Factors underpinning platinum’s all time high price remain entrenched

12 February 2026

After a final 25% surge, which lasted only three weeks, the record platinum price rally reset between 29 January and 02 February 2026 before finding support levels that lifted platinum back above US$2,000/oz. Although the precious metals complex is currently moving largely in unison, it is worth noting that platinum’s specific and compelling market fundamentals have not changed. The price increase has not solved for the ongoing shortage of metal, which is illustrated by sustained high lease rates and strong OTC backwardation. Looking back, as platinum reached an all-time high of US$2,923/oz on 26 January our platinum price attribution model (PPAM) was increasingly showing a large residual component to price setting, indicative of the significant impact that the macro-economic and geopolitical environment was having on commodity markets.

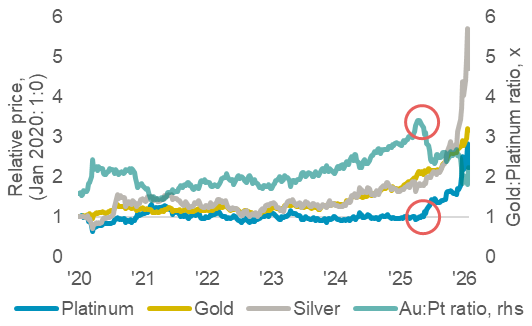

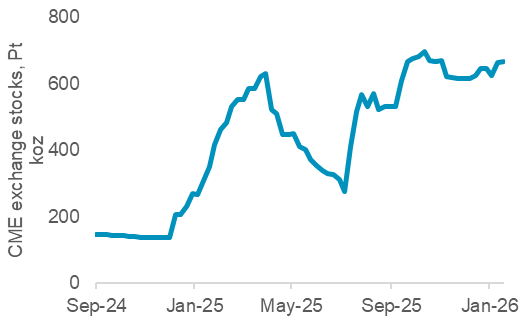

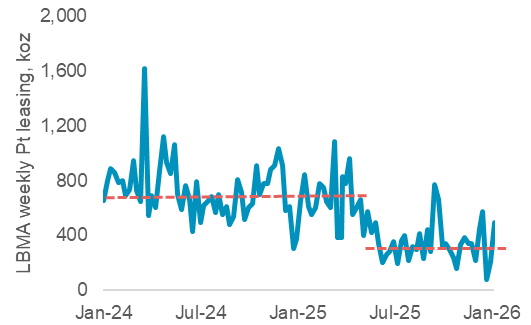

From the start of 2025 to the 2026 YTD peak, platinum prices increased by 220%, with three distinct phases to the price rally. The first step change in platinum prices occurred during Q2 2025 when, reacting to a record discount to gold (Fig 2), Chinese jewellers rotated towards platinum, which coincided with global end-users pivoting away from leasing towards ownership (Fig 6). The second leg up in prices occurred during late Q3 2025. Platinum stocks held on the CME rose (Fig. 3) as the US’s rhetoric on critical minerals supplies intensified, announcing tariffs on copper and launching the Section 232 investigation, followed by the palladium anti-dumping investigation.

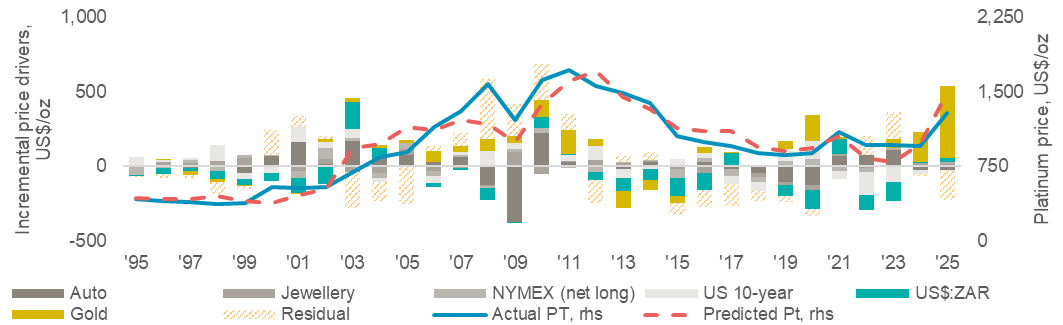

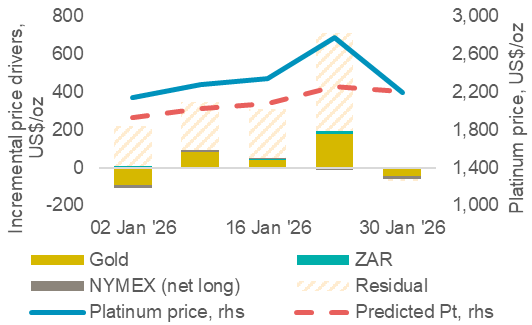

Figure 1. Our PPAM suggests gold prices and the US$:ZAR are the dominant incremental factors setting Pt prices

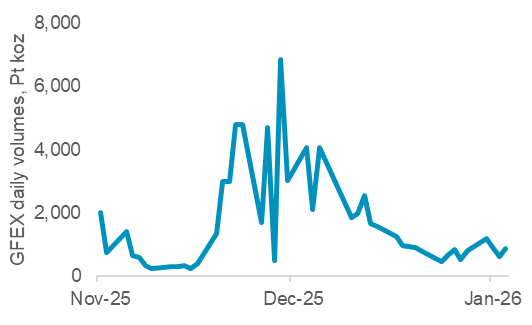

The third phase of platinum’s price rise occurred from December 2025 as precious metals sentiment became increasingly bullish. Optimism around precious metals has been underpinned by geopolitical risks, expectations of monetary policy easing, and growing concerns surrounding fiscal policy amongst large economies. Platinum was further buoyed by the launch of futures and options contracts on Guangzhou Futures Exchange.

Our PPAM reflects the tailwind of precious metals sentiment, with gold underpinning much of platinum’s price setting in 2025 (Fig. 1). Notably, through January 2026, platinum’s early price momentum increasingly began to disconnect from the expected price derived from our PPAM (Fig. 5). The residual factor (i.e. unexplained price drivers) between spot and our PPAM exceeded US$500/oz by 26 January 2026 when platinum achieved an all-time high of US$2,923/oz. With the late January 2026 platinum price correction, the residual factor in our PPAM has declined to -US$11/oz suggesting prices are now aligned with traditional drivers.

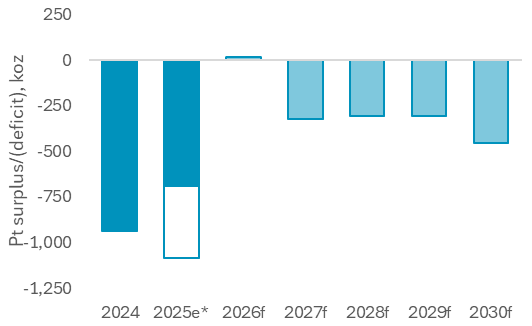

In our view, platinum’s mild price recovery in February 2026 likely reflects some consolidation with investors returning their focus to tangible market dynamics such as platinum’s elevated lease rates (Fig. 6) and compelling supply demand outlook (Fig. 7).

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates that the platinum market entered a period of consecutive supply deficits from 2023, although a balanced market is forecast in 2026 it is not expected to alleviate current market tightness

- Platinum supply remains challenged, both in terms of primary mining and secondary recycling supply

- Although US tariffs present some downside risks to demand, these are likely offset by tailwinds to jewellery demand and Chinese investment demand

- Elevated lease rates and OTC London backwardation highlight tight market conditions

- The platinum price remains significantly below the price of gold

Figure 2: A record discount to gold led Chinese jewellery wholesalers to switch to platinum during Q2 2025 kickstarting platinum’s price rally

Figure 3: Uncertainties surrounding the US’s trade policies have led to an increase in metal held on exchange, restricting physical supply in Europe

Figure 4: GFEX launched in November 2025 and the increase in volumes coincided with higher prices before the exchange implemented position limits

Figure 5: The residual or “unexplained” factors in platinum’s price formation became increasingly large with platinum’s initial rally through January 2026

Figure 6: The increase in lease rates has led to a reduction in leasing volumes as end users shift to ownership over leasing

Figure 7: Higher platinum prices are likely to support supply and erode demand at the margin which should reduce deficits over the medium-term

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.