Can platinum market deficits be met by ETFs? Yes, but only at much higher prices

15 October 2024

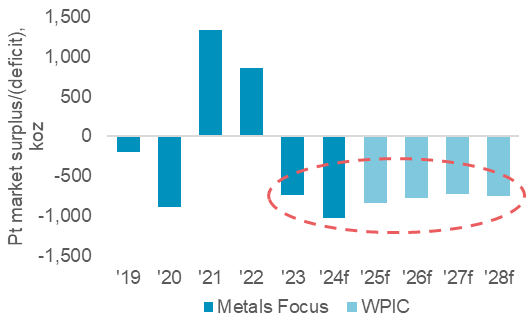

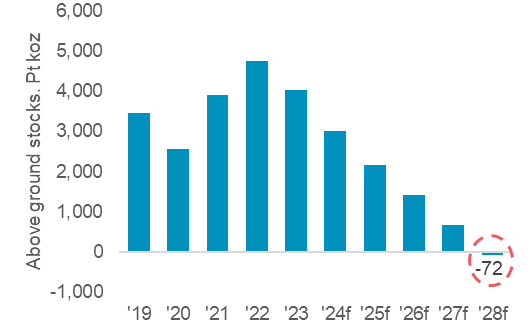

In our updated two-to-five-year platinum market outlook (link), we expect platinum market deficits to average 769 koz from 2025f to 2028f. Drawing on above ground stocks (AGS) will be needed to supply the market, however, these are expected to be depleted during 2028f. A common argument is that despite depleting AGS, platinum prices will not respond to consecutive years of market deficits since ETF disposals will fulfil metal shortfalls. While ETFs can act as a source of supply, it is incorrect to assume holders are price agnostic. Palladium demonstrated, most ETF disposals only occurred through a significant price rally that saw spot exceed the weighted average cost of the accumulated ETF holdings and more. Thus, platinum ETF disposals may occur if prices are above the US$1,100/oz weighted average cost of ETF holdings, but large disposals will require much higher prices.

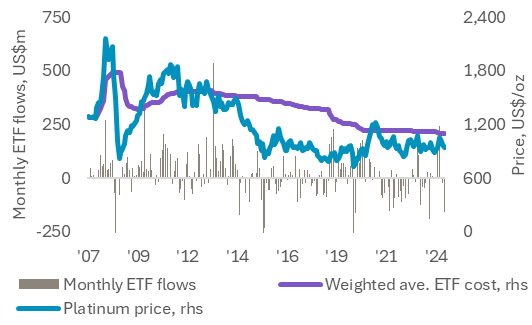

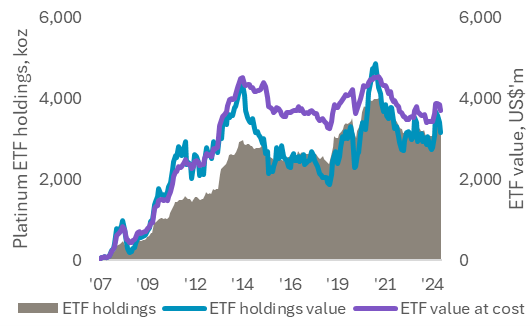

Platinum ETFs launched in 2007 and have accumulated around 3.2 Moz of physically backed holdings (Fig. 5). This has supported platinum demand, but vice versa, disposals would result in ETFs acting as a source of supply. However, it is often ignored that platinum ETF demand stems from investors seeking a return on capital via platinum price appreciation. Hence, ETF disposals are not price agnostic. By calculating the weighted average cost of metal held in ETFs, it is possible to estimate a price threshold required for metal to be sold. The cumulative cost of ETF holdings is determined by adding the monthly metal accumulations at the average price. Dividing this by the total number of ounces gives a weighted average cost on a per ounce basis which we estimate is US$1,100/oz for platinum ETFs currently (Fig. 1).

Fig 1. Weighted average cost of platinum ETF holdings is estimated at US$1,100/oz

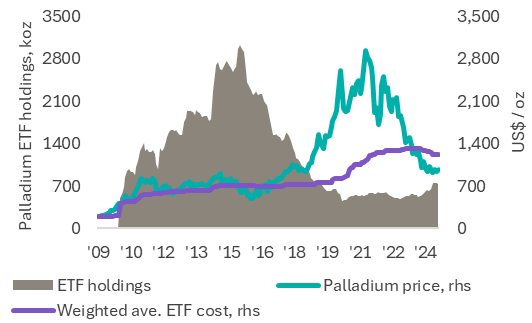

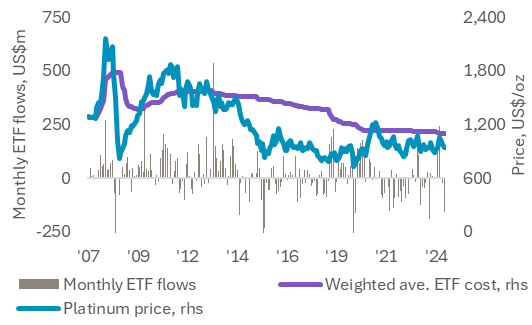

Fig 2. Most palladium ETF disposals occurred only after the spot price exceeded the weighted average cost

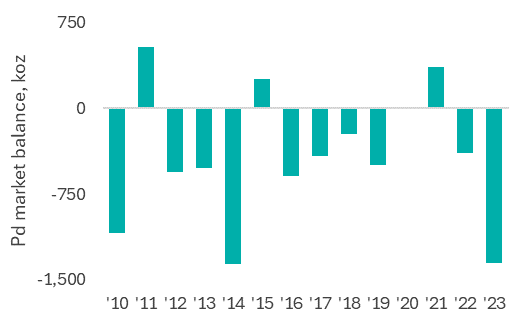

Palladium illustrates that the weighted average cost of ETF holdings is broadly the threshold at which ETF disposals occur in a market expecting consecutive years of deficits (Fig. 7). From 2015 to 2020, palladium prices tripled, and ETF holdings declined from 3.0 Moz to 0.6 Moz. However, most disposals occurred after spot prices exceeded the weighted average cost of ETF holdings (Fig. 2). Accordingly, unless the platinum price sustainably trends above US$1,100/oz, we do not anticipate large outflows and believe market deficits will only be met through the depletion of AGS. This could be compounded by the ongoing interest rate downcycle, which improves the competitiveness of non-yielding assets like commodity ETFs.

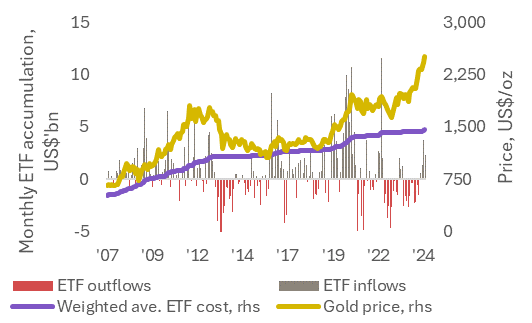

Interestingly, looking at gold ETFs, spot prices have almost always traded above the weighted cost of ETF holdings (Fig. 8). However, where the gold price has entered a down trend, ETF outflows accelerate and vice versa with increasing prices. Under a Veblen scenario, increasing platinum prices may in fact cause investors to build additional platinum ETF holdings, potentially exacerbating the market deficits we forecast to at least 2028f.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market entering a period of consecutive supply deficits from 2023

- Platinum supply remains challenged, both from primary mining and secondary recycling

- Automotive platinum demand growth should continue into 2024f due principally to substitution of platinum for palladium in gasoline vehicles

- Platinum is a critical mineral in the global energy transition underpinning a key role in the hydrogen economy

- The platinum price remains historically undervalued and significantly below the price of gold

Figure 3: Platinum markets are expected to record consecutive deficits from 2023 until at least 2028f

Figure 4: Sustained platinum market deficits are set to fully deplete above ground platinum stocks during 2028f

Figure 5: As platinum prices change, the value of metal held in ETFs will differ from the cost to purchase and accumulate that metal

Figure 6: Depressed platinum prices since 2015 have slowly lowered the weighted average cost of ETF holdings as metal has been accumulated at lower prices

Figure 7: Palladium markets recorded multi-year deficits* from 2010 which resulted in a significant upward rerating of the palladium price, platinum looks similarly poised

Figure 8: Gold ETF accumulations tend to positively correlation with prices where investors build holdings into upward price trends

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.