Fear of Section 232 outcome in the US is key to PGM trade uncertainty and the availability of exchange stocks

4 December 2025

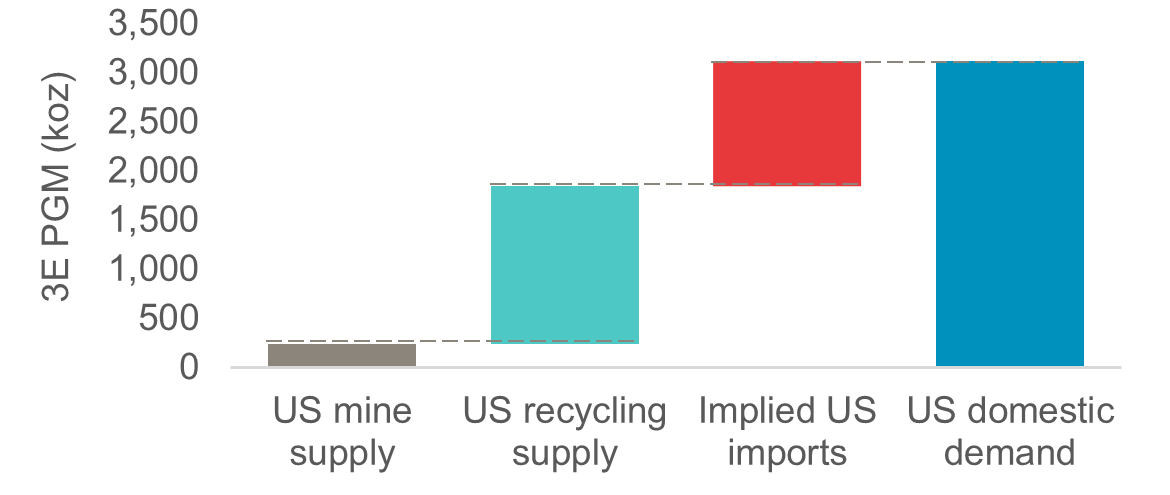

The US is net short PGMs (fig. 1). Accordingly, with the US’s Section 232 (S232) investigation into critical minerals having likely concluded (albeit not yet made public), our base case is that PGMs are unaffected since disrupting imports may harm high value-add domestic sectors such as vehicle production. This aligns with the US reducing tariffs on China to maintain rare earth imports. However, the threshold for an adverse S232 outcome is relatively low, meaning that PGM tariffs or import quotas cannot be totally ruled out. Sustained fears of potential tariffs or quotas may impact the availability of CME warehouse stocks to help ease tight markets and soften high lease rates.

In April 2025, the US Department of Commerce commenced a S232 investigation into the risks posed by critical mineral imports (including PGMs) to national security. Identifying imports as a threat to national security can be as broad as them having a negative impact on the economics of a domestic industry if it means that the industry is unable to meet US needs during an emergency. Under this loose definition of a threat, it is conceivable PGMs are at risk of an adverse S232 recommendation since the US’s PGM demand cannot be met by domestic supplies (fig. 1). We believe the completed S232 report was submitted to President Trump in mid-October 2025. Legally, it is the president who has sole discretion on whether to act on the document’s recommendations (within 90 days). Trump has previously opted to ignore a S232 report in 2019 that concluded uranium imports were a threat to national security, albeit trade stances have hardened in the US more recently.

Figure 1. With limited domestic mine supply, the US is highly dependent on PGM imports (3E)

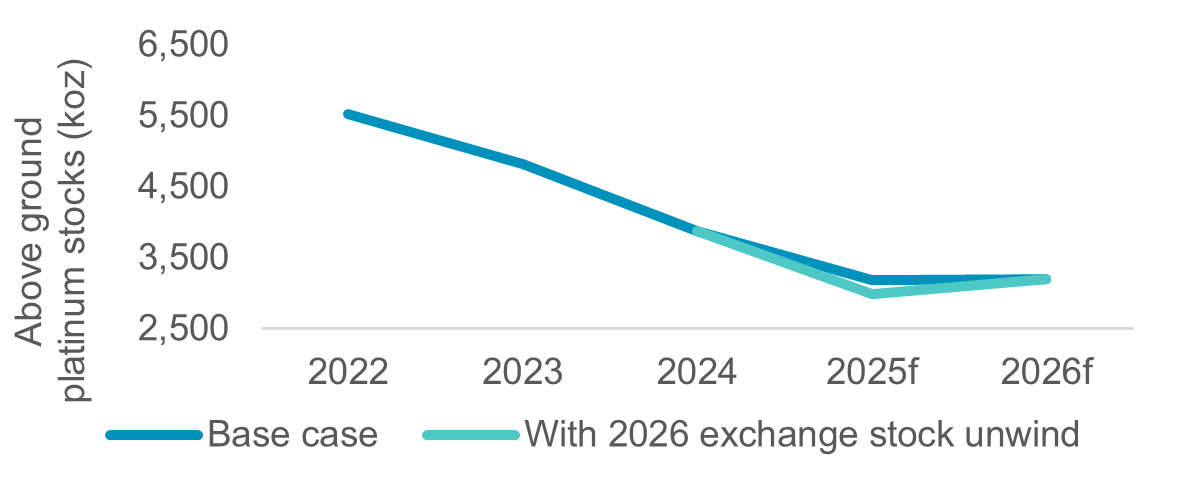

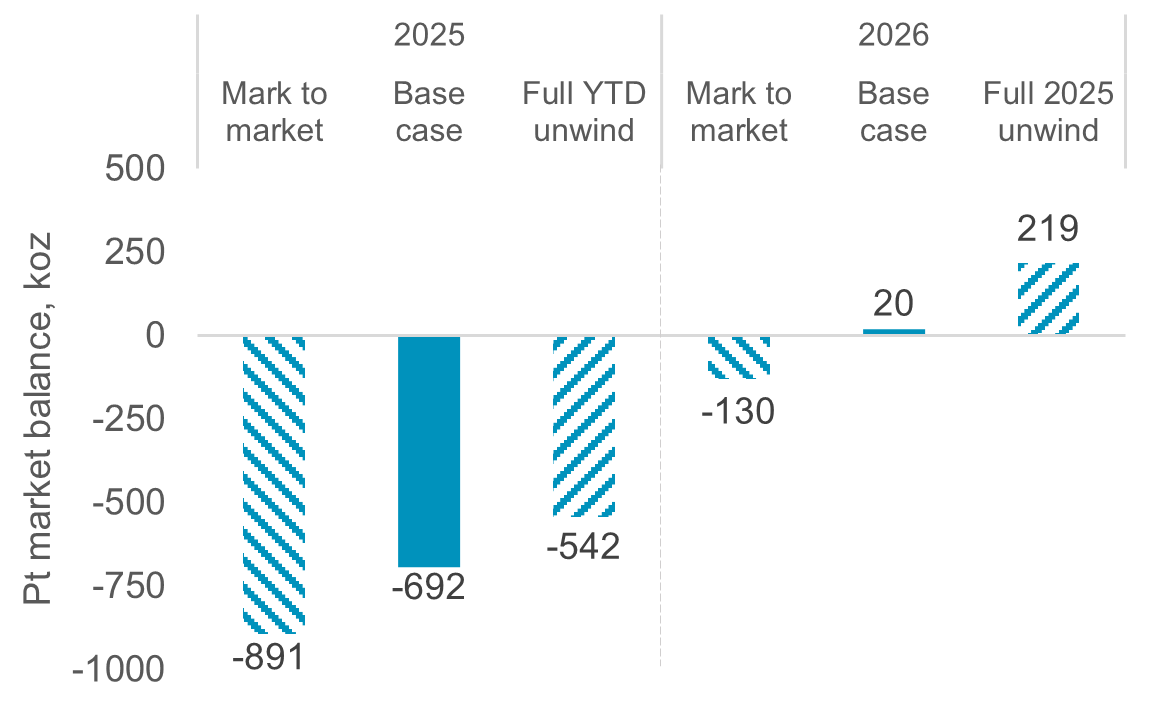

Figure 2. The timing of unwinding exchange stocks does not rebuild above ground platinum stocks

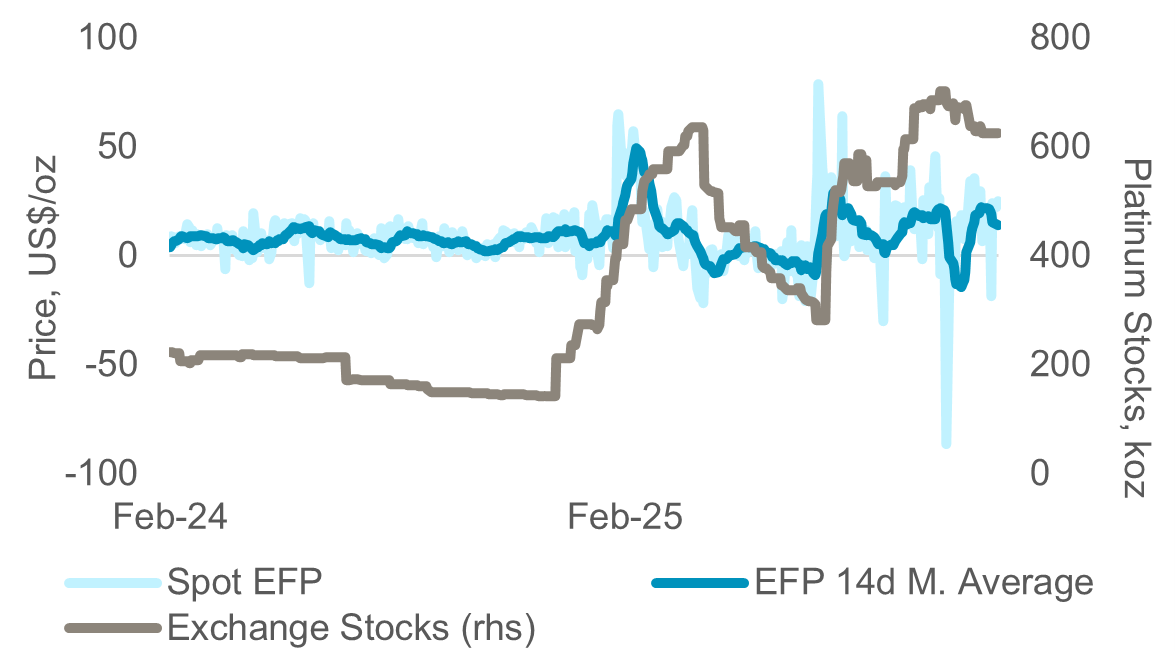

Tariff fears have led to significant US onshoring of PGMs by end users and speculators. CME warehoused platinum stocks have increased from 270 koz at the start of 2025 to 624 koz (fig. 3). Our supply demand forecasts assume no trade barriers arise and that CME warehouse stocks unwind to ~420 koz by year-end and return to ~270 koz by the end of 2026f (fig. 5).

However, if one assumes the S232 outcome affirms harm and Trump agrees, then it is likely that some combination of scaling import quotas and/or tariffs will be enacted. In this scenario, onshored metal may remain trapped in the US. This would exacerbate our forecast platinum market deficit in 2025f (fig. 5). However, CME warehouse stocks will not remain elevated in perpetuity, instead they unwind at a slower pace. It is possible that even with tariffs or quotas, there could be some release of CME stocks if the tariff costs are less than exchange for physical (EFP) differential or the quota volumes are unrestrictive relative to historic imports.

If Trump ignores an affirmative S232 recommendation or the S232 report finds PGM imports do not harm US markets, then a significant outflow of platinum from CME warehouses is likely. Although a drawdown of CME stocks from 670 koz to 270 koz in 2026f would push platinum markets into a surplus (fig. 5), there is no net impact on above ground stocks which will remain depleted after three years of substantial deficits (fig. 2).

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates that the platinum market entered a period of consecutive supply deficits from 2023, although a balanced market is forecast in 2026 it is not expected to alleviate current market tightness

- Platinum supply remains challenged, both in terms of primary mining and secondary recycling supply

- Although US tariffs present some downside risks to demand, these are likely offset by tailwinds to jewellery demand and Chinese investment demand

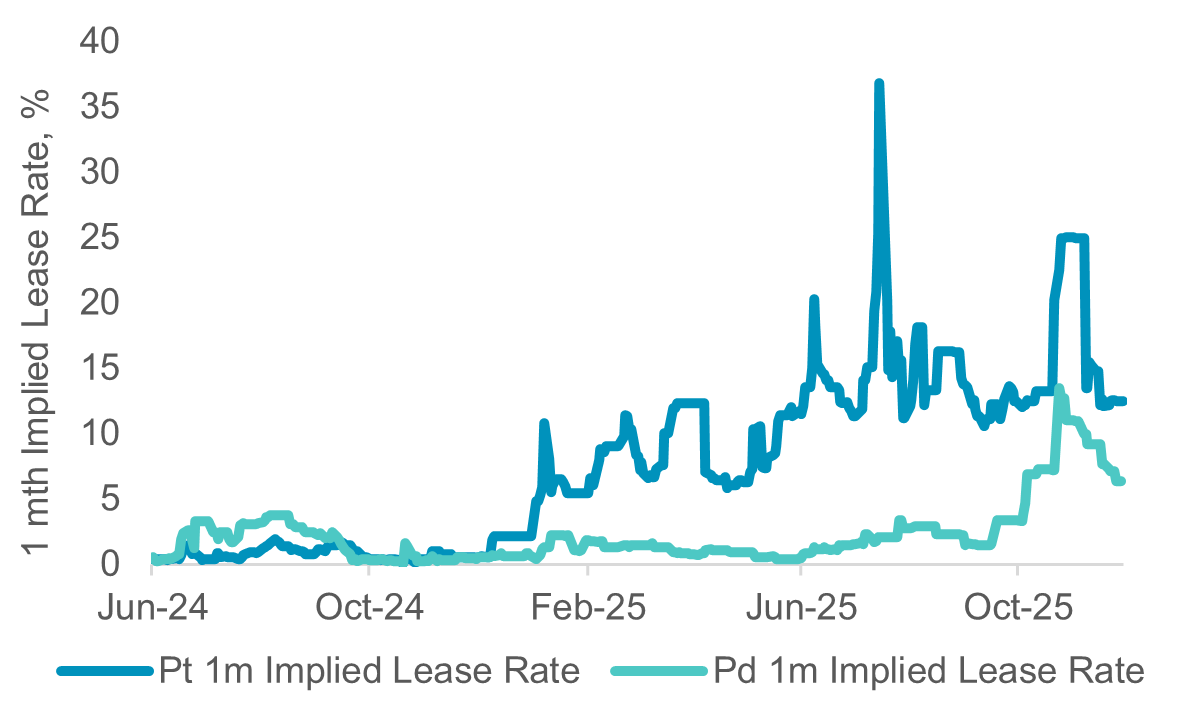

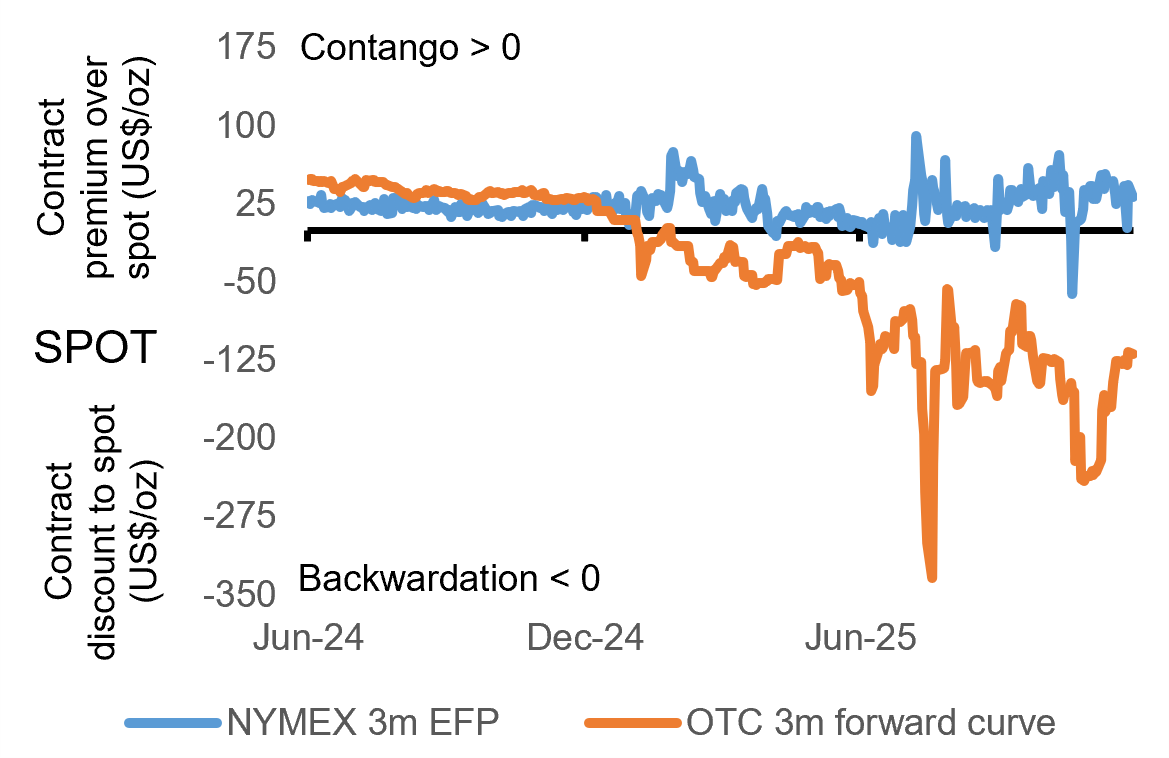

- Elevated lease rates and OTC London backwardation highlight tight market conditions

- The platinum price remains significantly below the price of gold

Figure 3: Tariff fears prompted a positive EFP, at its peak implying a ~5% risk adjusted tariff rate, driving platinum into CME warehouses, easing tariff risks and a negative EFP may release metal back to the market

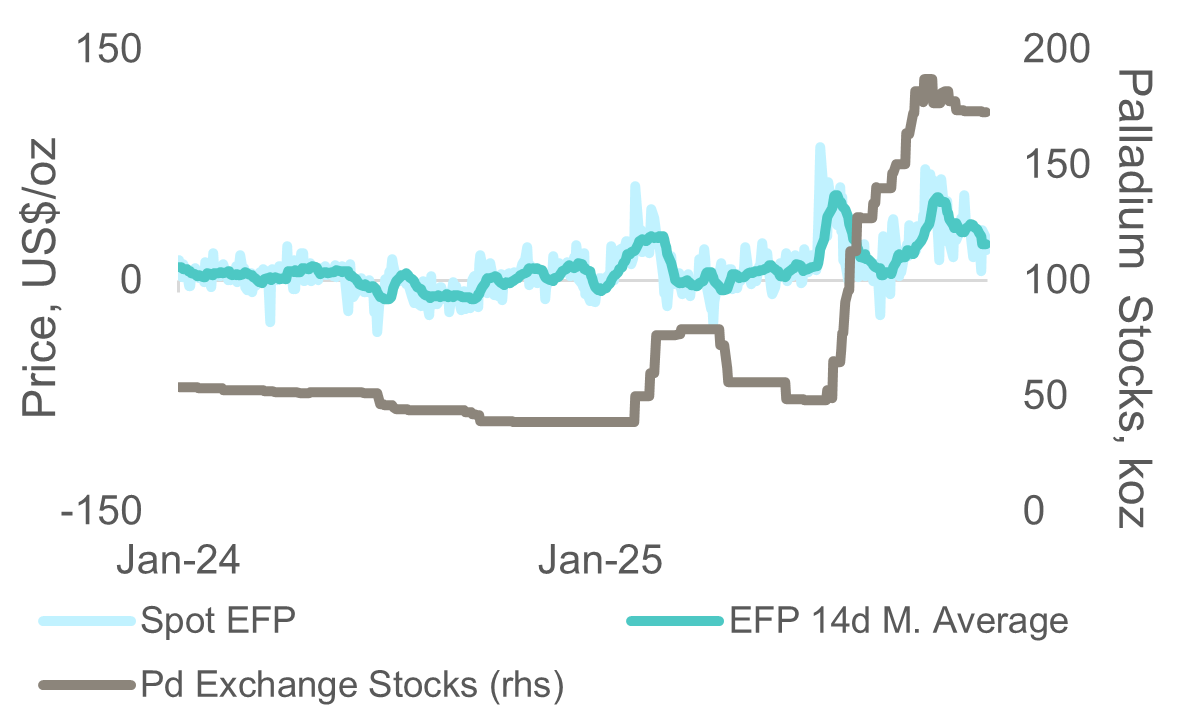

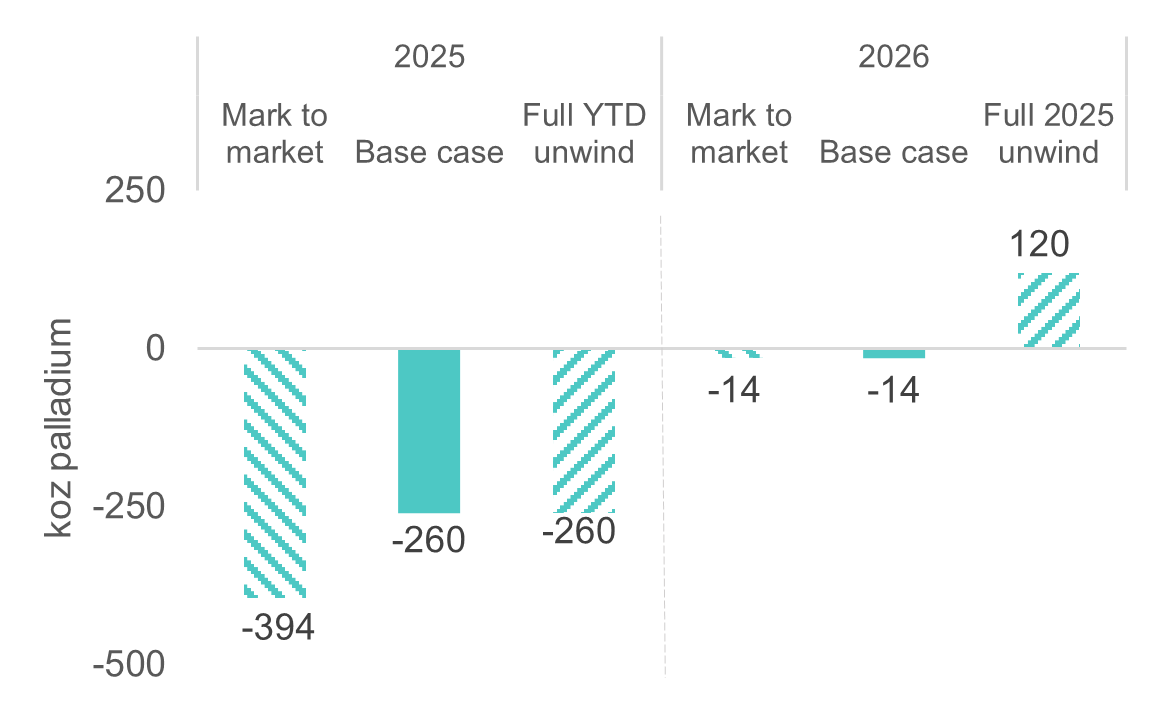

Figure 4: CME palladium stocks have also risen, but the real acceleration in inflows occurred after the US started an anti-dumping investigation into Russian palladium

Figure 5: If year-to-date exchange stock inflows stay at current levels, the 2025 deficit increases from 692 koz to 891 koz, if they unwind it reduces to 542 koz. If they persist into 2026 the market would be in a 130 koz deficit, if they unwind, the surplus increases to 219 koz

Figure 6: We have not included palladium exchange stock movements in our 2025 deficit of 260 koz, doing so would increase the deficit to 394 koz. Unwinding exchange stocks in 2026 moves the market into a 120 koz surplus.

Figure 7: US demand for metal has contributed to the global shortage that has resulted in elevated lease rates.

Figure 8: A shortage of metal in the London market has resulted in strong OTC backwardation.

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.