Updated palladium supply/demand outlook: Reduced supply and stronger near-term demand prolong larger deficits

29 May 2024

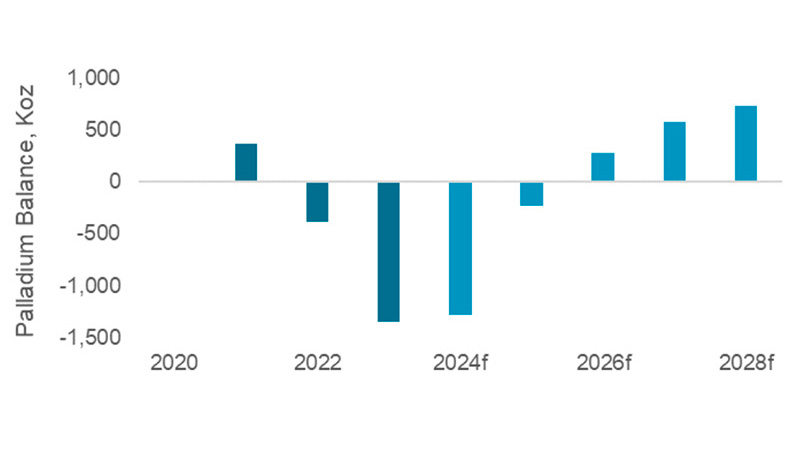

This Platinum Essentials presents our updated estimates for palladium market balances from 2024 through 2028. Palladium is still forecast to transition into a market surplus, but this is delayed by a year to 2026 and the deficit in 2024 is increased by over 1 Moz to 1,281 koz. Both changes are supply driven, with mine supply expectations cut back by producer restructuring and maintenance, and recycling supply growth being delayed. Indeed, the projected transition to a surplus is entirely contingent on a significant increase to recycling (up by >1.3 Moz p.a. by 2028), but this outlook is predicated on a number of challenges being resolved. Any delays to solving these issues could easily slow the pace of the growth in recycling supply, resulting in deeper and more persistent deficits and further postpone the surplus. This would in turn feed into value expectations and provide upward support for palladium prices.

Forecast five-year palladium market imbalances are more dependent on supply growth, particularly recycling, than demand decline. More PGM-rich vehicles produced during periods of rising emission standards are now reaching end-of-life, and are expected to increase annual palladium recycling supply by more than 1.3 Moz p.a. by 2028. The compound annual growth rate (CAGR) of 9% from 2023 to 2028, is nearly twice that of platinum recycling. Near-term deficits are deeper than our previous forecasts, and the tipping point into a market surplus is delayed to 2026 from 2025. This is due to higher automotive demand and lower mine supply, together with a slower-than- expected recovery in automotive recycling. Nevertheless, the anticipated substantial growth in recycling supply is expected to increase the availability of the metal over the longer term, leading to a palladium surplus of 725 koz in 2028. However, there are significant downside risks to the pace of growth in recycling supply due to the ongoing shortage of end-of-life vehicles and regulatory challenges. Should these headwinds persist, they could increase near-term deficits and further delay the transition into a surplus.

In contrast, the outlook for platinum is much more constructive over the longer- term. Compared to palladium, platinum faces the same downside risks to supply and the potential for higher-for-longer automotive ICE demand, but it also benefits from a more diversified demand base and significant growth in demand from an emerging hydrogen economy. We forecast the platinum market to remain in deficit for the foreseeable future.

Figure 1. Palladium demand remains resilient with the tipping point into a surplus from 2026 strongly contingent on the pace of recycling growth.

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.