The slowdown in BEV market growth is driving investor interest in platinum on a higher-for-longer ICE automotive thesis; are budget BEVs a threat to this outlook?

31 July 2024

The slowdown in pure Battery Electric Vehicle (BEV) market growth is driving investor interest in platinum on a higher-for-longer Internal Combustion Engine based (ICE) vehicle automotive demand thesis. This report examines if slowing BEV demand is temporary or structural, and whether the BEV market could be reinvigorated by announced budget friendly BEV models. Our key conclusion is that budget BEVs are unlikely to lift overall declining BEV growth as, in reality, they address a small market and are ultimately less cost-effective for a cohort of buyers that typically do not have access to cheaper at-home charging.

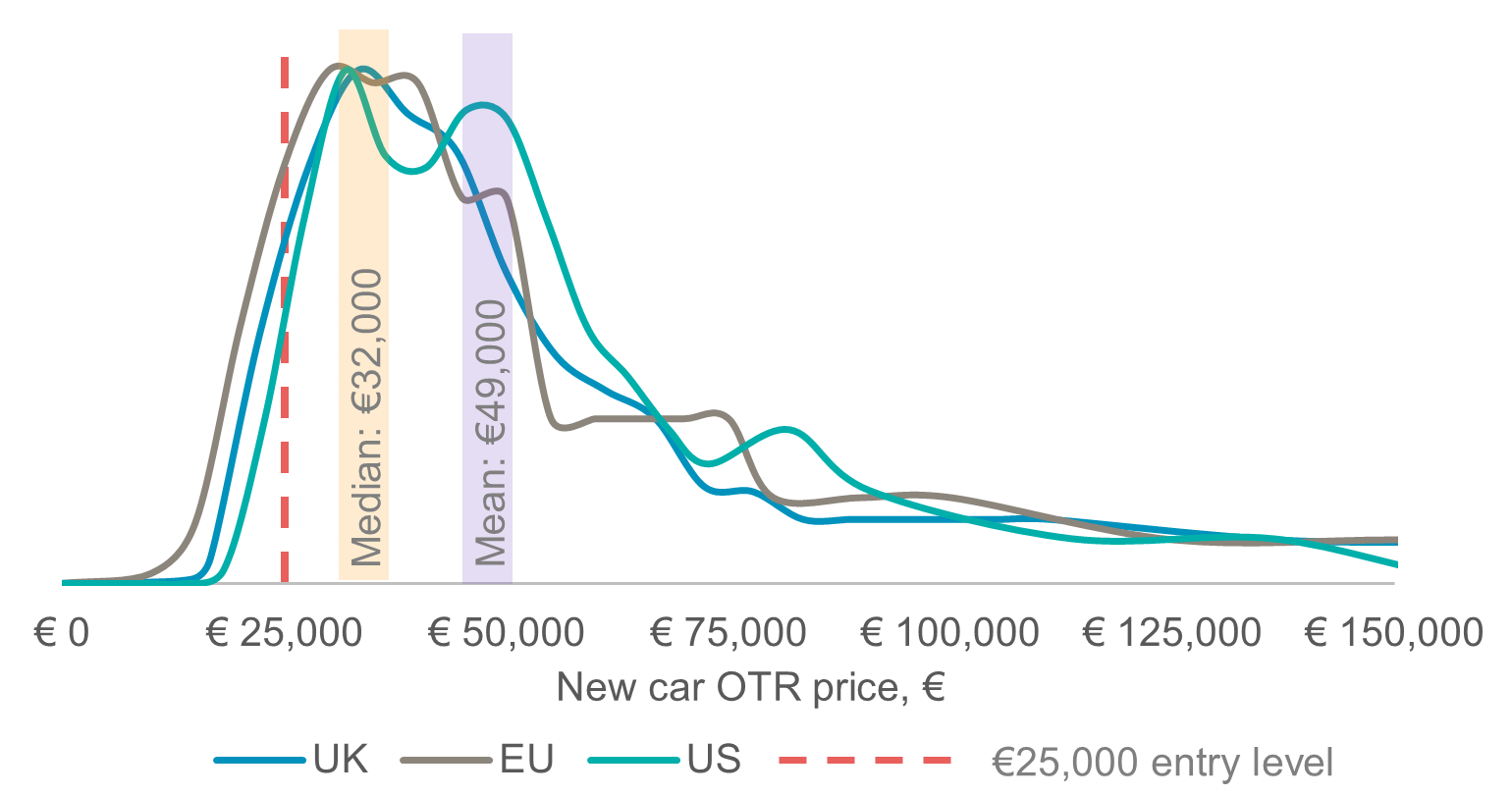

Contrary to expectations, the sub-€25,000 new car market is small and only accounts for ~15% of listings in developed economies. This is not the “mass transportation” segment it is sometimes described as by automakers. The true mass-market lies within the €30,000 to €50,000 price range where around 45% of new cars (including BEVs) are priced in developed markets. This suggests that BEVs are already competing in the mass market and that producing cheaper BEVs to compete in the niche €25,000 low-end vehicle market is no panacea for stalling overall BEV demand growth.

Furthermore, we expect a BEV’s perceived lower running costs versus an ICE/hybrid equivalent to unwind, raising doubts about achieving “price parity”. Firstly, governments are already tapering purchase and running subsidies. Secondly, are changes to the commonly cited benefit of BEVs being cheaper to run versus petrol/diesel. Cheap electricity is largely a function of access to “at-home” charging, whereas the reality is that public charging can be more expensive than petrol/diesel. Housing stock data shows a skew towards smaller homes/apartments which, by inference, will not allow installation of private charging. However, residents of small homes and apartments are likely to be the target market for affordable BEVs. Therefore, buyers of affordable BEVs residing in small homes (unable to install at-home charging) are reliant on expensive public charging eliminating running cost advantages over an ICE.

Finally, we are uncertain how prevalent €25,000 BEVs will be given affordable cars generate lower margins, which without subsidies could make BEVs loss-making. Moreover, access to China’s competitive BEV imports in developed countries is likely to be constrained by trade tensions between the west and China. Thus, we see several factors that point to slowing BEV demand growth being structural and implying higher-for-longer automotive PGM demand.

Figure 1. €25,000 no longer represents the mass market for new vehicles

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.