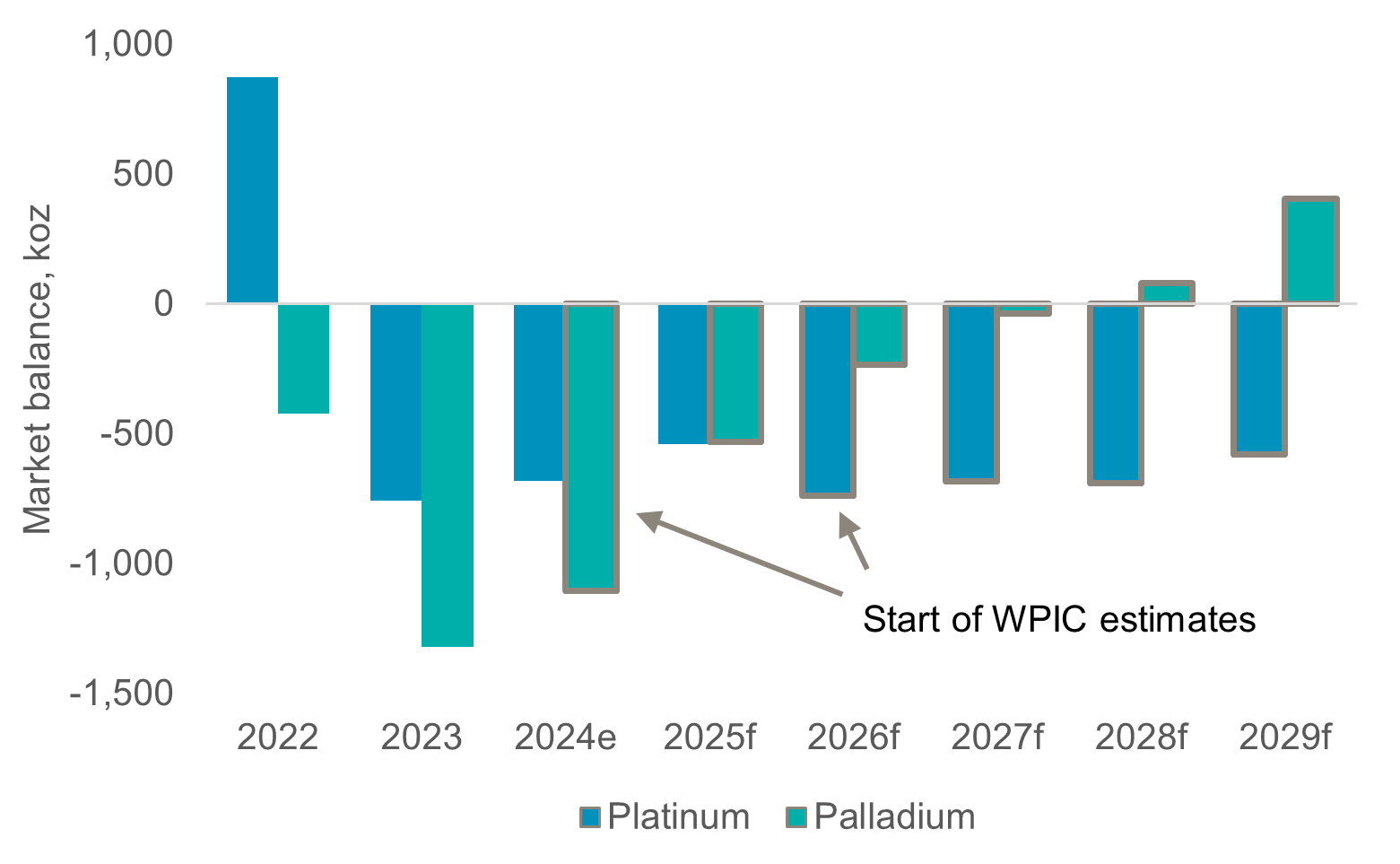

Jan‘25, Five-year supply/demand outlook; platinum deficits persist, palladium’s are deeper and last longer

6 February 2025

With our Platinum Quarterly (link) now running through 2025, this Platinum Essentials contains revised estimates for platinum supply/demand balances in the years 2026 to 2028 and our first estimate for 2029. Platinum market deficits established during 2023 and 2024 are set to persist throughout the forecast period through 2029f. WPIC expects platinum market deficits to average 672 koz pa from 2026 to 2029, or approximately 8% of demand. We have also updated our palladium forecasts to 2029f, where we expect deficits to 2027f (previously 2025f) before market surpluses emerge from 2028f.

Since our previous two- to five-year outlooks, many of the themes previously highlighted are persisting. In the automotive sector, slowing demand growth in light vehicle electrification is entrenched. Accordingly, we expect a long tail in automotive platinum group metals (PGM) demand, with modest erosion of -1.4% CAGR for platinum and -1.0% CAGR for palladium through 2029f. Our updated automotive outlook includes a deferred fuel cell electric vehicle ramp up. Elsewhere platinum demand is forecast to record 1% growth p.a. in both jewellery and industrial applications to 2029f, while palladium’s price pull-back should incentive great use in jewellery and industrial applications over the next five years. Investment demand forecasts utilise 10-year historic averages, which suggests growth of ~150 koz off 2024 levels for platinum.

Assuming PGM prices remain at or above current levels, we expect miners to spend 2025 consolidating on restructuring initiatives implemented during 2024. The aggregated mid-point of company guidance indicates supply erosion of -0.9% and -1.3% CAGR from 2024e to 2029f for platinum and palladium respectively. We believe forecast risks are higher for recycled PGM supply, particularly automotive supply. Although improving scrap availability should support future volume growth, low prices and overcapacity are weighing on profitability and disincentivising supply.

Consolidating the revised forecasts, we have reduced our platinum market deficits by an average of 25 koz (versus previous publications). Large mine restructuring announcements in the US and Southern Africa occurred after our prior palladium market forecasts; thus larger average revisions of -217 koz for supply and +156 koz for demand were made (versus previous publications).

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.