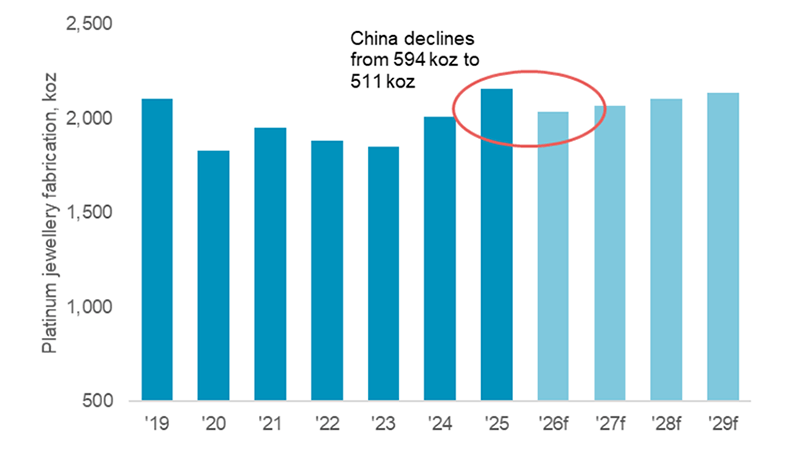

January 2026: Platinum Jewellery Demand Update. Today, platinum jewellery demand is globally diversified rather than being concentrated in China, as growth in markets outside of China between 2014 and 2024 partially compensated for a loss of demand in China over that period. In 2024, platinum jewellery demand returned to growth across all markets, including China, after troughing in the previous two years. Since the end of 2024, platinum jewellery demand has been benefiting from platinum’s price discount to gold. This was a key reason behind the estimated growth of 7% in global platinum jewellery demand seen in 2025, to reach a seven-year high.

Articles

WPIC produces bespoke research on the platinum market for its partners CME Group and JPX Group, aimed at informing and educating investors. This content can be accessed here. CME Group is the world’s leading and most diverse derivatives marketplace offering the widest range of futures and options products for risk management. JPX Group is one of the leading exchange groups in the Asia-Pacific region.

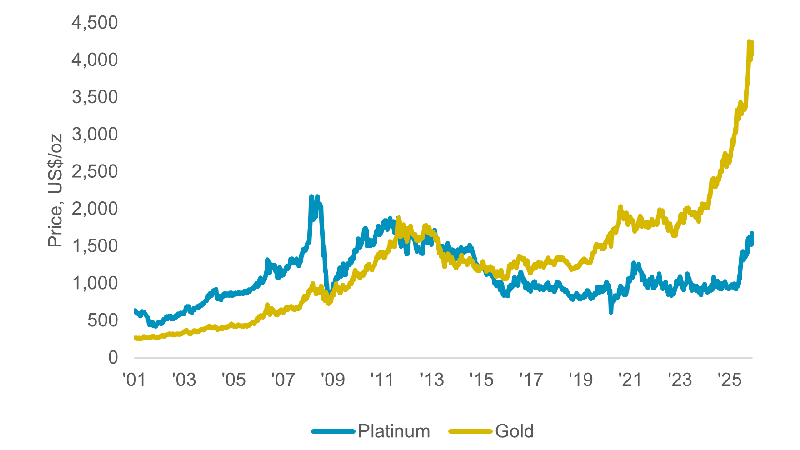

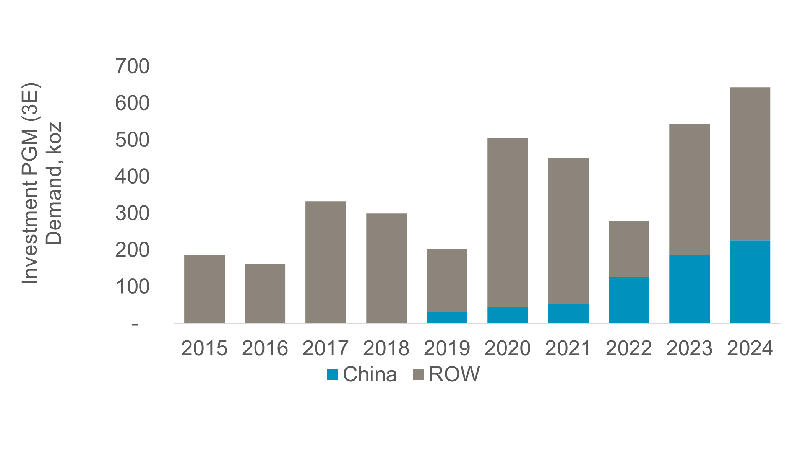

December 2025: What’s Next for Platinum Investment? Sustained market deficits may have laid the groundwork for platinum’s price appreciation this year, but geopolitics and macroeconomics provided a tailwind. Heightened uncertainty, triggered by evolving U.S. trade policy and the threat of tariffs, has led to geographic demand dislocation and competition for metal, with security of supply a key theme that has emerged during 2025. Market tightness has prevailed, evidenced by the sustained elevation of platinum lease rates and backwardation in the London over-the-counter (OTC) market. The investment case for platinum remains compelling. The market is forecast to record its third consecutive significant annual deficit in 2025 (estimated at 692 koz), which will deplete above ground stocks (AGS) to only five months of demand cover. Although high prices typically encourage markets to self-solve for structural deficits by either incentivising new supply or pricing demand out of the market, history shows that both platinum supply and platinum demand can be remarkably price inelastic over near-to-medium term time horizons. WPIC’s two-to-five-year platinum market forecast anticipates that AGS will be substantially depleted by the end of the decade, as diverse and resilient demand continues to outstrip constrained supply.

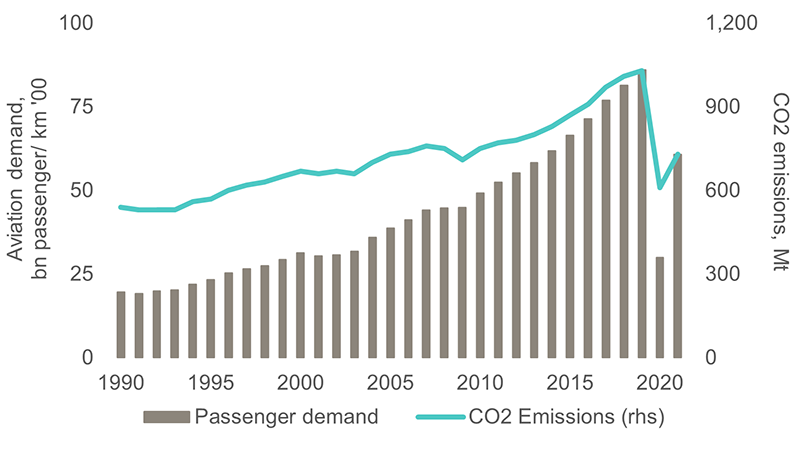

November 2025: Platinum Demand and Sustainable Aviation Fuel. Sustainable aviation fuel (SAF) is emerging as a core pillar of decarbonisation in aviation, with the International Air Transport Association estimating that SAF could contribute around 65% of the reduction in emissions needed by aviation to reach net zero emissions by 2050. Platinum is required across all major SAF pathways. WPIC expects annual SAF capacity additions to increase eight-fold from ~2 Mt in 2024 to ~16 Mt by 2050, while platinum demand from SAF production is expected to increase from negligible volumes to ~260 koz per annum by 2050. This platinum demand growth will be incremental overall, mitigating the expected decrease in petroleum platinum demand as global markets make their energy transition from 2030 to 2040.

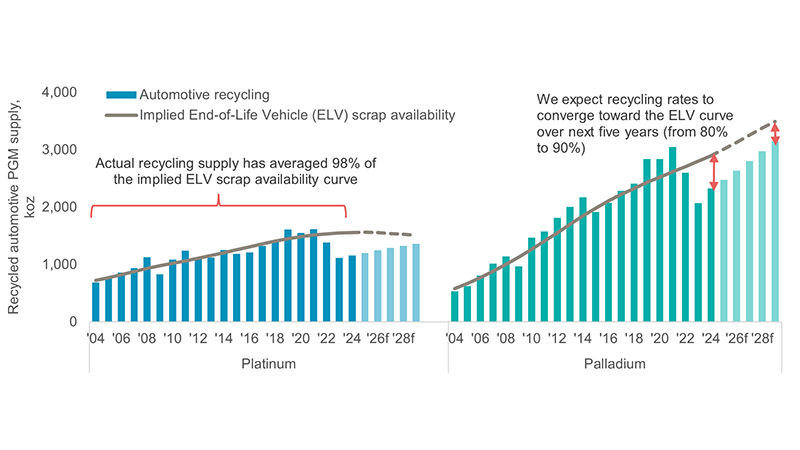

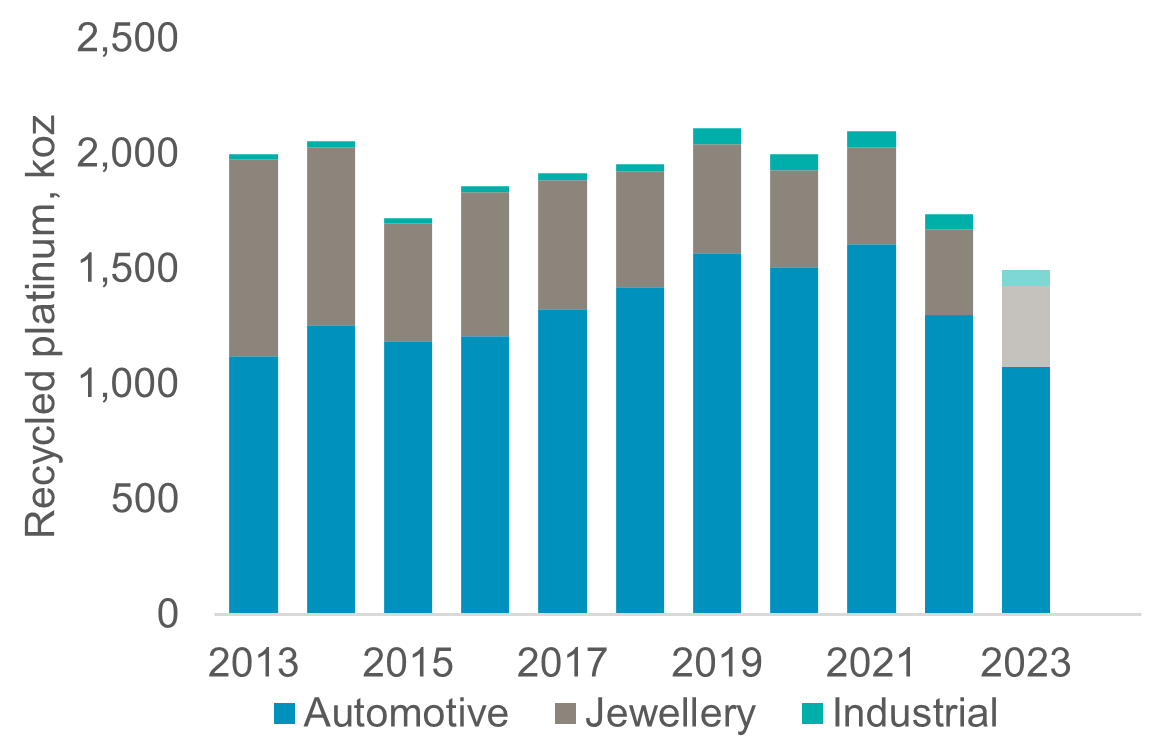

October 2025: Platinum Group Metals – Automotive Recycling Supply. WPIC research has identified that automotive PGM recycling supply is more price elastic than traditionally believed. This helps to explain why platinum recycling supply was depressed between 2022 and 2024, when the low PGM basket price led to some hoarding of spent autocatalysts by scrapyards that lacked the economic incentive to sell recovered catalysts. Higher PGM prices in 2025 are supportive of recycled supply growth. However, platinum automotive recycling supply is not expected to recover to the peak level reported in 2021, and we expect this to contribute to sustained platinum market deficits through 2029.

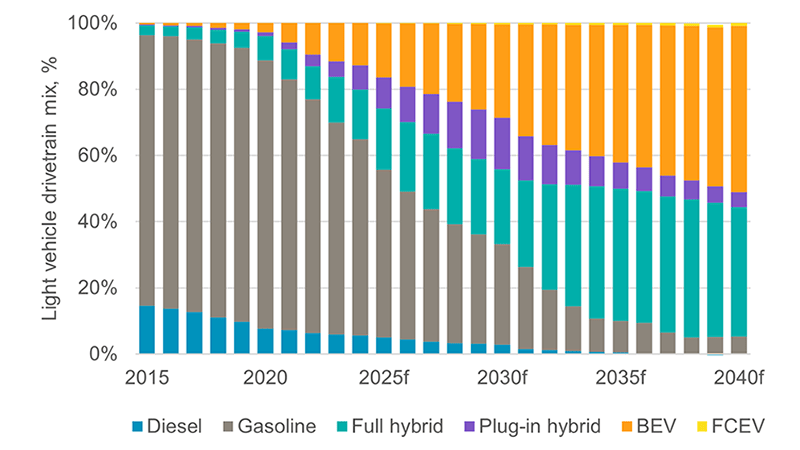

August 2025: Platinum Automotive Demand Update. This year, automotive demand for platinum is forecast to reduce by 2 per cent to 3,052 koz. Set against the context of an expected economic downturn amid uncertainty as US tariff policy continues to evolve, this demonstrates a high degree of resilience, with automotive demand for platinum in 2025 forecast to be some 11% above the prior five-year average. Longer-term, despite increasing battery electric vehicle (BEV) production, WPIC forecasts that ICE vehicle drivetrains (including hybrid vehicles) will continue to account for the majority of new vehicles produced to 2040.

July 2025: Platinum Market China Update. Given that total annual demand for platinum today is about 8 Moz for all end uses, China’s needs as the largest single consumer of platinum in the world, combined with a lack of domestic supply, mean it is reliant on importing metal and could be left short of platinum in the future. China can significantly reduce the risk to industrial users of platinum by increasing the amount of PGMs on Chinese soil. Growing platinum investment holdings in China are helpful in this regard, as is the renewed interest being seen in platinum jewellery, which effectively provides a domestic reserve of platinum due to its quasi-investment status.

February 2025: Platinum jewellery outlook. Platinum jewellery market decline now appears to have stabilised, with year-on-year growth of 5% estimated for 2024 and 2% year-on-year growth forecast for 2025, when total platinum jewellery demand is expected to reach 1,983 koz.

November 2024: Electrical demand, data proliferation and platinum. Electrical is a small sub-sector of platinum industrial demand that is growing in importance. In 2023 it accounted for around 1% of total platinum demand. Historically, electrical demand has mainly comprised of the use of platinum in hard disk drives (HDDs) in a cobalt, chromium and platinum alloy which is the storage layer in an HDD stack. However, platinum is now also finding increasing uses in the semiconductor and sensor industries. All three applications are growing due to rising demand for Artificial Intelligence (AI), and, in the case of HDDs, the associated need for more data storage capacity.

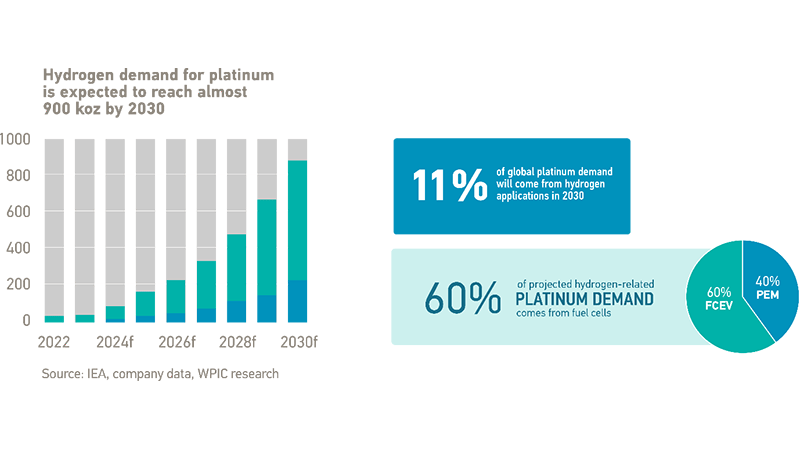

November 2024: Platinum Group Metals in the Hydrogen Economy Midstream. Hydrogen end markets could account for 11% of total platinum demand by 2030, increasing from 40 koz in 2023 to around 900 koz in 2030, driven primarily by the use of platinum in upstream (electrolyser) and downstream (hydrogen fuel cell) applications. Midstream applications have an important role in enabling market development and the establishment of a global trade in green hydrogen.

September 2024: How to invest in platinum. Platinum has strong demand, limited supply and is currently significantly undervalued relative to gold – factors that investors are taking into consideration when looking at types of platinum investment. Ways of investing in platinum include: direct ownership of platinum bullion (coins, bars); online/digital bullion accounts with fractional ownership; and shares in physically-backed platinum exchange-traded products. Options for those taking positions on the price of platinum but not necessarily requiring physical ownership include futures contracts and other derivatives.

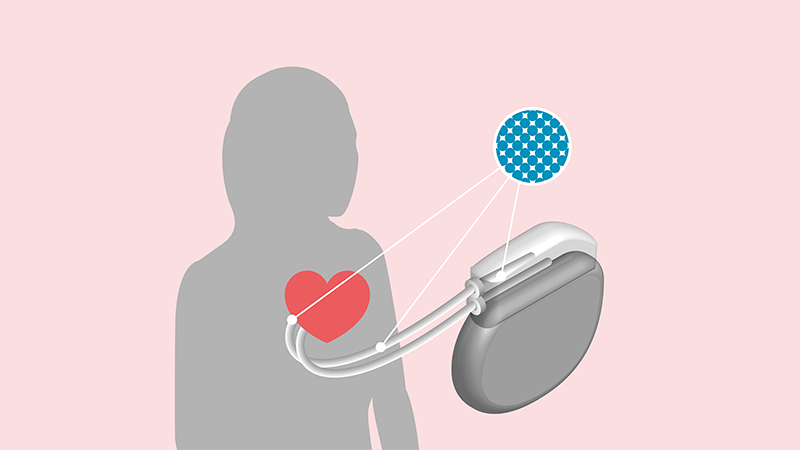

May 2024: Platinum medical demand is projected to grow 3% to 299 koz in 2024. Its use in cancer treatment drugs will see the most significant growth, driven by double-digit increases in oncology investment, outpacing other medical fields. Meanwhile, the use of platinum in medical devices will also grow, albeit more slowly, driven by ongoing, long-term factors such as an ageing population and improving access to healthcare in emerging markets.

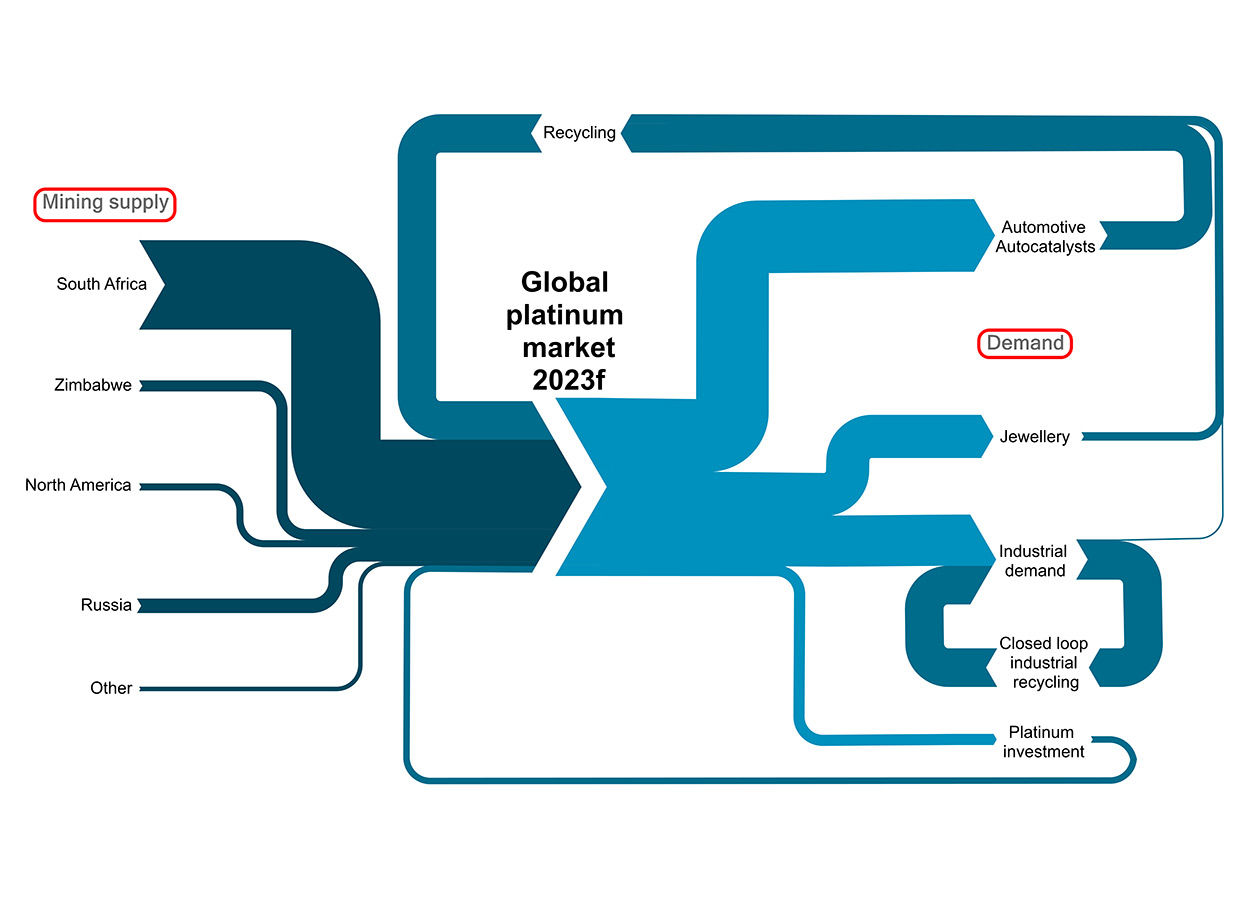

May 2024: Recycled Platinum Supply Outlook. Recycling is an important secondary source of platinum supply, accounting for approximately 25% of total annual supply. By far the most significant source of recycled platinum supply – around 80% – comes from spent autocatalysts in end-of-life vehicles.

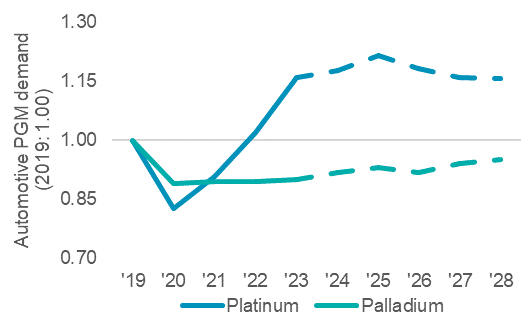

March 2024: Platinum-for-palladium substitution. The platinum market transitioned to a deficit of 878 koz in 2023. Strong automotive demand growth from the use of platinum in autocatalysts was a key factor, surging by 16 per cent year-on-year to 3,272 koz. The current trend for platinum to substitute for palladium in gasoline autocatalysts is a significant reason behind the increase in automotive demand. In 2023, platinum-for-palladium substitution rose from 391 koz in 2022 to 669 koz. The forecast is for substitution to grow further, reaching 742 koz in 2024.

January 2024: Why palladium matters to the growth of the platinum market. Hydrogen-related demand for platinum is forecast to grow substantially through the remainder of the decade and beyond. Platinum catalysts in the electrolysis and fuel cell markets are expected to account for up to 15% of total platinum demand by 2030, reaching as much as 35% of total annual platinum demand by 2040. Yet platinum has transitioned into a supply deficit in 2023, with WPIC’s outlook suggesting consecutive deficits sustained to at least 2027. Multi-year platinum deficits will draw down above ground platinum stocks and tighten markets at a time of rapid acceleration in the growth of the hydrogen economy. Fortunately, there are existing end-uses of platinum where substitution with other platinum group metals (PGMs) could free up availability of platinum to ensure it is not a bottleneck for the growing hydrogen economy. In this context, palladium is of particular relevance due to its use in autocatalysts, its primary demand segment.

January 2024: Platinum jewellery demand. Research has shown platinum to be the precious metal most associated with love and the evolution of platinum as a jewellery metal has been rooted in buyer behaviour in the bridal sector, although self-purchasing is becoming an increasing trend. Jewellery is the third largest demand segment for platinum, accounting for between 23 and 30 per cent of total annual platinum demand. Platinum’s rarity and precious metal status has led to strong, long-standing associations with the luxury goods market, especially in western markets and Japan.

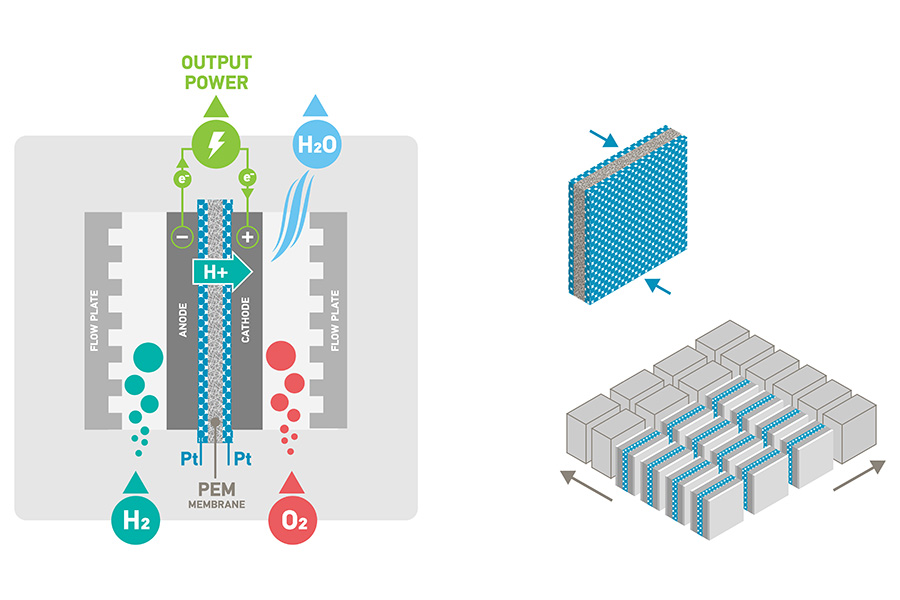

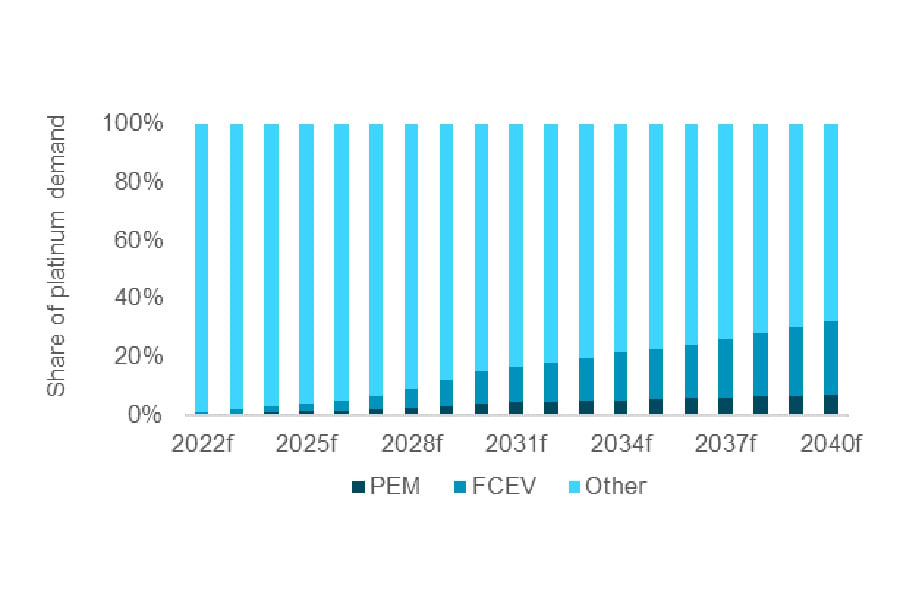

October 2023: Why is hydrogen an important new demand segment for platinum? Platinum’s importance to the hydrogen economy makes it one of the only established commodities offering the prospect of significant growth in demand from a new end-use segment. The need to decarbonise is more acute than ever and platinum-based proton exchange membrane (PEM) technologies have a significant role to play in the energy transition.

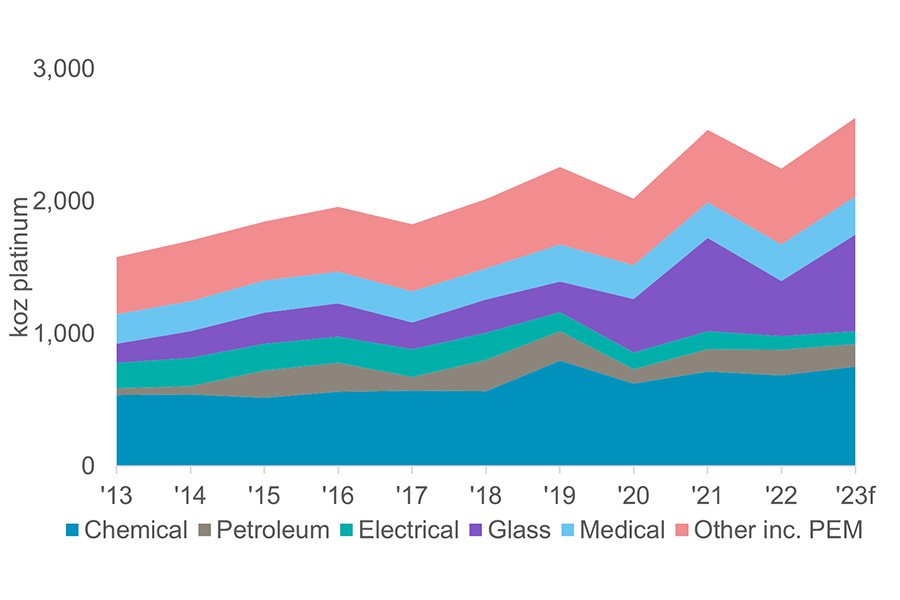

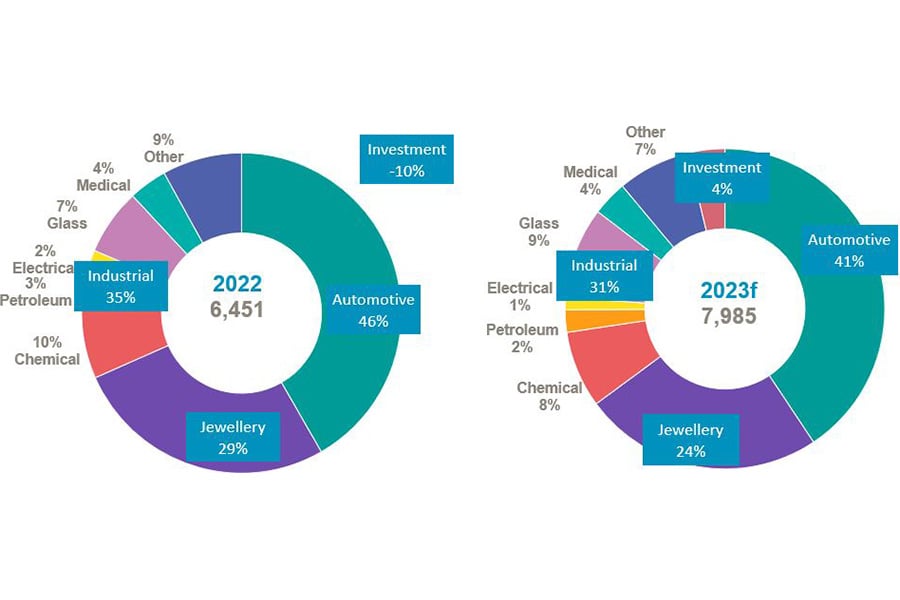

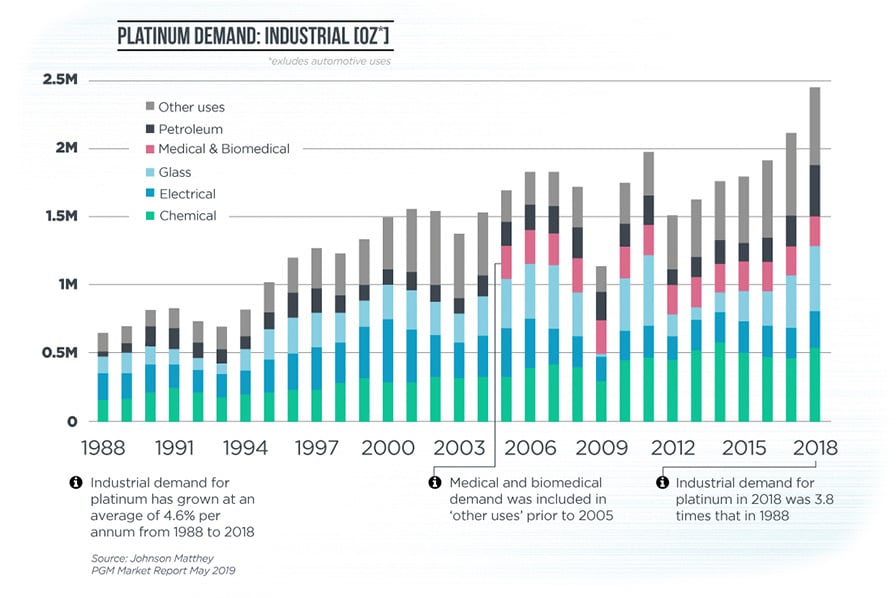

September 2023: Platinum Chemical Demand. Industrial demand for platinum is due to reach a record high this year, growing 14 per cent year-on-year to 2,667 koz. Chemical demand for platinum is a subset of industrial platinum demand. On its own, the chemicals sector only accounts for a modest component of total platinum demand at around 10 per cent (figure 1). However, on average, chemical demand is the single largest sub-sector of platinum industrial demand (figure 2). In addition, chemical demand for platinum has exhibited a consistent history of platinum demand growth, increasing by a CAGR of 3.5 percent between 2013 and 2023.

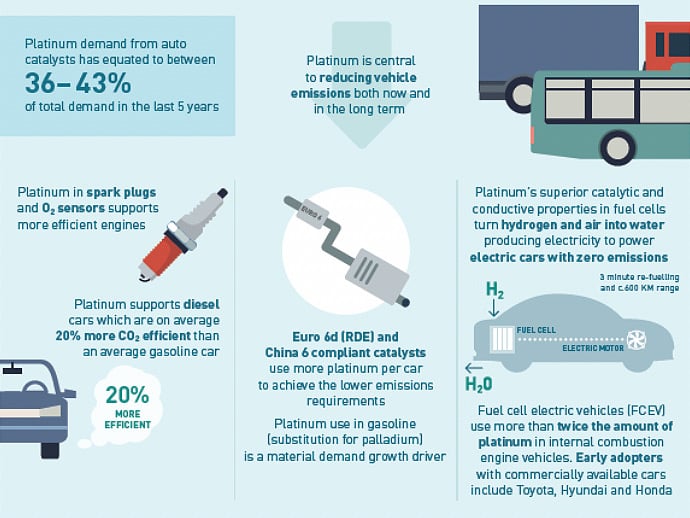

August 2023: The Outlook for Platinum Automotive Demand. This year, automotive demand for platinum is forecast to grow by 12 per cent to 3,255 koz (+357 koz year-on-year). This growth is predicated on two major trends – higher platinum loadings per vehicle due to tighter emissions regulations and increasing platinum-for-palladium substitution in gasoline autocatalysts. This substitution could see platinum displace as much as 615 koz of what could have otherwise been palladium demand in 2023.

June 2023: Industrial Demand for Platinum. Platinum has a unique combination of physical and chemical properties resulting in its extensive use in industry and manufacturing, where its high melting point, density, ultra-stability, extreme non-corrosiveness and catalytic effects are highly valued. Industrial demand for platinum has grown at twice the pace of global GDP since 2013 and is the second largest demand segment for platinum after automotive demand.

March 2023: Platinum recycling and the circular economy. The circular economy advocates designing products to be more durable, repairable, and recyclable, maximizing the reuse of materials and therefore ensuring they are kept in circulation for as long as possible. It seeks to reduce waste and reinforces the importance of managing impacts and consuming fewer resources to deliver sustainable outcomes, lowering both demand for raw materials and the environmental impact associated with obtaining them.

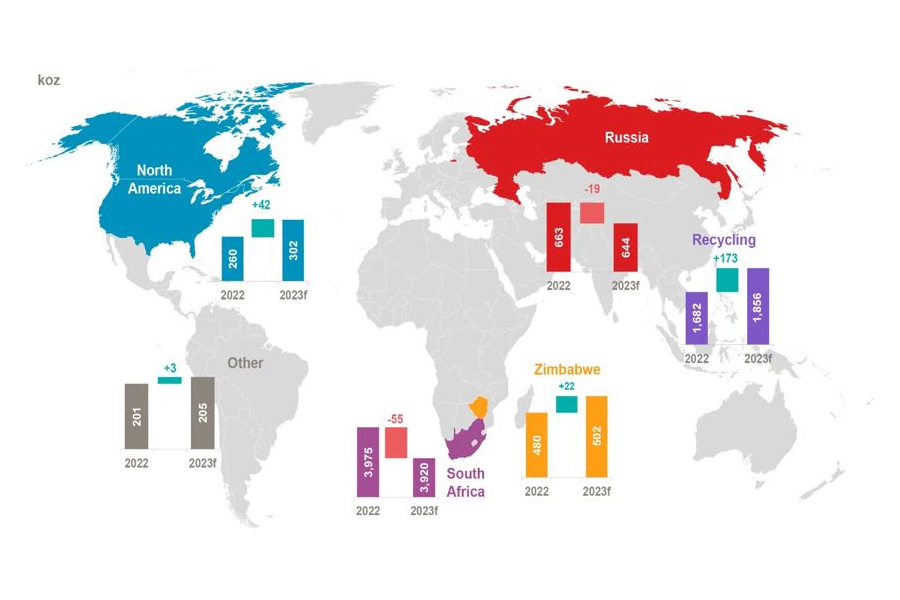

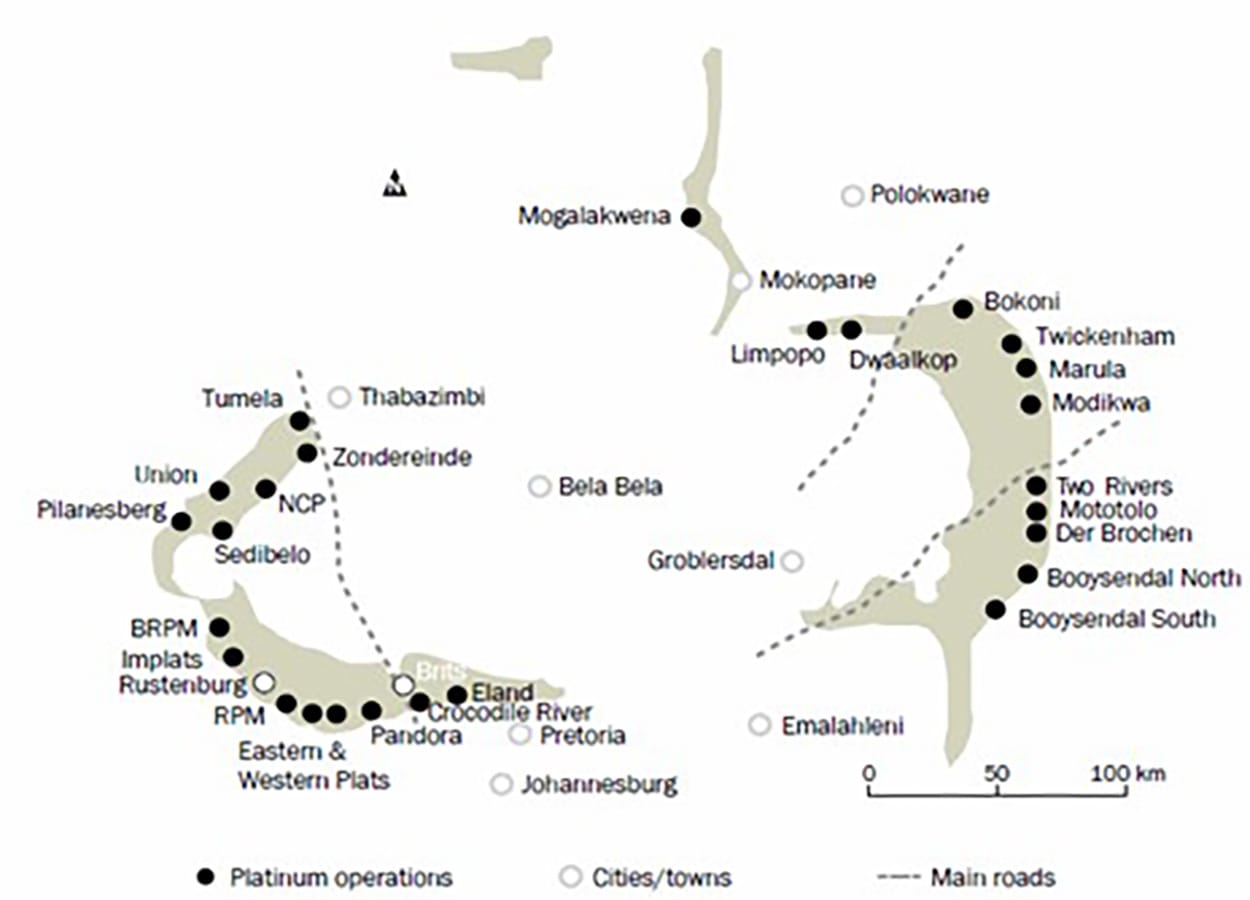

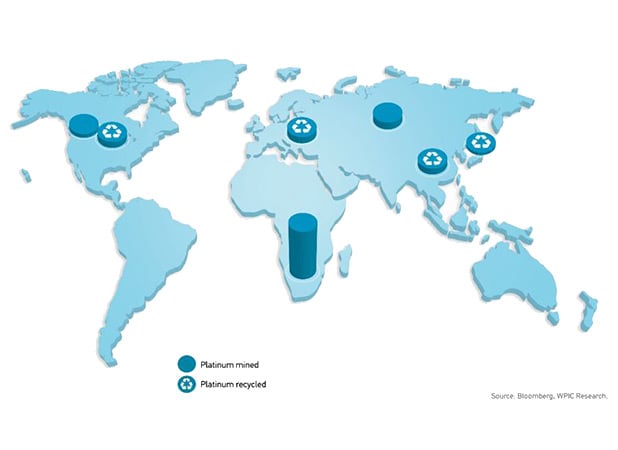

February 2023: Platinum mined supply. Platinum mine supply is unusually highly concentrated, with over 70 per cent of global mine supply coming from a relatively small geographic region in South Africa. Here platinum mine supply has declined from a peak of 5.3 moz in 2006 to an estimated 4.3 moz in 2022. Globally, refined platinum mine supply has declined from 6.8 moz in 2006 to an estimated 5.0 moz in 2022.

December 2022: Platinum - the critical mineral for energy transition and energy independence. There are not many established commodities that offer the prospect of significant growth in demand from a new end-use segment as platinum does through its importance to the hydrogen economy. The need to decarbonise is more acute than ever and platinum-based proton exchange membrane (PEM) technologies will have a significant role to play in the energy transition. While hydrogen-related demand for platinum is relatively small in 2022 and 2023, it is expected to grow substantially through the 2020s and beyond, reaching as much as 35 per cent of total annual platinum demand by 2040.

November 2022: An Introduction to Platinum Investment. Over recent years, the platinum market has been characterised by constrained supply and highly variable demand; looking ahead, however, supply is expected to remain constrained while demand is expected to grow strongly, supported by higher platinum loadings in autocatalysts, including substitution for more costly palladium as well as to meet tighter emissions standards, with platinum use in fuel cell electric vehicles (FCEVs) and in the production of green hydrogen becoming increasingly significant drivers of demand growth over the next decade.

August 2022: Fuel cell electric vehicles and platinum demand. Despite the transition to electric vehicles already underway, internal combustion engine vehicles (ICEs) will remain a significant part of the global automotive drive train mix well into the 2030s. However, the decline in platinum use associated with fewer ICE vehicles being produced will be more than offset by higher platinum loadings and increased platinum-for-palladium substitution in the near- and medium- term. Demand for platinum in hydrogen fuel cells for fuel cell electric vehicles will offset the eventual long-term decline in automotive demand for platinum from catalytic converters.

March 2022: Substitution among Platinum Group Metals. Automotive demand is the single largest demand segment for platinum, with platinum automotive demand accounting for around 40% of total platinum demand. Palladium and rhodium automotive use is around 80% and 90% of total palladium and total rhodium demand, respectively.

December 2021: Platinum and the hydrogen economy. Due to its unique chemical and physical properties, platinum is at the forefront of proton exchange membrane (PEM) applications – transformative technology that holds the key to unlocking the zero-emissions potential of hydrogen. PEM technology is used in both electrolyzers to produce hydrogen and in hydrogen fuel cells which can power, for example, an emissions-free fuel cell electric vehicle (FCEV).

September 2021: Medical and biomedical demand for platinum. Around 25 percent of annual platinum consumption – excluding automotive demand – is industrial. Of this, medical and biomedical demand for platinum is a relatively small, yet consistent, component. In 2020, platinum demand from medical and biomedical applications was 235 koz and it accounted for three percent of total platinum demand.

January 2021: Platinum Supply. The outlook for an investment in platinum is, as with all commodities, intrinsically linked to its fundamental supply/demand position, with value tending to reflect the market balance. Typically, prices rise on consecutive deficits and fall on consecutive surpluses, although this is not always the case.

October 2020: A deep dive into the demand for platinum jewellery. Jewellery is the second largest demand segment for platinum, accounting historically for between 26 and 35 per cent of total annual platinum demand. Platinum’s rarity and precious metal status has led to strong, long-standing associations with the luxury goods market, especially in western markets and Japan. China is the largest market for platinum jewellery, with a market share of 41 per cent, or 871 koz, in 2019, although this has been on a declining trend since the peak of the market in China in 2013 when demand reached 1,990 koz.

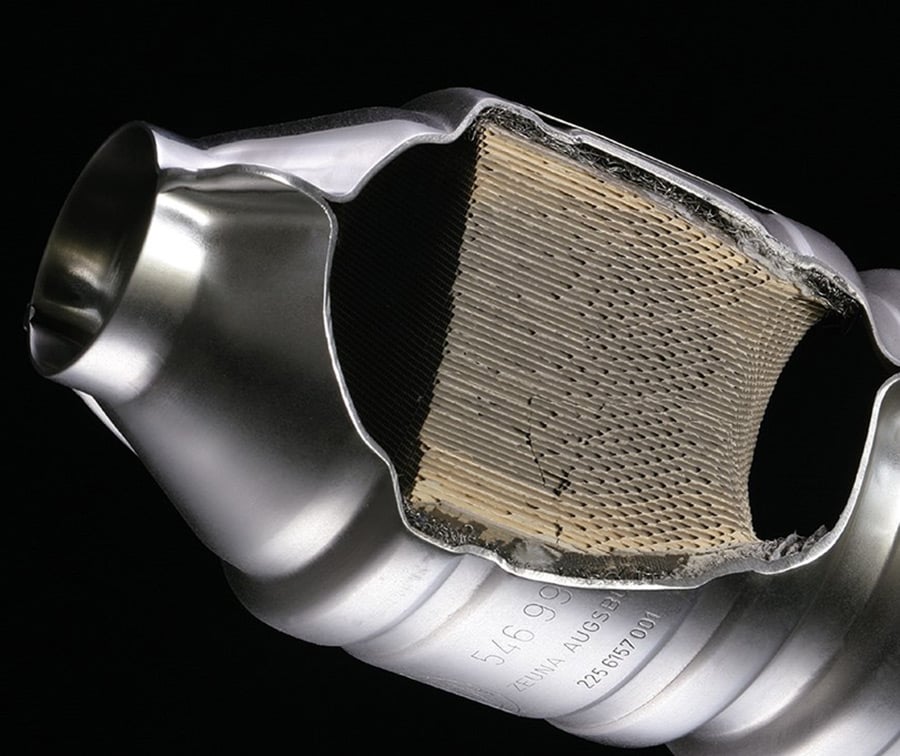

August 2020: Automotive demand. Platinum has been used in autocatalysts for over forty years, with automotive demand the single largest demand segment for platinum, accounting for around 40% of annual platinum demand. As a result, investor sentiment towards platinum is heavily influenced by trends in the auto sector, which has had to overcome significant challenges, including the Dieselgate scandal, in recent times.

This year, automakers are feeling the negative impact of the COVID-19 pandemic; in the first half of 2020, global light vehicle sales contracted 28% year on year, with European sales down 43%. Yet behind the headline data, and against a background of tightening emissions legislation around the world, a more detailed examination reveals several automotive themes, including resurgent diesel demand and substitution by platinum for palladium, that point to a more positive outlook for platinum automotive demand than auto sales data alone might suggest.

Feb 2020: Industrial demand is a key segment for platinum. Understanding the dynamics of platinum demand is essential to understanding the investment case for platinum, which is based on an evaluation of trends in platinum demand, supply, and market balances. Currently, platinum demand growth drivers, against a backdrop of constrained supply, increase the consequent likelihood of future deficits. Industrial use of platinum is diverse in terms of both end uses and geography, coming from six main sectors - chemical, medical, glass, petroleum and other (which includes platinum-based hydrogen fuel cells, used in FCEVs (FCEVs)

Industrial demand for platinum is not reliant on any one sector or territory and is likely to continue growing at or above the rate of global growth.

Dec 2019: Investing in platinum. Diversification? Relative value? Supply/demand fundamentals? Inflation hedge? Irrespective of the reason for seeking exposure to platinum as an investment asset, there is a wide range of routes available when it comes to addressing the question of how to invest in platinum. Investors have a broad range of choices to consider, including: platinum bullion; online bullion accounts; physically-backed platinum exchange-traded funds; and futures contracts.

In fact, investors are often surprised to discover just how accessible platinum investment is, with ownership of physical platinum possible without the onus of vaulting. Fractional ownership is also an option and, depending on the type of investment, minimum investment levels can start at around US$50. What is more, as a rare metal with unique properties, in demand as both an industrial and precious metal, platinum is attractive as a long-term store of value. It can form part of a retirement savings plan, in much the same way as shares in a listed company or an exchange traded fund, including those physically- backed, like gold and platinum.

Oct 2019: Introduction to platinum: Precious metal with wide industrial uses. Platinum has a unique combination of physical and chemical properties; it is in demand as both a precious and industrial metal. Its high melting point, density, ultra-stability and extreme non-corrosiveness make it crucial to many industrial and manufacturing processes, yet it is also used to fabricate the finest jewellery in the world. Platinum is also an investment asset that reflects its value across the demand spectrum from industrial to precious metal. It is included in investment portfolios via physical bars and coins, on-line bullion accounts, physically-backed exchanged traded funds and through futures contracts.

Thirty times rarer than gold, platinum is found at very low concentrations in the Earth’s crust. Platinum extraction from mining is concentrated in only three geographical locations in the world, with 80 per cent of all production in Southern Africa. Around 6 moz (190 metric tons) of platinum is mined worldwide each year, compared to 108 moz (3,300 metric tons) of gold. Each year, a further 2 moz (60 metric tons) of platinum comes from recycling, predominantly from autocatalysts in end-of-life vehicles.