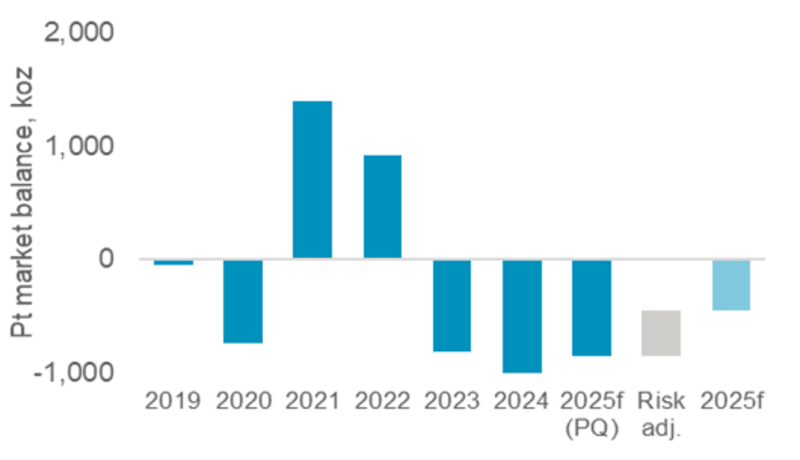

26 June 2025: Platinum supply and demand are price inelastic in the short-term, leading to sustained market imbalances: Platinum market deficits to persist as inelastic supply and demand are unlikely to react to rising prices: Despite the platinum price reaching a ten-year high, both supply and demand are expected to continue to show limited short-term price sensitivity. Costs, the economics of byproduct metals, and long lead times are constraints on mine supply. From a demand perspective platinum is essential in the majority of its end uses, especially in automotive and industrial applications, making them largely price inelastic in the near-term. As a result, the platinum market is still expected to post a near million-ounce deficit in 2025f.

Platinum Perspectives

WPIC® research is free of charge. It can be consumed by asset managers under MiFID II

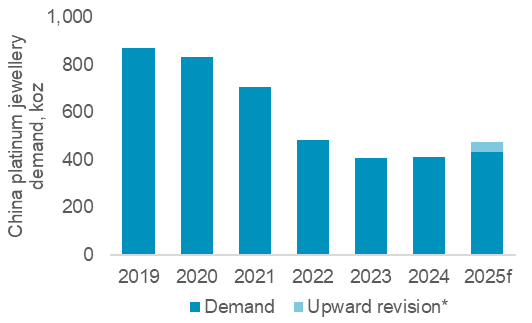

30 May 2025: Chinese platinum jewellery fabrication is growing rapidly as consumers turn away from expensive gold: Chinese platinum jewellery fabrication is growing rapidly as consumers turn away from expensive gold: In response to an exceptional rally in the gold price, which has weighed on demand and balance sheets, jewellery fabricators have shifted some inventory to lower priced platinum. With ten new platinum jewellery showrooms opening in Shuibei, China, so far in 2025, forecasts for China’s platinum jewellery fabrication demand have been revised upwards from 5% growth originally to 15% year-on-year growth to 474 koz in 2025f.

10 April 2025: Structural platinum market deficits will persist despite US tariffs and associated GDP risks: Structural platinum market deficits will persist despite US tariffs and associated GDP risks: The US’s imposition of wide-ranging tariffs on trading partners risks pushing the global economy into a recession or, at the very least, slowing GDP growth. Assessing the downside risks for platinum demand, we have used the supply chain disruptions of 2021/22 as a point of reference where platinum demand was its lowest in our time series. Positively, our conclusion is that structural demand changes, mitigate some downside scenario risks where platinum demand reductions are insufficient to eliminate the embedded deficit of 848 koz forecast for 2025.

28 March 2025: Platinum market deficit boosted by tariff-linked exchange stock movements that are unlikely to unwind anytime soon: Platinum market deficit boosted by tariff linked exchange stock movements that are unlikely to unwind anytime soon: The fear that tariffs will result in platinum being unavailable in the US at current prices has resulted in a steepening of the forward curve and significant inflows into NYMEX approved warehouses. Whilst trade tensions persist, we expect exchange stocks to remain elevated, but if tensions ease, only with material exchange stock outflows from current levels would the forecast 2025 deficit of 848 koz begin to reduce.

7 February 2025: Trump’s policies and the PGM markets Part 3: Rolling back environmental commitments and ‘Drill, baby, drill!’: Trump’s policies and the PGM markets Part 3: Rolling back environmental commitments and ‘Drill, baby, drill!’: Trump’s reductions of the US’s environmental commitments and “green” incentives, as well as his focus on increasing oil production, are expected to be net positive to PGM demand. Slower US BEV adoption increases PGM demand with each 1% reduction in BEV market share increasing 2E PGM demand by 25 koz per annum, which should more than offset any platinum demand lost from the US’s hydrogen plans.

3 February 2025: Trump’s policies and the PGM markets Part 2: A number of potential headwinds for platinum demand and pricing: Trump’s policies and the PGM markets Part 2: A number of potential headwinds for platinum demand and pricing: Trump’s economic policies are, in aggregate, expected to be negative for near-term platinum demand and prices. Protectionist activities and tariffs are viewed as inflationary, which is likely to lead to a slowdown in the FED’s rate cutting trajectory and support a stronger US dollar. We note that our Platinum Price Attribution Model (PPAM), highlights the inverse relationship of platinum prices with the US 10-year yield and US$:ZAR exchange rate respectively. Inflation will also pressure consumers’ pockets, which could negatively impact platinum demand from the automotive and jewellery sectors, where demand is positively correlated to the platinum price (per our PPAM).

24 January 2025: Trump’s policies and the PGM markets Part 1: US trade tariffs could reduce Pt and Pd demand by 1% and 4%: Trump’s policies and the PGM markets Part 1: US trade tariffs could reduce Pt and Pd demand by 1% and 4%: Trump’s threat to enact trade tariffs is causing tension in the platinum markets. This Platinum Perspectives addresses the potential negative impact of tariffs, which could reduce annual platinum demand by 100 koz or 1% of total demand if 25% tariffs are placed onto Canadian and Mexican automotive imports. In two upcoming Platinum Perspectives, we will discuss the impact on PGM demand from 1) Trump’s policies on emission standards and “green” incentives, and 2) the broader economic impact of Trump’s policies.

28 November 2024: Platinum’s positive price seasonality may be accentuated by recycling supply risks through early 2025: Platinum’s price seasonality may be accentuated by recycling supply risks through 2025: Over the past 25 years, the platinum price has shown the strongest positive price seasonality from December to February. This trend corresponds to seasonally weak mining supply as South African producers return from the year-end holiday period. Heading into 2025, historic seasonality may be accentuated if the projected recovery in recycled platinum supply continues to be deferred, as has been seen in previous years.

15 October 2024: Can platinum market deficits be met by ETFs? Yes, but only at much higher prices: Platinum ETFs could be a source of supply to help meet forecast significant market deficits, but only at much higher prices: A common assumption is that platinum prices will not respond to consecutive years of market deficits since exchange traded fund (ETF) disposals will offset metal shortfalls. While ETFs can act as a source of supply, it is incorrect to assume holders are price agnostic as they are looking to make a return on investment and will look to sell at a level above their cost of acquisition. Based on historic palladium market behaviour, platinum ETF disposals may occur if prices are above the US$1,100/oz weighted average cost of ETF holdings, but large disposals will require much higher platinum prices.

15 August 2024: Policy certainty is accelerating hydrogen electrolyser approvals and supporting platinum’s investment case: Policy certainty is accelerating hydrogen electrolyser approvals and supporting platinum’s investment case: In the past month, four large-scale European electrolyser projects (>100 MW) have passed their final investment decisions (FID) following clear policy setting and growing government funding. This has seen the amount of European electrolysis capacity reaching FID increase by c.33%. Industry confidence in green hydrogen continues to grow; WPIC forecasts hydrogen-linked platinum demand to grow from c.40 koz in 2023 to 476 koz by 2028f. The hydrogen economy is a substantial new end market for platinum, reinforcing the demand strength of platinum’s investment case.