22 January 2026: January 2026 five-year supply/demand outlook; market deficits to narrow compared to the past three years. Five-year supply/demand outlook; market deficits to narrow compared to the past three years. This Platinum Essentials leverages market developments seen during 2025 into our medium-term supply/demand outlook while including a first forecast for 2030f for the platinum and palladium markets. The key feature of 2025 was platinum’s strong price performance (+127%) which was underpinned by both macropolitical and fundamental market factors. In 2026, the investment outlook for platinum along with the broader precious metals’ asset class remains compelling given persistent external shocks. However, platinum’s price increase, if sustained, will impact the longer-term supply demand outlook by supporting supply and eroding some demand at the margins. We now expect platinum market deficits to average 348 koz from 2027f to 2030f, which equates to ~4% of demand and less than the ~8% previously forecast.

2 to 5 Year View

Platinum is the world’s most precious metal.

Now more accessible and attractive to investors than ever beforeTrevor Raymond, CEO,

World Platinum Investment Council

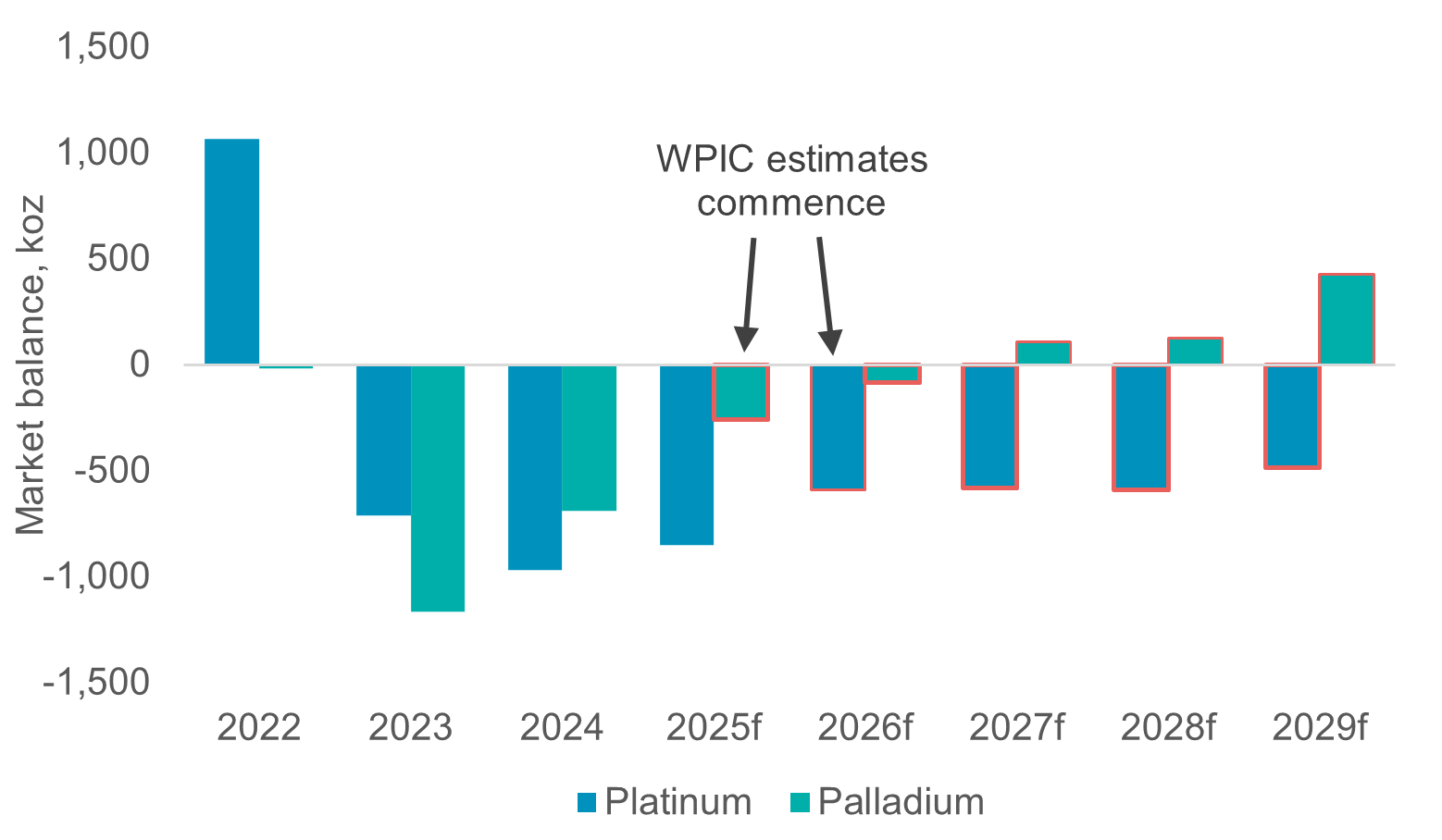

30 September 2025: Sep‘25, Five-year supply/demand outlook; current price levels unlikely to shift fundamentals away from deficits. Five-year supply/demand outlook; current price levels unlikely to shift fundamentals away from deficits. This Platinum Essentials leverages market developments seen during 2025 into our five-year supply/demand outlook for the platinum and palladium markets. Notably, despite platinum prices having increased by 52% year-to-date, we do not see significant price-elasticity in either supply or demand. The platinum investment case remains compelling, with the overriding feature being that the substantial platinum market deficits of 2023 and 2024 are expected to persist throughout our forecast period to 2029f. Inclusive of 2025 forecasts which are provided by Metals Focus, we expect annual platinum deficits to average 620 koz from 2025f to 2029f, or 8% of average annual demand.

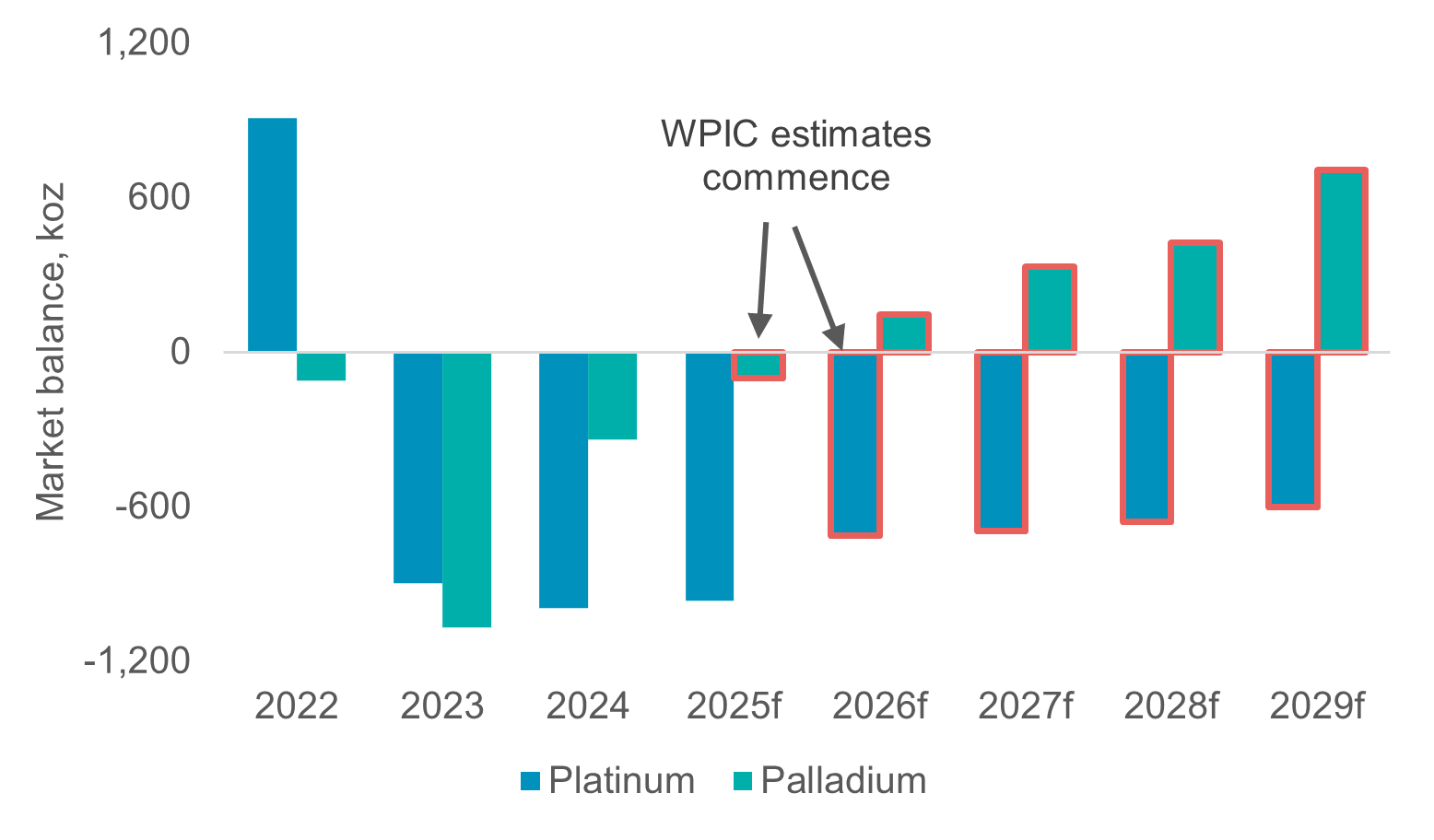

19 June 2025: Jun‘25, Five-year supply/demand outlook; platinum deficits persist, despite a shifting economic landscape. Five-year supply/demand outlook; platinum deficits persist, despite a shifting economic landscape. This Platinum Essentials leverages market developments seen through the first half of 2025 into our five-year forecasts for the platinum and palladium markets. The platinum investment case remains compelling, with the overriding feature being that the substantial market deficits of 2023 and 2024 are expected to persist throughout our forecast period to 2029f. Inclusive of 2025 forecasts which are provided by Metals Focus, we expect annual platinum deficits to average 727 koz from 2025f to 2029f, or 9% of average demand. The palladium market is expected to record a small deficit in 2025f, before transitioning to a small surplus in 2026f.

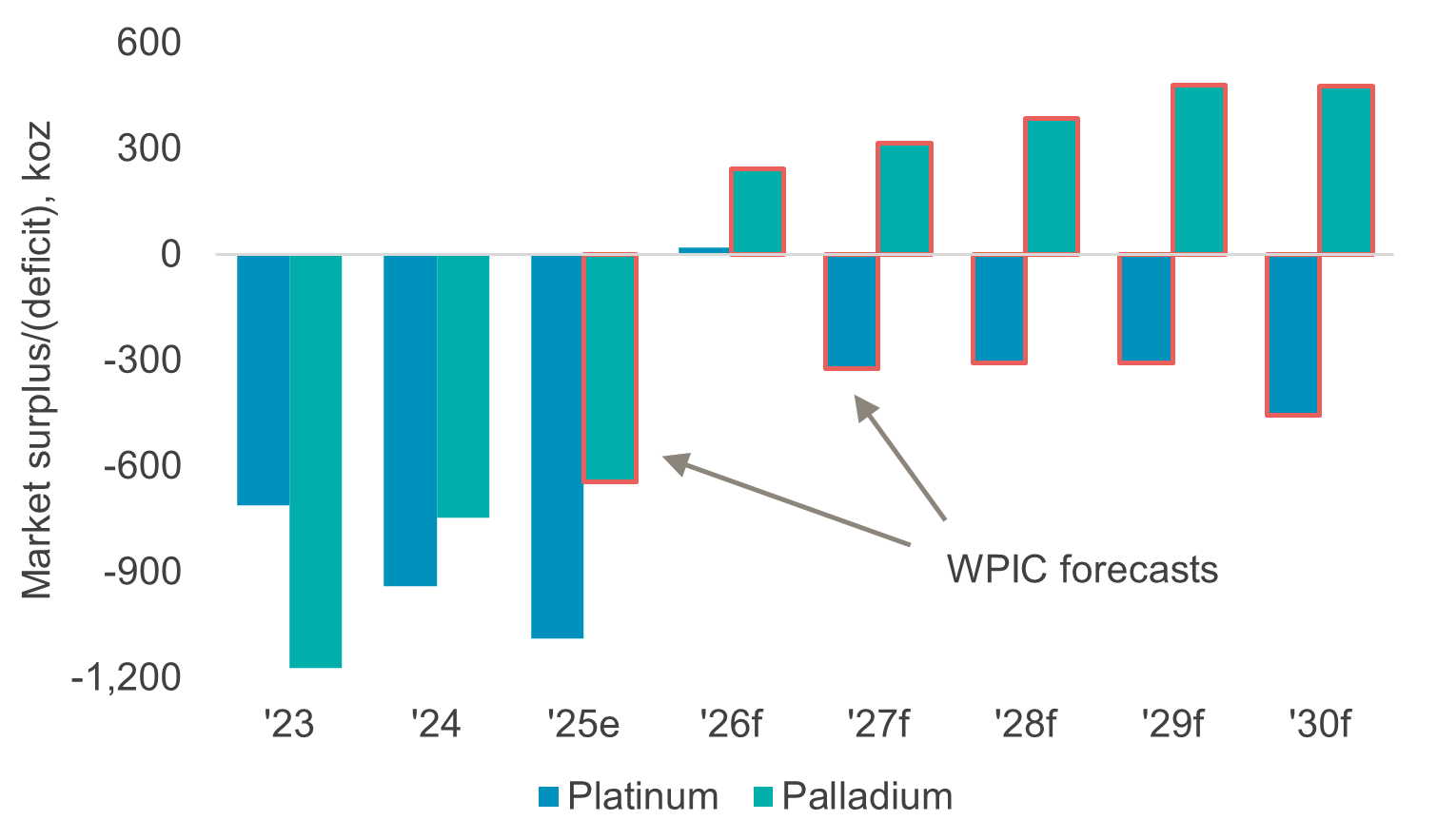

6 February 2025: Jan‘25, Five-year supply/demand outlook; platinum deficits persist, palladium’s are deeper and last longer. Five-year supply/demand outlook; platinum deficits persist, palladium’s are deeper and last longer. With our Platinum Quarterly now running through 2025, this Platinum Essentials contains revised estimates for platinum supply and demand balances in the years 2026 to 2028 and our first estimate for 2029. The material platinum market deficits established during 2023 and 2024 are set to persist throughout the forecast period through 2029f. WPIC expects the consecutive platinum market deficits to average 689 koz pa from 2026 to 2029, or approximately 9% of annual demand. Within our updated palladium forecasts to 2029f, we expect market deficits to last until 2027f (previously 2025f) before market surpluses gradually build from 2028f. Given ongoing uncertainties, this report does not fully capture the impact of Trump’s policies on PGM demand, but we do not expect them to be of sufficient magnitude to materially change the platinum and palladium deficits laid out herein.

26 September 2024: Sep‘24, 2-5 year platinum supply/demand outlook: Robust demand and limited supply drive larger market deficits. September 2024 Platinum Essentials: Updating WPIC’s two- to five-year platinum supply demand outlook: Robust demand and limited supply drive larger market deficits. This Platinum Essentials contains revised platinum supply/demand estimates for 2025f to 2028f. The platinum investment case remains compelling, with the overriding feature being that the substantial market deficits of 2023 and 2024f are expected to persist throughout our forecast period to 2028f. This report is separate to the one-year forward outlook for 2024 we publish in our Platinum Quarterly (PQ), which is prepared independently for us by Metals Focus.

1 January 2024: Updating WPIC’s two- to five-year supply demand outlook: Multi-year deficits expected. With our Platinum Quarterly outlook now running through 2024, this Platinum Essentials contains revised platinum supply/demand estimates for 2025 to 2027 and our first estimate for 2028. In 2023, the platinum market is estimated to have recorded its largest single annual deficit of >1 Moz. Our analysis highlights that the platinum market will remain undersupplied through at least 2028. This report is separate to the one-year forward outlook for 2024 we publish in our Platinum Quarterly (PQ), which is prepared independently for us by Metals Focus.

1 June 2023: Updating WPIC’s two- to five-year supply demand outlook: Consecutive years of deficits. Our most recent Platinum Quarterly presented data for Q1 2023 and an updated outlook for full year 2023, including an expected full-year deficit of almost 1 Moz. This report presents an updated outlook for platinum supply and demand for the years 2024 to 2027. Projections have been lowered for both supply and demand, but we continue to forecast consecutive deficits that deepen from 2024 through 2027. This report is separate to the one-year forward outlook for 2023 we publish in our Platinum Quarterly (PQ), which is prepared independently for us by Metals Focus.

1 March 2023: Updating WPIC’s two- to five-year supply demand outlook: Supply side risks raise conviction on deficits. This report presents an updated outlook for platinum supply and demand for the years 2024 to 2027. On a like-for-like basis, total demand is broadly unchanged, while platinum supply forecasts have been reduced to reflect updated mined supply guidance. We reaffirm our expectations that platinum supply will record sequentially deepening deficits between 2024 to 2027. This report is separate to the one-year forward outlook for 2023 we publish in our Platinum Quarterly (PQ), which is prepared independently for us by Metals Focus.

1 December 2022: Updating WPIC’s two- to five-year supply/demand outlook: Sustained platinum deficits. This report presents our updated outlook for platinum supply and demand for the years 2024-2026 as well as initial estimates for 2027. On a like-for-like basis, total demand is slightly down on previous estimates, but significant cuts to mine supply guidance result in much deeper deficits. However, with published mine supply guidance now updated, we have based our supply forecasts on the mid-point of guidance ranges (previously the low-point). This has resulted in supply demand balances that are broadly unchanged from previously. This report complements, but is entirely separate from, the one year forward outlook we publish in our Platinum Quarterly (PQ), which is prepared independently for us by Metals Focus.

1 September 2022: Updating WPIC’s two- to five-year supply/demand outlook: Deeper deficits despite recessionary risks. This report presents our updated outlook for platinum supply and demand for the years 2023-2026 as well as an updated automotive drivetrain outlook to 2040. This report complements, but is entirely separate from, the one year forward outlook we publish in our Platinum Quarterly (PQ), which is prepared independently for us by Metals Focus. All estimates in our supply/demand outlook from 2023-2026 in this report are based upon publicly available information and WPIC in-house analysis. Our updated outlook, factors in estimates of the impact of slowing economic growth and increased inflation on demand, and also updates supply to take into account reduced guidance from the PGM miners as well as headwinds to recycling supply. In aggregate, the reductions to supply outweigh the reduced demand outlook and the forecast deficits are deeper on average over the four years by ~50 koz p.a.