Jewellery market growth returns as China’s decline halts, strong ex-China growth continues and platinum’s discount to gold results in price parity with white gold

16 January 2025

In this Platinum Essentials, we analyse the jewellery market, explaining the drivers of global demand and future opportunities for platinum. Jewellery is key component of total platinum demand at 25% of total demand.

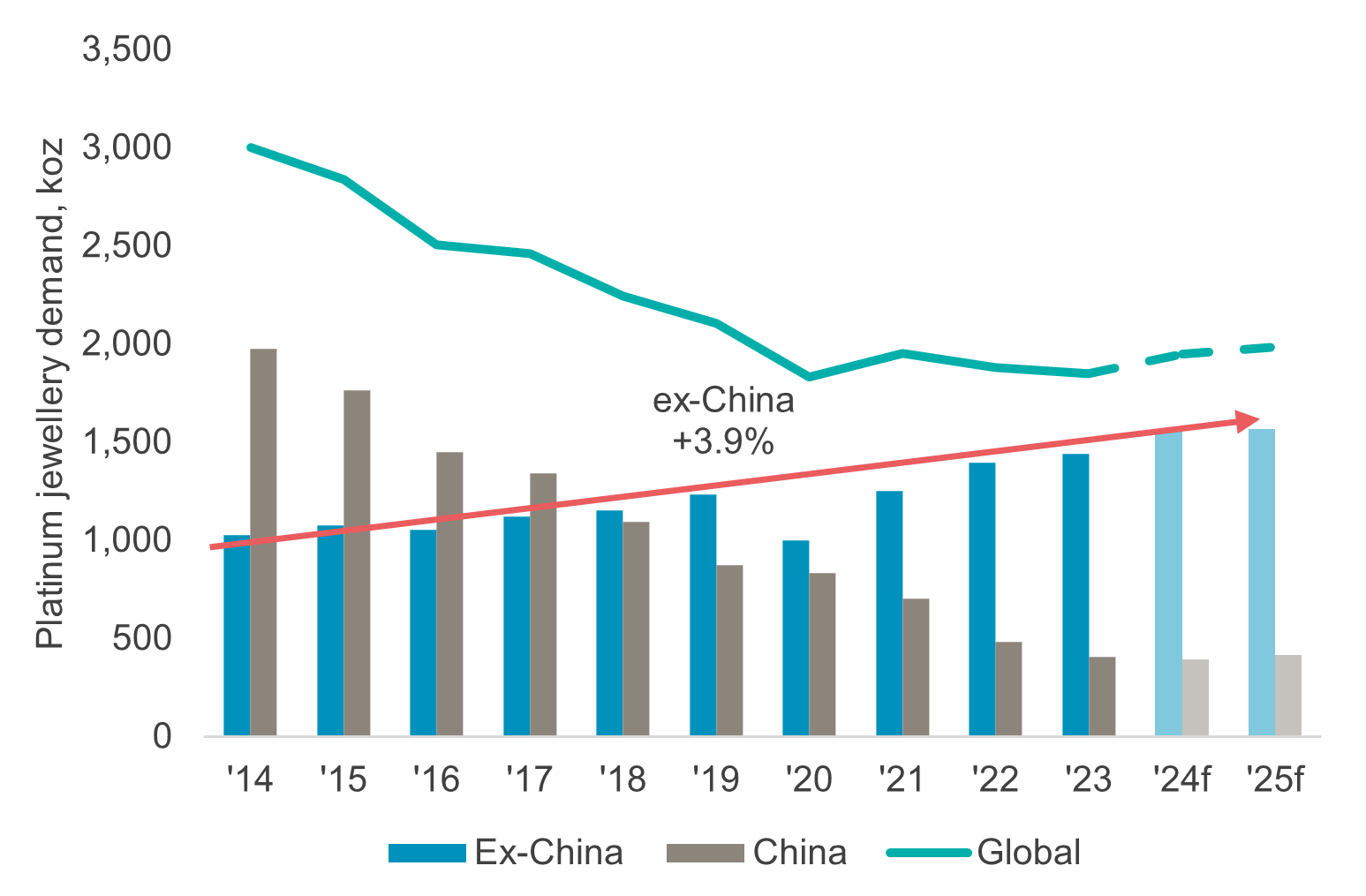

Within WPIC’s data series, the platinum jewellery market peaked at 3.0 Moz in 2014 and has declined to 1.9 Moz in 2023. This erosion is entirely due to a slump in demand in China. What has gone under-appreciated over the past decade is the scale of growth in ex-China platinum jewellery demand, which is forecast at 1.6 Moz in 2024f compared to 1.0 Moz in 2014. This growth reflects a combination of gains due to its gold price discount, strong gains for the European-centred luxury brands and the metal’s successful introduction in India. The size and growth of the ex-China global platinum jewellery market is now sufficient to offset the annual decline from China, implying global jewellery demand for platinum has already troughed. In our latest two- to five-year forecast (link), we expect platinum jewellery demand growth of 2.0% CAGR from 2023 to 2028f.

However, in undertaking a deeper analysis of jewellery markets, we believe platinum could gain share from the estimated 1.7 Moz white gold market given the prospects for price-driven switching, emerging risk management tools and technology advancements. Assuming 5% of white gold demand is switched into platinum demand, this would increase total platinum demand by an average of 100 koz or 1.3% p.a. through the years 2025-2028.

Figure 7. Non Chinese platinum jewellery demand is ~80% of the global market and growth is expected to offset weak Chinese demand

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.