18 July 2024: Shanghai Platinum Week 2024: Key take aways from China’s dynamic platinum market: Shanghai Platinum Week 2024: Key take aways from China’s dynamic platinum market: China is the largest consumer of PGMs globally, however, it remains an opaque market to the rest of the world. Equally, China’s domestic PGM users do not have a good understanding of international market dynamics including supply chains in the rest of the world. Shanghai Platinum Week (SPW) presents a unique opportunity for a global gathering of PGM industry stakeholders. This report highlights insights of the conference and associated site visits, which will have an influence on our understanding of the Chinese PGM market. The conference itself was attended by more than 500 in-person delegates, with the live stream feed watched by an aggregate of more than 770 thousand people! The key takeaways from SPW reinforced platinum’s strong investment case, as challenges weigh on supply while demand finds support across a diverse number of end-uses, which emphasise some of the dynamic PGM trends within China. Our research team is available to discuss these and other findings in more detail.

Platinum Perspectives

WPIC® research is free of charge. It can be consumed by asset managers under MiFID II

19 June 2024: Politics and policy changes could further benefit the investment case for platinum : Politics and policy changes could further benefit the investment case for platinum: Recently announced US and EU tariffs on Chinese vehicle imports, as well as changes to the European and South African political landscape, could further support the positive investment case for platinum. Automotive PGM demand could remain higher for longer if BEV tariffs and weaker green legislation slow BEV uptake in the large US and EU vehicle markets. While SA PGM mine supply may reduce further from the economic liberalisation and reforms that a government of national unity could provide.

4 June 2024: Any delays to forecast recycling recovery will prolong larger deficits in the palladium market: Any delays to forecast recycling recovery will prolong larger deficits in the palladium market: WPIC forecasts deficits for 2024 and 2025, followed by surpluses from 2026 onwards. The transition to surplus is contingent on a significant increase to recycling, predicated on a number of existing recycling challenges being resolved. Any delays to solving these could slow the pace of the anticipated growth in recycling supply, resulting in deeper and more persistent deficits in the short to medium term. This could in turn feed into value expectations and provide upward support for the palladium price, especially in the context of any potential short covering rallies.

17 May 2024: London Platinum Week’s key themes risk deepening deficits, supporting the compelling investment case: London Platinum Week’s key themes risk deepening deficits, supporting the compelling investment case: London platinum week was dominated by two themes, downside risks to recycling supply, and higher-for-longer automotive PGM demand stemming from ICE containing vehicles (mainly hybrids), compensating for slowing battery electric vehicle (BEV) growth. Both topics are ones we have highlighted previously, and both have the potential to deepen the ongoing market deficits forecast through 2028. There was equally interesting insight from what was not widely discussed, namely mine supply and hydrogen, both now considered to be longer-term in their impact.

2 May 2024: Hybrid and EREV market share growth overtaking BEV supports higher-for-longer automotive PGM demand: Hybrid and EREV market share growth overtaking BEV supports higher-for-longer automotive PGM demand: PGM sentiment has been affected by the drivetrain transition where rising BEV market share weighs on PGM demand expectations. In reality, explosive BEV growth has slowed and is being comfortably outpaced by PGM-containing hybrids and extended range electric vehicles (EREVs) that support a ‘higher-for-longer’ automotive PGM demand outlook. Accordingly, WPIC forecasts only a muted tapering of PGM automotive demand over the next five years at 1.1% CAGR, suggesting demand erosion projections are overdone.

18 April 2024: Latest Russia sanctions unlikely to impact near-term PGM markets, but there may be longer term benefits: Latest Russia sanctions unlikely to impact near-term PGM markets, but there may be longer term benefits: Russia accounted for 28% of primary 2E PGM supply in 2023 as a by-product of base metal mining from polymetallic ore bodies. We see a limited impact from the latest round of base metal sanctions; like after the April 2022 PGM sanctions by the London Platinum and Palladium Market, metal will continue flowing. However, the latest sanctions probably eliminate any expectations of supply growth from Russia, which given its importance to class 1 nickel markets may slow BEV growth rates and support higher for longer ICE PGM demand.

28 March 2024: Revised US emission timelines support higher for longer PGM demand : Revised US emission timelines support higher for longer PGM demand: The United States has finalised its vehicle emission reduction targets for 2032. These targets are unchanged from those proposed in April 2023, however, the interim thresholds leading up to the 2032 targets have been made more lenient. This follows a growing global trend of concessions on emission reduction timelines which cumulatively extends the role of ICE vehicles mainly through hybrid technology, which supports higher for longer ICE demand for PGMs.

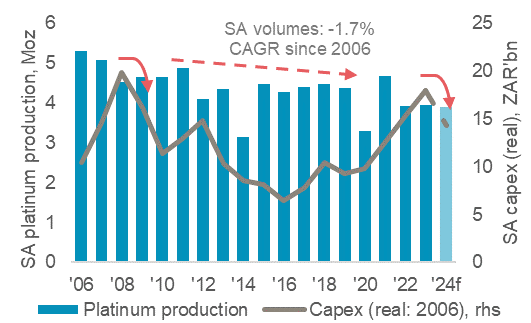

27 March 2024: Platinum’s supply risks cannot be overlooked as PGM prices remain weak and miners reduce capex: Platinum’s supply risks cannot be overlooked as PGM prices remain weak and miners reduce capex: South African PGM miners have all announced cost focussed restructuring in response to a lower PGM basket price during 2023. While restructuring announcements are not expected to materially impact near-term production, supply risks cannot be overlooked. Previous instances of declining capex have contributed to a slow decline in output. Should future supply match past reduced-capex trends, a supply risk of -250 koz per annum by 2028 could materialise and further deepen projected market deficits.

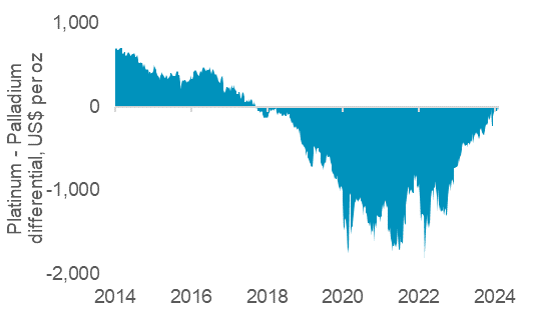

27 February 2024: With palladium oversold and platinum’s attractive fundamentals, both metals have upside : With palladium oversold and platinum having attractive fundamentals, both metals have price upside: Palladium’s recent price fall to platinum sees the sister metals now priced at near parity for the first time since 2018. This palladium price fall has been long-expected, due to forecasts of palladium moving into surplus from 2025. However, a build in net managed money short positions leaves it vulnerable to short squeezes, and a potential delay to recycling growth could keep the market in deficit for longer. In contrast, platinum’s fundamentals are much more attractive, with the current market deficit expected to continue until at least 2028. This should be reflected in the price after excess automaker inventory management has run its course.

_129341.png?v1)

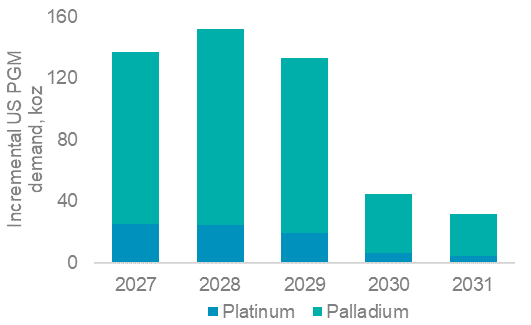

24 January 2024: Platinum for palladium substitution is embedded into automotive demand and unlikely to reverse swiftly : Platinum for palladium substitution is embedded into automotive demand and unlikely to reverse swiftly: Platinum for palladium autocatalyst substitution is expected to reach 700 koz in 2024f, up from 620 koz in 2023f. Our analysis shows that there are no economic incentives and a number of risks to reversing this process. Furthermore, the process of reverse substitution will be slow, even if it does occur. Thus, existing substitution is largely embedded in annual automotive demand for the medium term.