Sep‘24, 2-5 year platinum supply/demand outlook: Robust demand and limited supply drive larger market deficits

26 September 2024

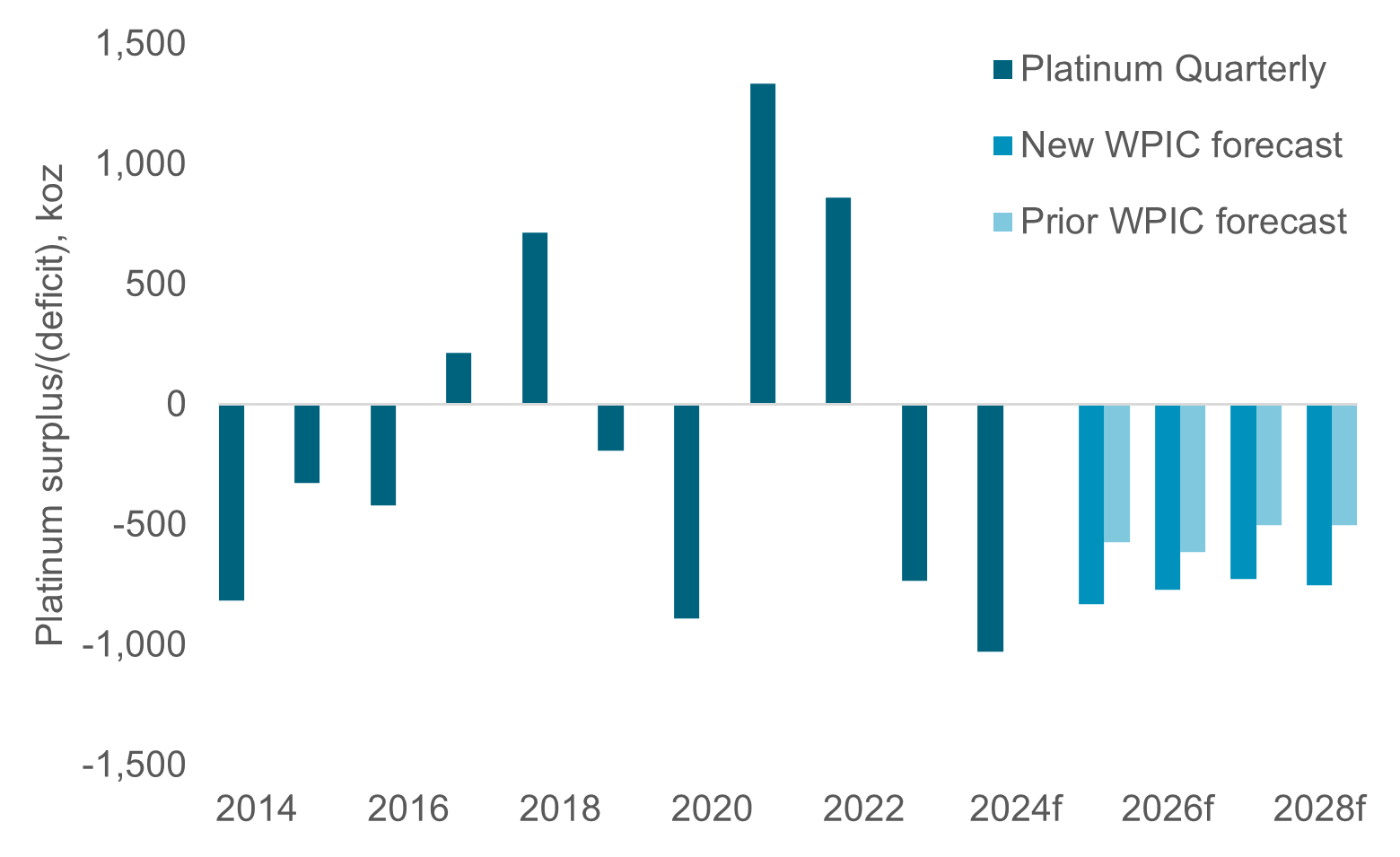

Our Platinum Quarterly Q2’24 market outlook for 2024 incorporated data from the first six months of the year and this Platinum Essentials similarly leverages market developments seen throughout this year into our two- to five-year forecasts. The platinum investment case remains compelling, with the overriding feature the substantial market deficits of 2023 and 2024f expected to persist throughout our forecast period to 2028f. We expect annual platinum deficits to average 769 koz from 2025f to 2028f, or 9% of average demand.

Compared to our January 2024 forecast, changes to three market segments are material enough to warrant us updating our longer-term forecasts. Firstly, 2024 has seen actions taken by the South African platinum group metal (PGM) miners in response to the low PGM basket price, with more restructuring initiatives announced, most recently during their financial results briefings. Plans include slowing ramp-up schedules, project deferrals and mines/shafts being closed or placed on care and maintenance. The aggregated mid-point of producer guidance has reduced by 5% between 2025f and 2028f.

Secondly, we have made a one-off downward revision to our platinum loadings forecasts to address trends in thrifting, vehicle mix and stagnating emission legislation. Despite us reducing our average 2025f to 2028f platinum automotive demand forecasts by 5%, the overarching automotive narrative is that of resilience. We only expect platinum automotive demand erosion of

-1% CAGR from 2023 to 2028f which is a far cry from the sentiment of the last three years where many market participants had expected sharp demand destruction due to drivetrain electrification. Instead, battery electric vehicle (BEV) sales growth has slowed drastically in 2024 whilst hybrid internal combustion engine (ICE) demand has proven robust.

The final notable update to our revised outlook is the inclusion of Chinese platinum bar and coin demand data; new line items in our Platinum Quarterly. Our two- to five-year outlook includes the impact of the additional China investment ounces, with total platinum investment demand now expected to average 558 koz per annum from 2025f to 2028f.

All estimates in this report are based upon publicly available information and WPIC in-house analysis*.

Figure 1. Consecutive platinum markets deficits are expected from 2023

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.