How to invest in Platinum

Rare and with unique properties, platinum is in demand as both an industrial and precious metal. There are many reasons to consider platinum as an investment.

A long-term store of value

Rarer than gold, platinum is recognised globally as an enduring symbol of quality and value.

A portfolio diversifier

Depending on individual investment goals, platinum can help provide diversification given its combination of precious and industrial attributes.

Accessible

A wide range of options exists for both private and professional investors, and low minimum investment levels are possible.

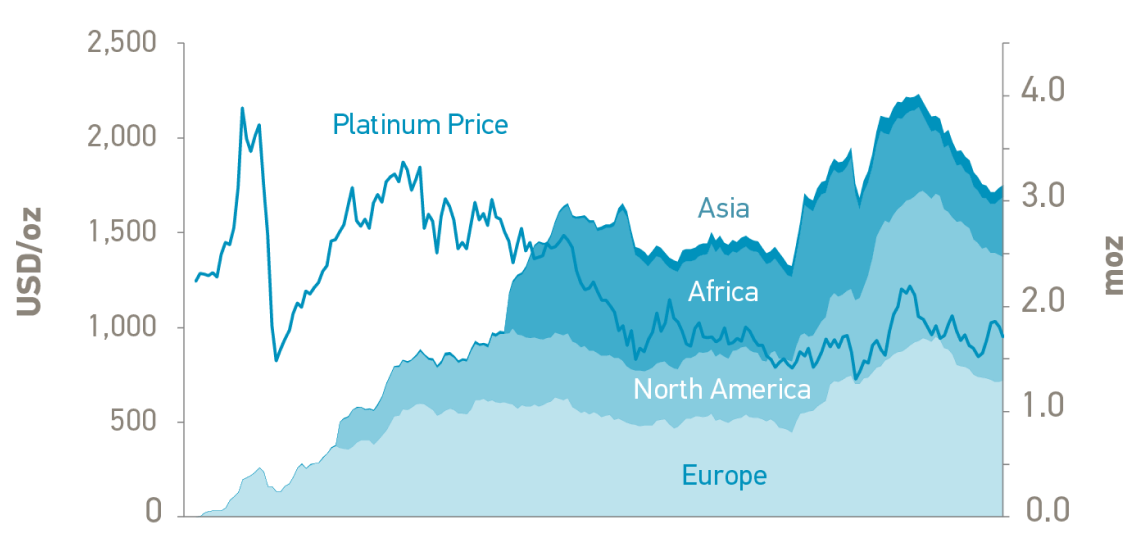

Supply/Demand balance

The platinum market is currently in deficit due to strong demand drivers, including the growing hydrogen economy, and constrained supply.

Currency Hedge

In certain circumstances, an investment in platinum can help protect against fluctuating exchange rates.

Investment options range from:

PLATINUM BARS AND COINS

Platinum bullion bars and coins are a straightforward and widely available way of adding physical platinum investment to a portfolio.

Platinum bullion is an umbrella term that refers to two types of investment products – bars and coins – which share common characteristics, with guaranteed purity, generally 99.95 per cent, being the key criterion.

Easily bought and sold

Guaranteed purity of 99.95% platinum

Range of sizes and fractional coins are available

Option of delivery to door or safekeeping in a specialist vault

Can be purchased from Sovereign mints such as the US Mint, the Royal Canadian Mint or The Royal Mint in the UK

Can be directly included in an Individual Retirement Account (IRA) in some jurisdictions including the US

EXCHANGE TRADED FUNDS

Exchange Traded Funds (ETFs) are listed entities that issue shares which can be traded on an exchange, meaning that prices can vary throughout the day.

Investors can buy and sell shares in a physically-backed platinum ETF, either directly from the stock exchange it is listed on or through a broker.

Minimum investment of just one share

In the UK, the US and Japan, platinum ETFs can be held as part of self-managed pension schemes, with possible associated tax benefits

Vaulted platinum bars are the only assets of the fund and reflect the platinum price, less fees – which are typically well below one percent per annum

Value of shares held is 100 per cent matched by physical platinum in the form of investment bars held in a highly secure vault

ETFs allow an individual or asset manager to invest in physical platinum without incurring additional costs, such as insurance premiums and storage

PLATINUM ACCUMULATION PLANS

Unique to Japan, platinum accumulation plans (PAPs) enable individuals to pay a monthly amount into an account in order to purchase platinum, a core part of their retirement savings.

Retail investors in Japan have been investing in precious metals for decades, with the purchase of kilogram and smaller platinum ingots produced by Japanese precious metals refiners and, more latterly, through exchange traded funds.

Each month the balance of physically-owned platinum accrues

Investors are free to sell all or part of their balance, or withdraw it in the form of bullion, coins or jewellery at any time

ONLINE INVESTMENT

Online bullion accounts enable investors to purchase, store and sell physical platinum bullion and other precious metals via a trading platform.

Any eligible person, anywhere in the world, can buy, store and sell physical platinum through the platform in a secure and cost-effective way. The platinum offered meets the ‘Good Delivery’ requirements as specified by the London Platinum and Palladium Market.

Multiple currency options

Option of delivery

Platform can be accessed 24/7

Platinum is stored in fully-insured, low- cost, high-security vaults

Low minimum investment: trade as little as 1 gram at a time

Blockchain technology can be used to facilitate digitally recorded fractional ownership of platinum

FUTURES, MINING STOCKS & SHARES

In addition to owning physical platinum, investors can gain indirect exposure to platinum.

Futures

Platinum futures are financial products that allow participants to lock in a future platinum price by entering into a binding contract to buy (or sell) an amount of platinum at a fixed price at a future date.

Investors can then either exercise the contract on its expiry date or - depending upon their view of the market - trade the underlying contract, potentially allowing them to make a profit (or loss), subject to market movements.

Futures are not physically-backed, although contracts do allow for the delivery of physical platinum

Investors choose to trade on a futures market for several reasons, including price transparency and deep liquidity

Futures exchanges can be fully electronic, operating in real time and able to execute millions of trades per second

They can also provide secure clearing services, giving investors further peace of mind regarding settlement and mitigating counterparty risk

Platinum mining stocks and shares

Exposure to platinum can also be achieved by investing in platinum mining stocks and shares. This gives investors the ability to invest in companies that produce platinum group metals rather than investing in the physical metal itself.