19 December 2023: South Korea’s H2 plans support future platinum demand : South Korea’s strategy to decarbonise its highly industrialised economy relies heavily on using green hydrogen, which will result in it becoming a significant platinum demand hub. South Korean hydrogen linked demand for platinum is expected to reach 300 koz pa by 2030, from its use in electrolysers to produce green hydrogen and its inclusion in Fuel Cell Electric Vehicles.

Platinum Perspectives

WPIC® research is free of charge. It can be consumed by asset managers under MiFID II

_440099.png)

_249405.png)

7 December 2023: Sustained recycling challenges could deepen platinum supply-demand deficits: Sustained recycling challenges could deepen platinum supply-demand deficits: An examination of factors influencing constrained recycled autocatalyst supply suggests that challenges which were previously deemed short-term may be multi-year considerations. Lower automotive scrap was initially attributed to suppressed new vehicle production because of disruptions from COVID and the semiconductor shortage. However, with light vehicle recovering in 2023, automotive recycling has continued to shrink. Should automotive recycling rates not recover and stabilise at the 2024 forecast levels, platinum supply could be reduced by an aggregate 900 koz between 2025f to 2027f.

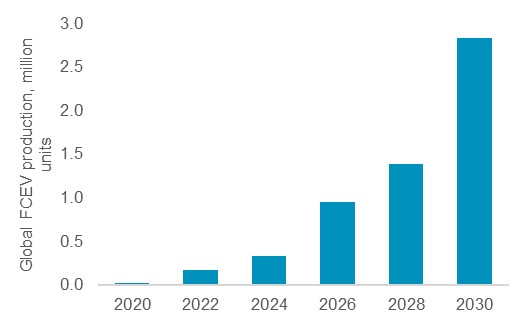

26 October 2023: Hydrogen Tech Expo: Evidence of growing momentum, with platinum set for key role as a transition metal : The hydrogen economy is building momentum, with electrolysis and fuel cell markets expected to account for up to 20% of total platinum demand by 2030. WPIC attended the European Hydrogen Tech Expo. Participants highlighted key developments in decarbonisation policy over the past twelve months. Better policy certainty is expected to accelerate investment decisions. Green H2 electrolysis is expected to increase 30-fold to ~500 GW by 2035 while levelised costs will reach parity with grey H2 in the next decade. This report offers a snapshot of developments in fuel cell use in automotive transport from the Expo.

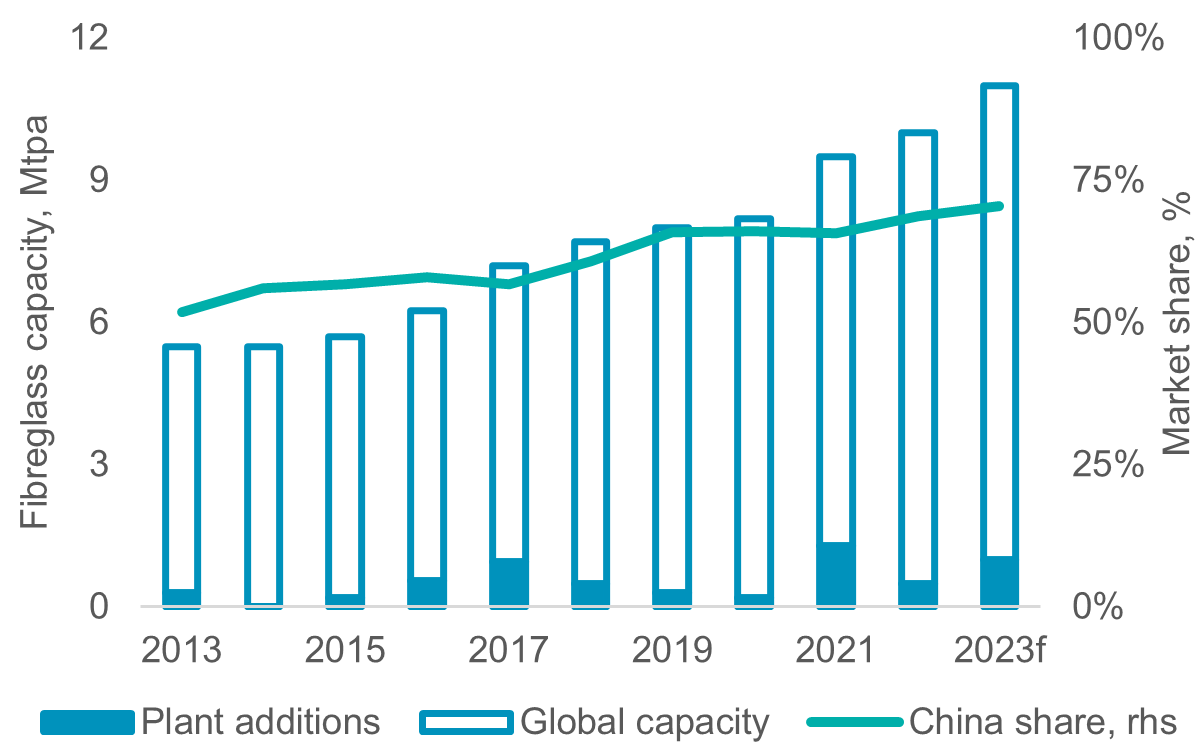

27 September 2023: China’s demand for glass fibre continues to grow, supporting ongoing platinum industrial demand growth: Strong growth in global glass and glass fibre demand has been a major factor behind platinum industrial demand growth of 5.4% CAGR over the last decade, double that of global GDP growth. Despite glass capacity growth being cyclical, our analysis suggests that ongoing growth in the renewable energy industry and automotive lightweighting will support sustained glass fibre demand growth and therefore industrial platinum demand growth.

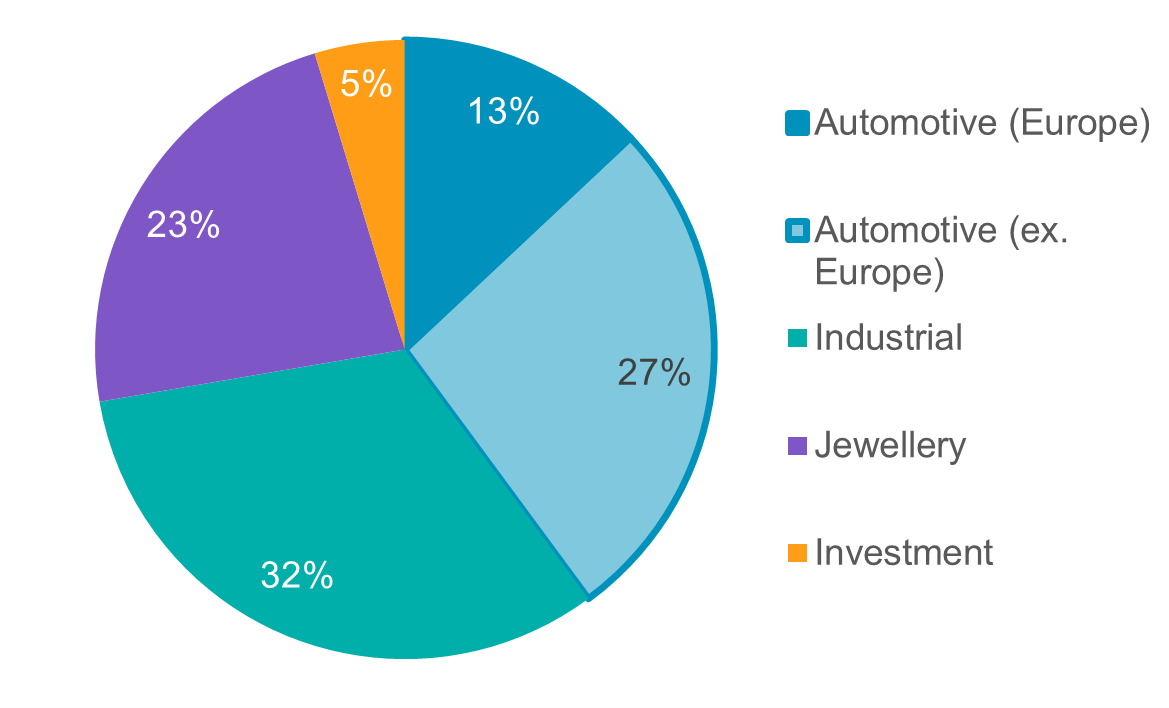

14 September 2023: Punitive tariffs against Chinese automakers could slow European BEV adoption and boost platinum demand: A hurdle to mass-market BEV adoption is affordability. A successful bid by Brussels to apply anti-dumping tariffs onto Chinese electric vehicles sold within the bloc will increase costs and slow BEV adoption rates. Deferring BEV adoption will support Europe’s automotive platinum demand, potentially adding 200koz over the period 2025-7.

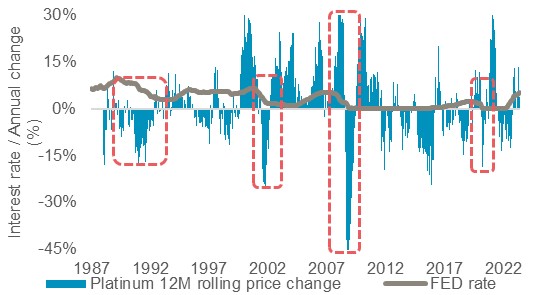

10 August 2023: Projected platinum supply/demand deficits should provide price support through economic downcycle: Analysis shows that the platinum price typically trends lower during economic down-cycles in combination with interest rate cuts. However, as the platinum market is forecast to enter a period of sustained deficits due to down-cycle resistant factors, we expect prices to prove more resilient during this cycle, or move higher.

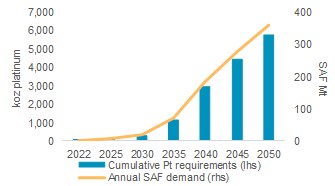

20 July 2023: Shanghai Platinum Week 2023: Key platinum demand takeaways and points of note: Shanghai Platinum Week 2023: Key platinum demand takeaways and points of note: WPIC co-hosted the third annual Shanghai Platinum Week (SPW) in the last week of June. This report highlights details of the conference as well as three key takeaways from the presentations that may influence future demand for platinum. The conference was attended by more than 650 delegates from over 400 organisations, with around 90 thousand watching online. Future SPW’s are scheduled for the second week of July (8-12 July 2024). There were too many topics discussed at the conference for us to cover them all. However, three topics; sustainable aviation fuel (SAF) automotive production forecasts for China, and projected fuel cell loadings stood out as having a bearing on future demand.

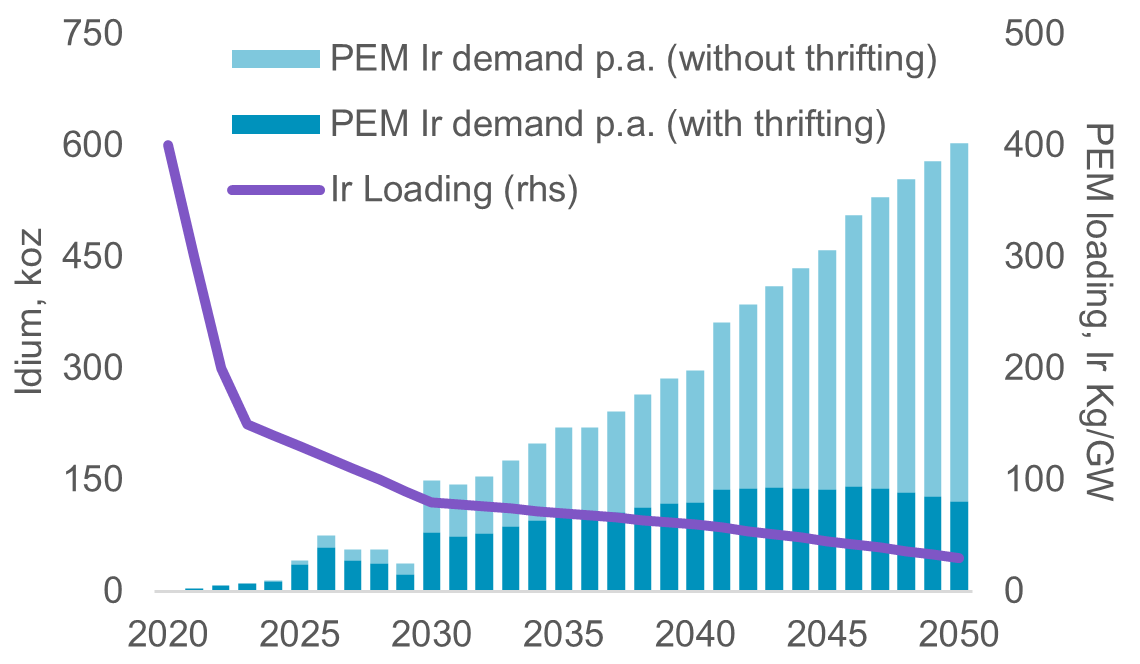

23 June 2023: Iridium availability is not a bottleneck to PEM electrolyser ramp-up; platinum demand from PEM electrolysers could reach >500 koz p.a. within 10 years: Allaying market fears, we do not expect iridium supply to impede the roll out of PEM electrolyser capacity. Electrolyser capacity is forecast to expand from <1GW to ~4,000 GW by 2050 (IEA). PEM technology is expected to achieve a >30% market share, facilitating the transition to green hydrogen. Despite the use of critical metals, thrifting, recycling and viable substitution in other applications will result in iridium supply being sufficient to meet identified demand and support cumulative installed PEM capacity of 1,550 GW by 2050.

1 June 2023: ETF investment returns: Growing investor appetite for platinum could deepen market deficit: South African investors have expanded their platinum ETF holdings by 430 koz year-to-date, as they see attractive upside for the metal in a market forecast to be in deficit by almost 1 Moz. In contrast, North American and European investors disposed of ETF holdings, reducing the net positive inflows to 300 koz versus only 30 koz included in the current outlook. As knowledge of the forecast record platinum deficit spreads, it is possible that ETF investor flows turn positive in North America and Europe, which could act to exacerbate the forecast deficit.

1 May 2023: How to solve an almost 1 Moz platinum market deficit: Our latest Platinum Quarterly highlighted a forecast record platinum market deficit of almost 1 Moz in 2023. Given the inelasticity of platinum supply, this shortfall has to be met from alternative sources such as above ground stocks. However, it is not known what platinum price will be necessary to attract the portion of above ground stocks required to meet the shortfall or indeed what impact having almost 80% of those above ground stocks locked-up in China will have on metal flows and price.