Hybrid and EREV market share growth overtaking BEV supports higher-for-longer automotive PGM demand

2 May 2024

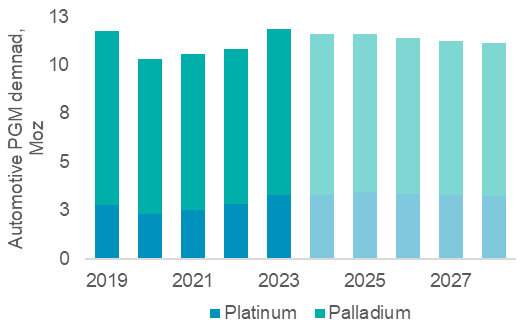

PGM sentiment has been affected by the drivetrain transition where rising battery electric vehicle (BEV) market share weighs on PGM expectations. However, WPIC forecasts only a muted tapering of PGM automotive demand over the next five years at 1.1% CAGR, suggesting demand erosion projections are overdone. Explosive BEV growth has slowed and is being comfortably outpaced by PGM-containing hybrids and extended range electric vehicles (EREVs) that supports a ‘higher-for-longer’ automotive PGM demand outlook.

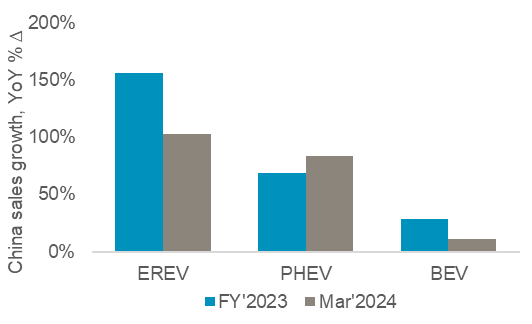

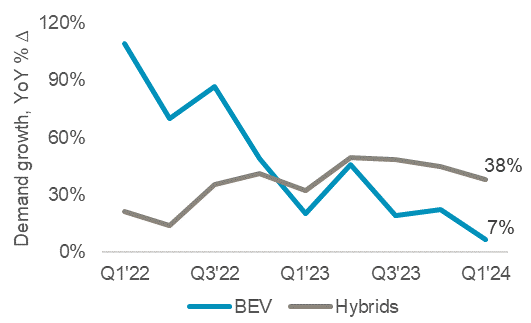

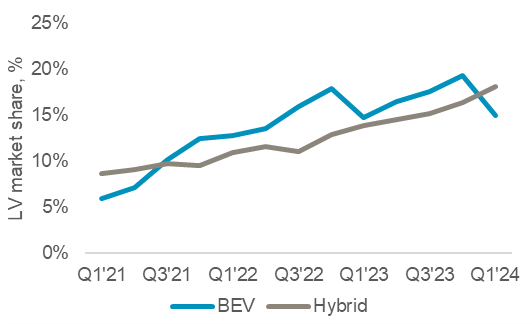

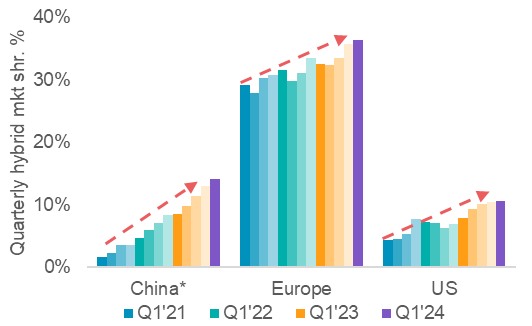

China, Europe, and the US account for around 90% of global BEV demand. Collectively, these markets have seen BEV sales growth rates slow from 20% YoY in Q1 2023 to 7% YoY in Q1 2024. Comparatively, hybrid demand growth accelerated to 38% YoY in Q1 2024 compared to 32% growth in the comparable period last year (Fig. 3). Diverging growth trends have led to hybrid market share increasing ahead of BEVs in Q1 2024 (Fig. 4). Growing hybrid demand highlights a consumer willingness to pay a premium to decarbonise, but that willingness only extends so far as not being encumbered by BEV’s range and charging drawbacks. This willingness to pay for an uncompromised “electric” experience is prominently bearing out in China with the emergence of EREVs. An EREV is a plug-in electric vehicle with an onboard combustion engine that is used as a generator to recharge the batteries (unlike a PHEV where the engine drives the vehicle if the batteries are flat). EREVs are China’s fastest growing new energy vehicle category (Fig. 1) and are on-track to exceed a million-unit sales in 2024 since they address BEV range and charging concerns (electric only range of ~300 km increases to ~1,000 km with the engine recharging).

Figure 1: PGM-containing EREVs are growing fast

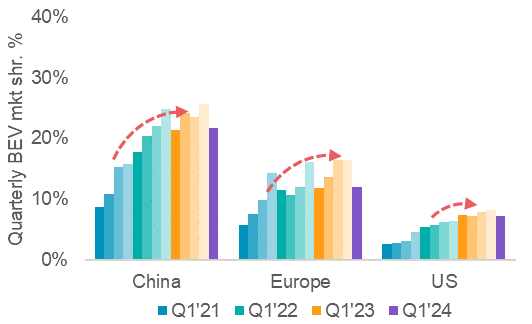

Figure 2: Pure BEV market share gains are plateauing

We do not explicitly model EREV demand, but the technology may gain share from both prospective BEV consumers (wanting additional range) and ICE consumers (wanting to decarbonise with less compromise). EREVs may appeal in the US where decarbonisation mandates are technology agnostic (EREVs reduce life-cycle emissions by a third compared to ICE) and the BEV penetration rate of ~7% lags other geographies (Fig. 2). Notably, Stellantis has released an EREV model in the form of the 2025 Ram pickup truck, a core part of the US auto market.

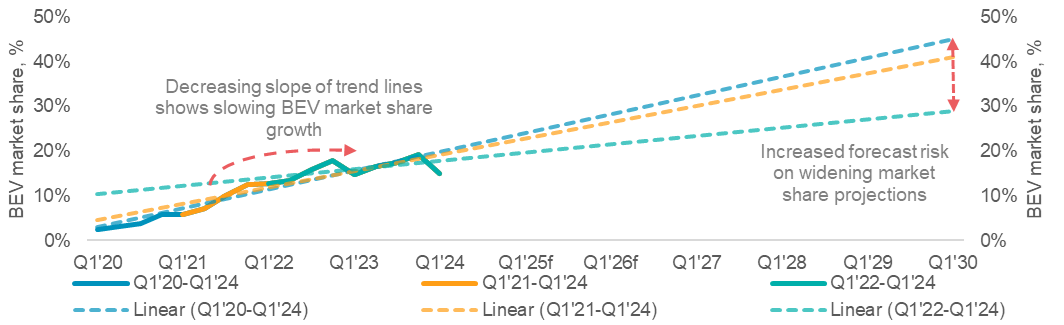

Our drivetrain outlook projects BEV market share of 31% by 2030 with the residual ICE vehicles being increasingly hybridised. Slowing BEV market penetration (fig. 7) and higher ICE (incl. hybrid and EREV), support our higher-for-longer automotive demand for PGMs thesis, but contrast with higher BEV penetration rates projected by other market commentators. Each 1% delta in LV BEV/ICE market share equates to 25 koz of platinum and 100 koz of palladium demand annually. This underpins our forecasts for platinum market deficits of ~430 koz from 2025 through 2028.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market entering a period of consecutive deficits from 2023.

- Platinum supply remains challenged, hampered by production challenges in South Africa and with recycling supplies.

- Automotive platinum demand growth should continue due principally to substitution in gasoline vehicles.

- Growing off a small base, hydrogen will be a major source of platinum demand in the future.

- The platinum price remains historically undervalued and significantly below both gold and palladium.

Figure 3: BEV demand growth has systematically slowed, highlighting unwinding subsidies and challenges in converting the next cohort of buyers from ICE to BEV

Figure 4: More consistent demand growth has supported hybrids regaining a market share lead over BEV in Q1 2024

Figure 5: The rate of light-duty hybrid market share gains is stable suggesting PGM automotive demand will have a long-tail into the 2030’s

Figure 6: Hybridisation of the drivetrain will support automotive higher-for-longer PGM demand despite rising BEV market share

Figure 7: Slowing BEV growth has altered the linear progression of expected BEV market shares gains thereby increasing future uncertainty relative to linear progressions from 2020 and 2021. Note that at the current rate of BEV growth in market share, it w

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.