Deregulating US emissions legislation intends to remove EV mandates and should not negatively impact PGMs

5 August 2025

The US has proposed unwinding emissions legislation. However, the repealing of the Environmental Protection Agency’s (EPA) ability to regulate greenhouse gas emissions should not negatively impact US automotive PGM demand (~12% of total 3E PGM demand in 2024). Our view is that these actions reflect moves against EV mandating which could sustain demand for ICE-based vehicles and PGM demand.

In March 2024, the EPA finalised standards to reduce emissions in passenger vehicles from model year 2027 through to 2032. These standards comprised of two regulated areas, namely, greenhouse gases (GHG) and “criteria pollutants”. GHG covered carbon dioxide (CO2) while criteria pollutants included emissions like nitrogen oxide (NOx), carbon monoxide (CO) and particulate matter (PM). In July 2025, the EPA (with probable Whitehouse influence) has proposed repealing GHG emission standards for vehicles. The proposal aims to rescind interpretations of the Clean Air Act which allowed the EPA to regulate pollutants that “endanger” public health or welfare. The EPA cites that CO2 itself is not toxic to humans (which is true) and therefore the “endangerment” finding is invalid. Moreover, the EPA argues that climate change, in so much as it is driven by GHG emissions, cannot reasonably be expected to be managed by the agency given US vehicle emissions account for only 1.8% (light/medium-duty) and 0.7% (heavy-duty) of global GHG emissions. Notably, the EPA said that legislation regulating criteria pollutants will be unaffected.

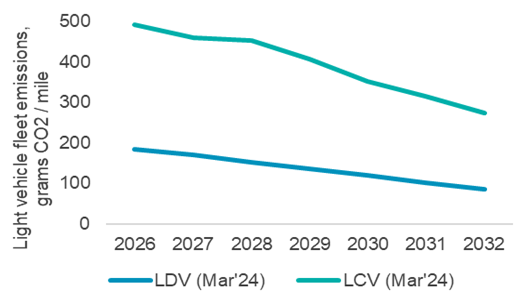

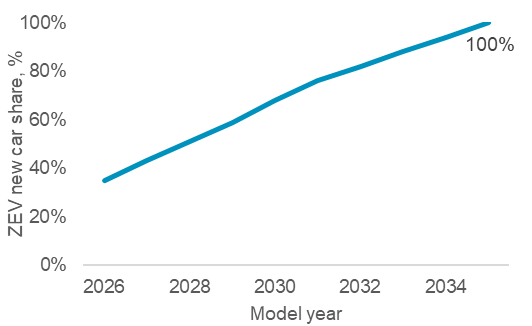

Figure 1. The EPA intends repealing GHG emission standards that required increased BEV adoption to achieve

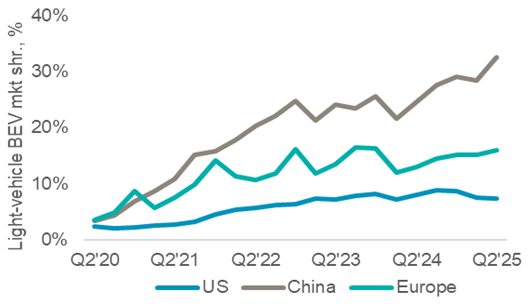

Figure 2. The US was already set to be a BEV adoption laggard prior to winding back emissions legislation

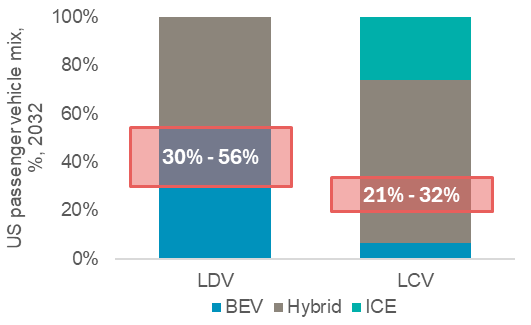

Since catalytic converters do not reduce CO2 emissions, but rather reduce harmful emissions designated as criteria pollutants; automotive PGM demand in the US should be unaffected by proposals to repeal GHG standards. Arguably, eliminating GHG emission standards follows the same ideological moves as withdrawing California’s waiver to set its own emission standards, where the Advanced Clean Cars II act set EV sales mandates at 100% by 2035 (Fig. 5). While the EPA’s GHG emissions standards were technology agnostic, its July 2024 publication noted the only practical way to meet CO2/mile limits (Fig. 1) was to raise clean vehicle adoption, with BEVs estimated to account for 30%-56% of new LV sales by 2032 (Fig. 4).

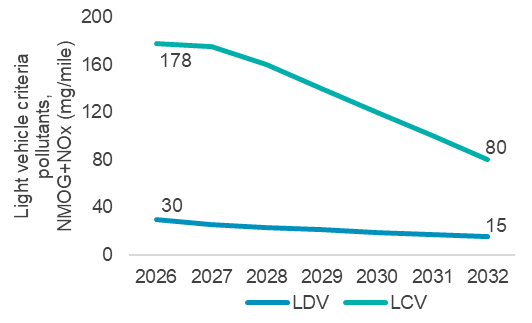

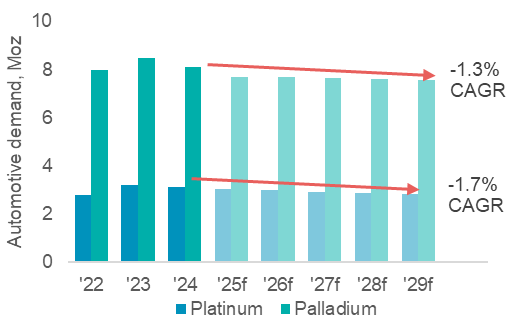

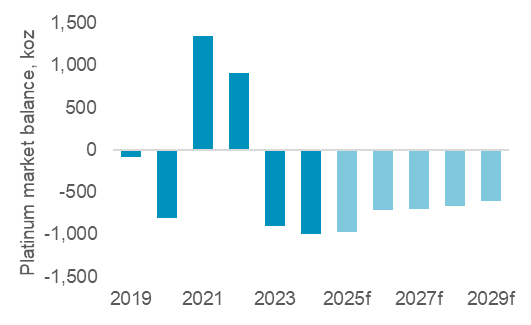

From Sept 2025, consumer demand for BEVs is likely to slow with the removal of Inflation Reduction Act purchase credits. Slowing BEV penetration will be compounded if automakers reduce their electric vehicle offering following the elimination of CO2 standards. While the US remains behind China and Europe’s BEV adoption rates (Fig. 2), tightening NOx and NMOG* emissions limits in 2027 (Fig. 3) should support prolonged PGM demand (Fig. 6). Accordingly, WPIC reiterates expectations that global automotive platinum demand erosion remains slow at -1.7% CAGR from 2024 to 2029f (Fig. 7) and that market deficits are maintained (Fig. 8).

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates that the platinum market entered a period of consecutive supply deficits from 2023 and these are expected to fully deplete above ground stocks by 2029f

- Platinum supply remains challenged, both in terms of primary mining and secondary recycling supply

- Although US tariffs present some downside risks to demand, these are likely offset by tailwinds to jewellery demand and Chinese investment demand

- Elevated lease rates and OTC London backwardation highlight tight market conditions

- The platinum price remains significantly below the price of gold

Figure 3: US criteria pollutants standards stipulate tightening NMOG*+NOx from 2026 to 2032 which will support automotive PGM demand, notably rhodium

Figure 4: The EPA forecasts that to meet CO2 standards by 2032, BEVs would need to account for 30%-56% of new LDV sales and 21%-32% of new LCV sales

Figure 5: The California Air Resource Board’s Advanced Clean Cars II act requires all new passenger vehicle sales to be Zero Emission Vehicles by 2035

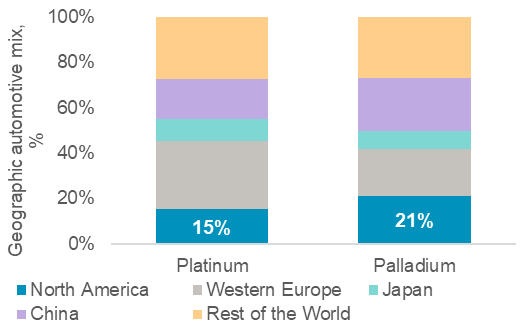

Figure 6: In 2024, North America accounted for around a fifth of global automotive platinum and palladium demand of ~11 Moz

Figure 7: Notwithstanding increased BEV demand, automotive platinum and palladium demand erosion is expected to be minimal from 2024 to 2029f

Figure 8: Platinum markets are expected to record consecutive and substantial deficits to at least 2029f

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.