WPIC’s platinum price attribution model examines the factors that establish platinum value in the market

29 October 2024

A key question market participants are asking is why hasn’t the platinum price reacted to recent market deficits? In response the WPIC has developed a Platinum Price Attribution Model to explain which key observable variables can be utilised as indicators to explain price movements. This report explains how the model has been constructed and what the key takeaways are.

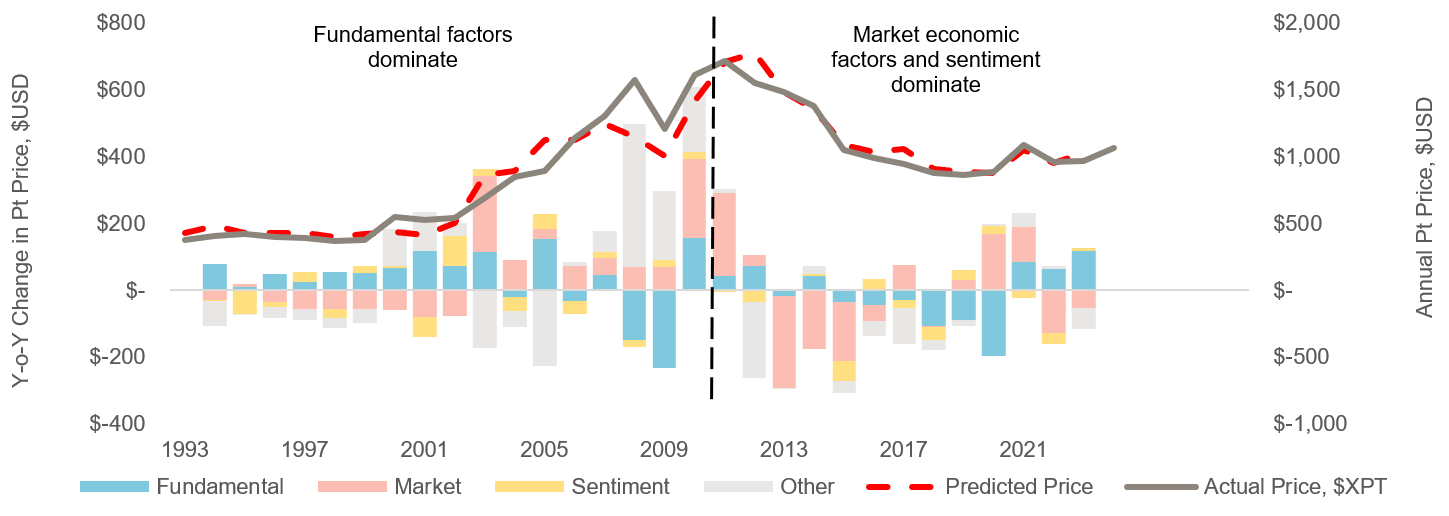

WPIC has utilised multiple regression analysis to create a multi-factor model (fig. 1) to explain historical platinum price movements from 1993-2023. We have divided these factors into three categories, fundamental (demand linked), market-economic (interest rates, gold price, exchange rates), and sentiment (futures positioning). The model accurately explains how changes to independent variables within fundamental, market-economic and sentiment categories have an aggregated impact on the annual platinum price. In addition, we can see the importance of the price setting factors evolves through time and why the platinum price has not yet reacted to the significant deficits of 2023 and 2024. Specifically, a structural break appears to occur in value setting following the end of the China led commodity Supercycle in 2011, which also coincides with the commencement of physically backed ETFs. Prior to this, underlying fundamentals were the key driver of platinum value and post this market-economic and sentiment have been the main drivers.

Looking ahead, with a series of deep market deficits expected – see our latest 2-5 year supply/demand outlook – the model suggests that that supply/demand fundamentals (deficits) are likely to return to being the key drivers of establishing platinum market value. The attractive outlook for the underlying fundamentals is likely to influence sentiment, which in combination with an easing rate cycle and high gold price (market-economic) will provide additional support to the outlook.

The link between a mathematic model such as this, and commodity market economics is not always straightforward. Nonetheless, the model does suggest that the aggregate impact of different market factors is likely to be supportive of a higher platinum price in the future.

Figure 1. The WPIC platinum price attribution model suggests that underlying fundamentals were the most important factor in establishing platinum market value pre-2011. Since then, market-economic and sentiment factors have had a greater influence.

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.