotive thesis; are budget BEVs a threat to this outlook? Despite some future BEVs mooted to achieve €25,000 prices (or below), we do not expect these to lift overall declining BEV growth as they account for only 15% of new car listings in developed economies and are ultimately less cost-effective for a cohort of buyers that typically do not have access to cheaper at-home charging. This reports highlights that striving for an affordable price does not implicitly imply “price parity” with ICE/hybrid vehicles and that cumulatively 2E PGM automotive demand erosion of 1.4% CAGR between 2023 to 2028f will prove more resilient than many would have expected.

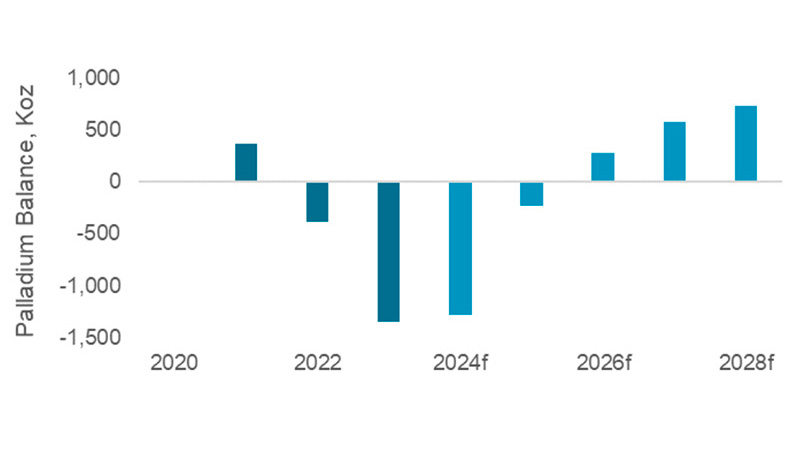

29 May 2024: Updated palladium supply/demand outlook: Reduced supply and stronger near-term demand prolong larger deficits. In this Platinum Essentials we present our palladium supply/demand estimates for 2024 to 2028. Our analysis reaffirms an expectation that palladium markets will transition to sustained market surpluses, but timing is highly contingent upon the recovery of palladium recycling supply. Initially, we project tightening deficits for 2024 and 2025, moving to surpluses from 2026, driven by a significant increase in palladium recycling supply of over 1.3 Moz p.a. by 2028. The surplus is delayed by one year compared to our previous forecast, due to more resilient automotive demand and a slower-than-expected recovery in autocatalyst recycling. Any delays to solving these issues could easily slow the pace of the growth in recycling supply, resulting in deeper and more persistent deficits and further postpone the surplus.

30 April 2024: Unpacking the economics of the hydrogen economy reinforces conviction that platinum demand will benefit from a major new emerging end-market. WPIC expects hydrogen end-uses to account for 11% of total annual platinum demand by 2030 (~875 koz). Platinum’s largest opportunity within the hydrogen economy lies with fuel cell electric vehicles (FCEV), particularly heavy-duty. While initial FCEV adoption has been slow, the economic hurdles are receding with HD FCEVs projected to reach cost parity with diesel by 2030 in Europe and China. Accordingly, we expect that the HD FCEV market share will increase to 5% by 2030. This results in platinum demand growth from hydrogen end markets, which almost offsets declining autocatalyst demand leaving platinum markets in consecutive deficits of around 430 koz on average between 2025 to 2028.

1 April 2024: Hydrogen 101 – An introduction for investors. This 101 report unpacks and explains hydrogen and the hydrogen economy as well as the important role played by platinum in the production and use of hydrogen. Hydrogen serves as a versatile energy carrier, capable of being produced from renewable energy sources and applied across various mobility and industrial sectors to facilitate decarbonisation. Platinum and other PGMs are set to play a pivotal role through their inclusion in electrolysers and Proton Exchange Membrane (PEM) fuel cells. Recognising hydrogen's pivotal role in achieving net-zero emissions, its integration into various sectors is inevitable.