Any delays to forecast recycling recovery will prolong larger deficits in the palladium market

4 June 2024

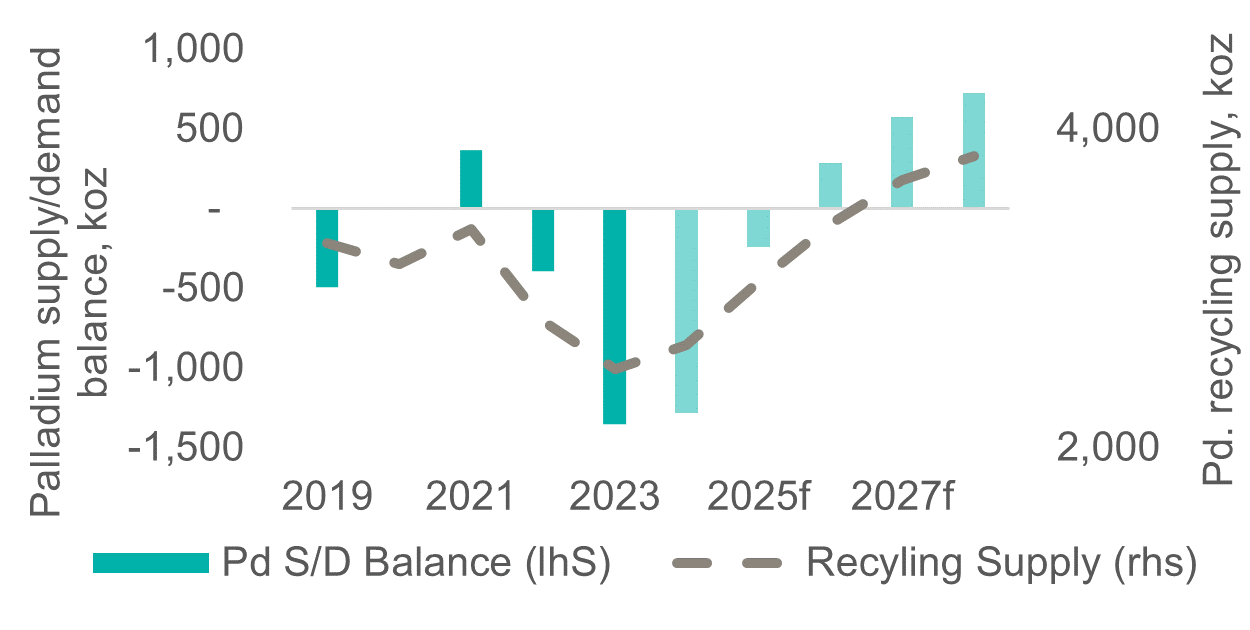

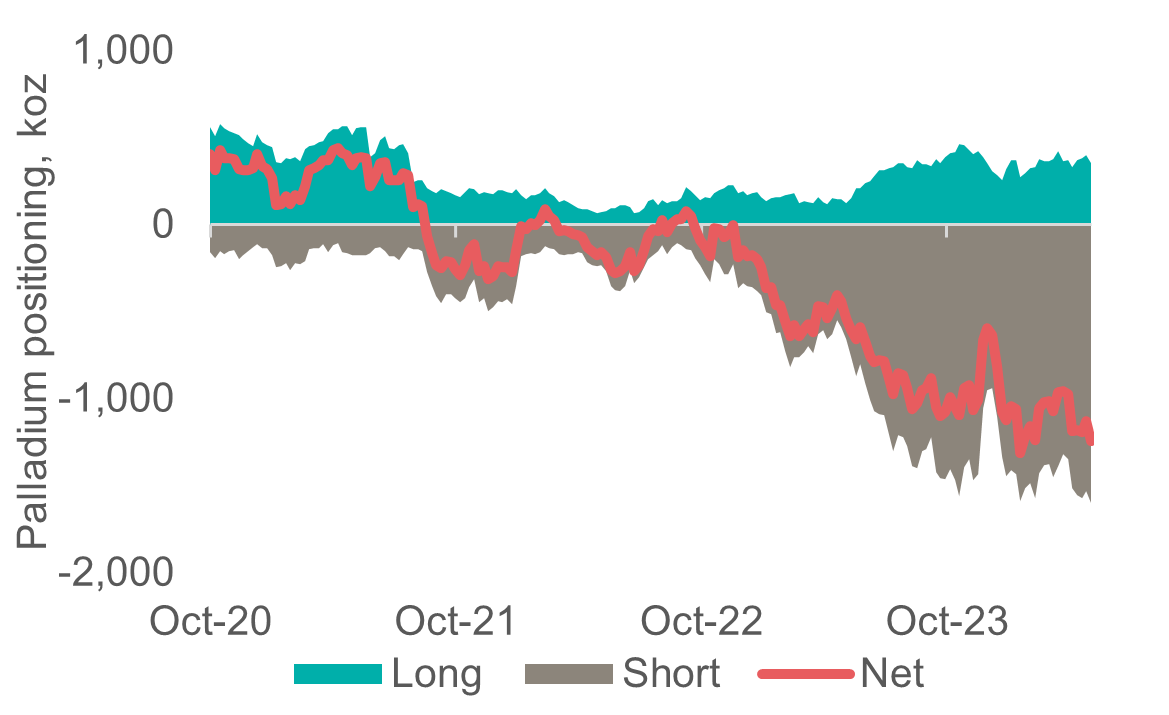

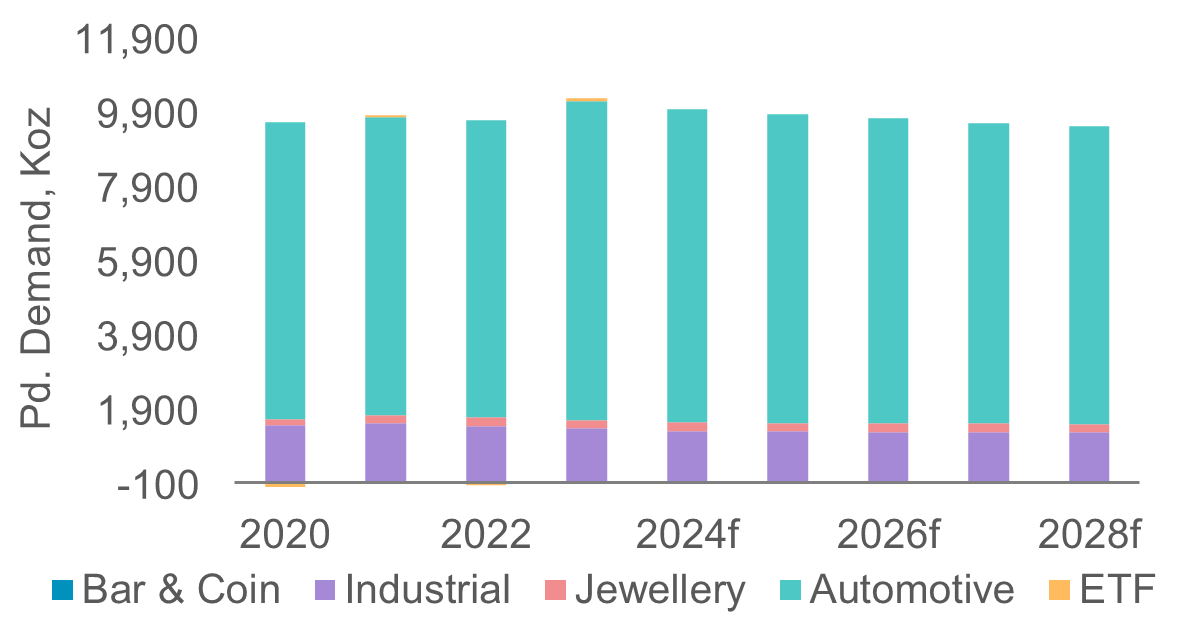

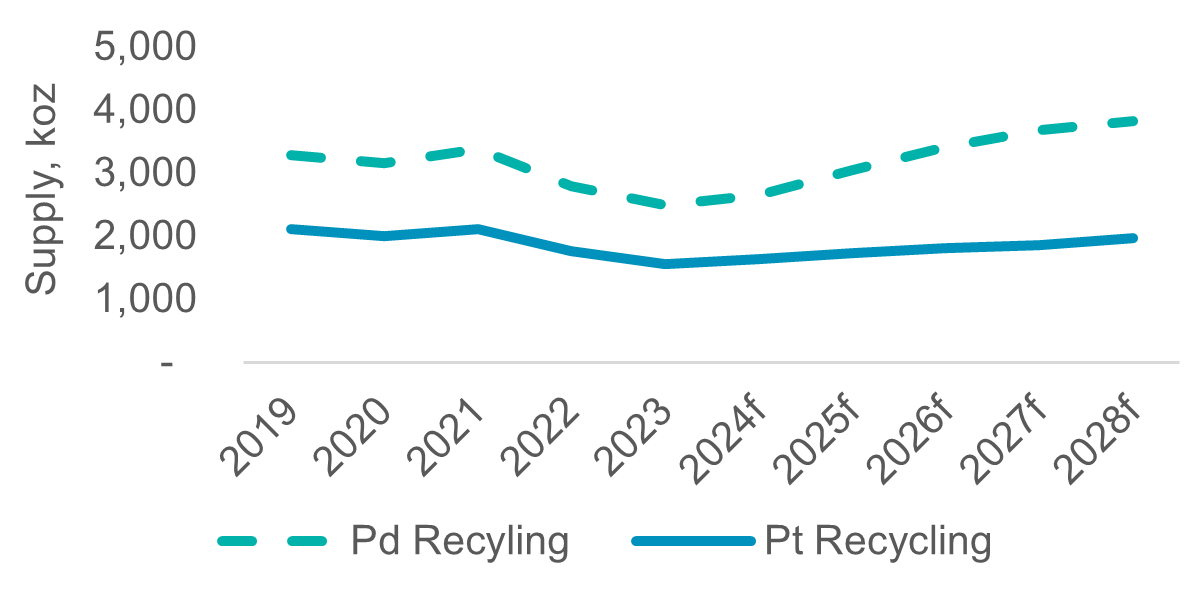

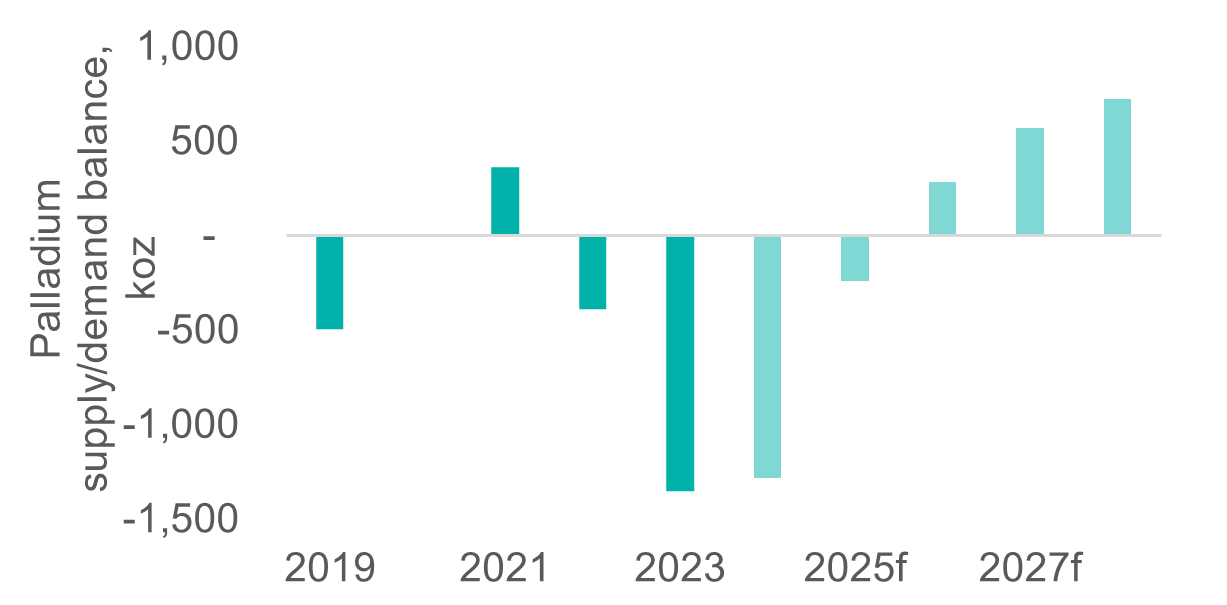

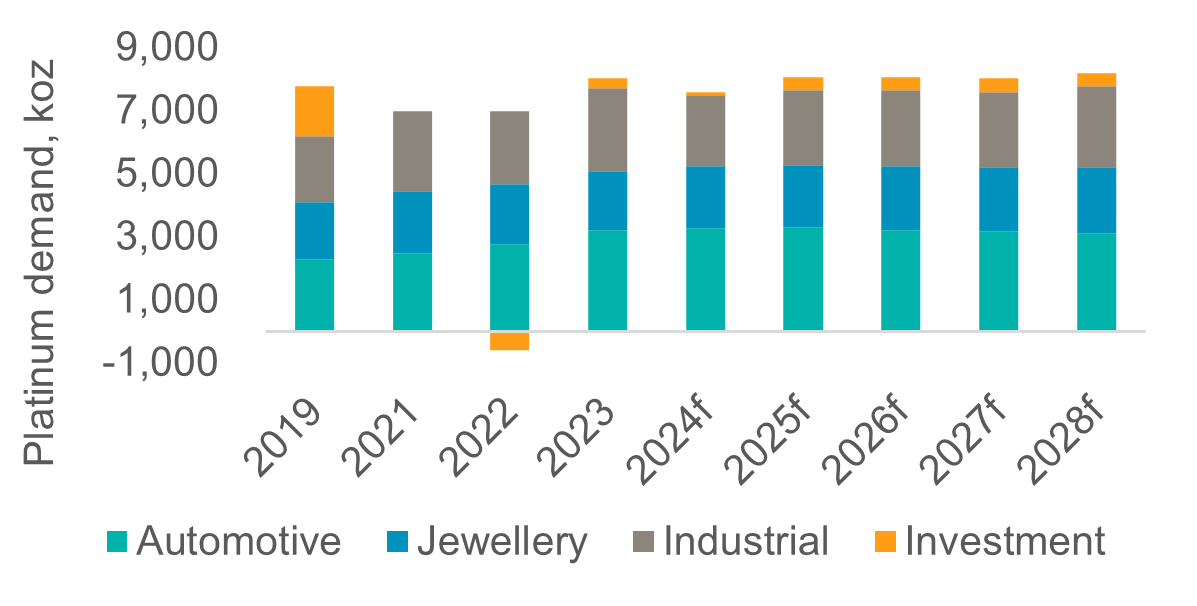

WPIC’s latest palladium supply/demand forecast projects tightening deficits for 2024 and 2025, followed by surpluses from 2026 onwards. Contrary to received market wisdom, the surpluses are not the result of a rapid decline in ICE demand, which remains relatively flat (fig 3). Indeed, the projected transition to a surplus is entirely contingent on a significant increase to recycling (over 1.3 Moz p.a. by 2028, fig 1), but this outlook is predicated on a number of existing challenges being resolved. Any delays to solving these could slow the pace of the growth in recycling supply, resulting in deeper and more persistent deficits and further postpone the surplus. This would in turn feed into value expectations and provide upward support for the palladium price, especially in the context of any potential short covering rallies (fig 2).

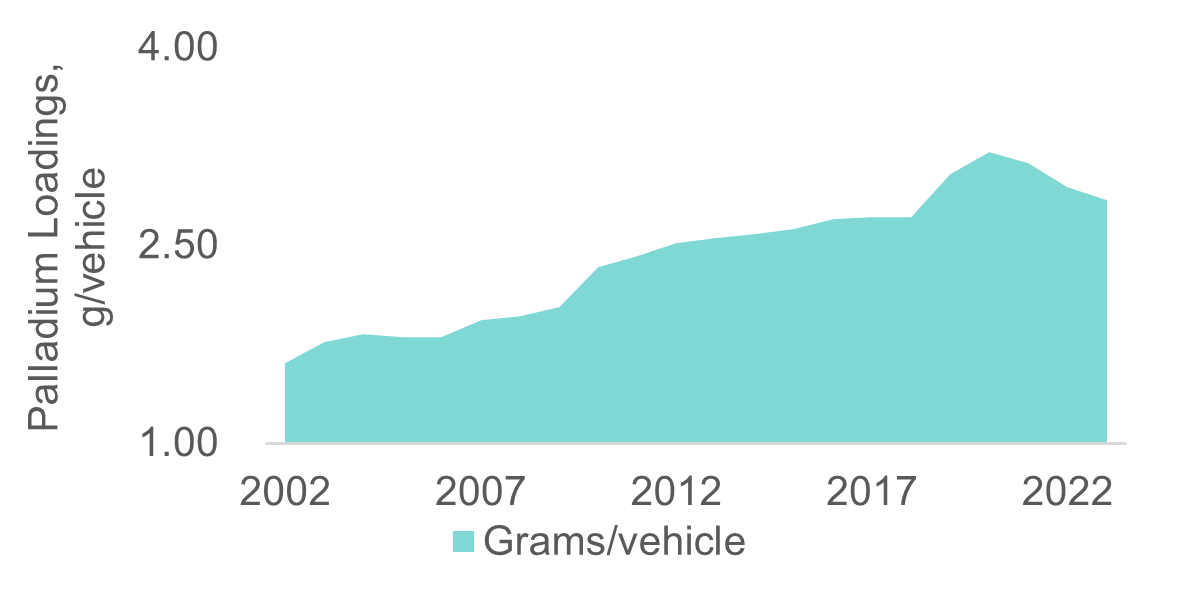

Market sentiment has been particularly negative towards palladium due to a view that demand will fall away with rapid drivetrain electrification. In reality, however, the outlook for auto demand is proving resilient due to consumer reluctance to adopt full electrification and growth in demand for hybrid vehicles (10-15% higher PGM loadings versus the pure ICE equivalent). Palladium is expected to move into a surplus, but this is driven by a 1.3 Moz p.a. increase in recycling rates (2023-2028). Challenges to mine and recycling supply have resulted in the tipping point into a surplus being delayed by a year to 2026 and our supply/demand estimates have been reduced by 1 Moz in 2024. Recycling headwinds include vehicles being used longer as high interest rates and consumer scepticism about electrification weigh on new purchases. Additional issues include concerns about scrap catalyst origin in Europe and the US, following high-profile cases of stolen autocatalysts being recycled, and punitive tax changes in China that hinder recycling growth. Our base case forecast assumes these challenges will be resolved, enabling a normalisation of recycling supply growth and increasing palladium availability over the long term. However, the timing and magnitude of the expected recovery are crucial to near-term market sentiment. Positive news for demand or setbacks to supply delaying the shift to surplus could trigger short-term covering rallies.

Figure 1: Palladium balances most sensitive to supply. Downside risks exist to timing of recycling supply growth.

Figure 2: Palladium appears oversold, and vulnerable to positive sentiment prompting short covering and price uplifts.

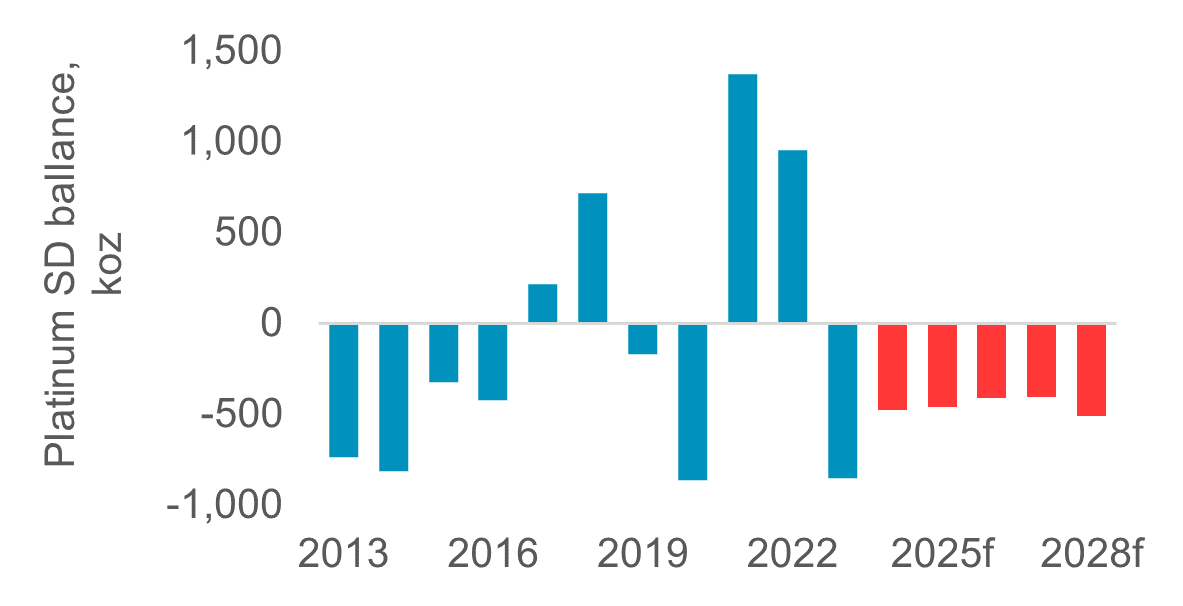

In contrast to palladium, platinum has much stronger short- and long-term fundamentals. Increasing recycling supply is more of a palladium phenomenon, with a projected CAGR of 9% (2023-2028), double that of platinum scrap. Platinum faces fewer downside demand risks and shares upside potential for market tightening. It is exposed to the same primary supply constraints but also benefits from a more diverse demand base and a growing hydrogen economy. Unlike palladium, the platinum market is expected to remain in deficit throughout our forecast period (2024–2028).

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market has entered a period of sustained deficits from 2023.

- Platinum supply remains challenged, hampered by headwinds to mine supply and with recycling rates.

- Higher-for-longer ICE/hybrid vehicle production will support automotive demand for platinum.

- Growing off a small base, hydrogen will be a major source of platinum demand in the future.

- The platinum price remains historically undervalued and significantly below gold.

Figure 3: Palladium demand will not dramatically decline. Instead, it remains relatively stable (-1% CAGR) over the forecast period (2023-2028).

Figure 4: Vehicle loadings have almost doubled on tighter emissions controls. The flat and longer scrappage curve delays that impact on recycling.

Figure 5: Palladium recycling to grow at 9% CAGR (2023-2028), double that of platinum as palladium rich gasoline vehicles reach end-of-life.

Figure 6: Growth in recycling supply results in palladium market surpluses from 2026, but any disruption to recycling will change the shorter-term outlook.

Figure 7: Platinum in contrast has a diverse and growing demand base, exceeding supply. Benefiting from the expansion of the hydrogen economy.

Figure 8: Platinum has a much more constructive long-term outlook. Platinum deficits average 450 koz p.a., depleting down above ground stocks and tightening the market.

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.