Hydrogen Tech Expo: Evidence of growing momentum, with platinum set for key role as a transition metal

26 October 2023

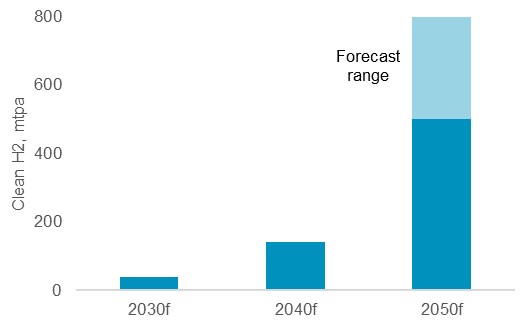

WPIC attended the Hydrogen Technology Exhibition hosted in Bremen, Germany. The event had 500 exhibitors, 200 speakers and 8,000 delagates in attendance. The expo highlighted the hydrogen economy is building momentum. Participants highlighted key developments in decarbonisation policy over the past twelve months which are expected to accelerate currently disappointing levels of FID. Green H2 electrolysis is expected to increase 30-fold to ~500 GW by 2035 while the levelised cost will reach parity with grey H2 in the next decade. Accordingly, we expect hydrogen applications to account for up to 20% of total platinum demand by 2030 with FCEV accounting for the majority of this consumption. This report offers a snapshot of developments in fuel cell use in automotive transport from the Expo.

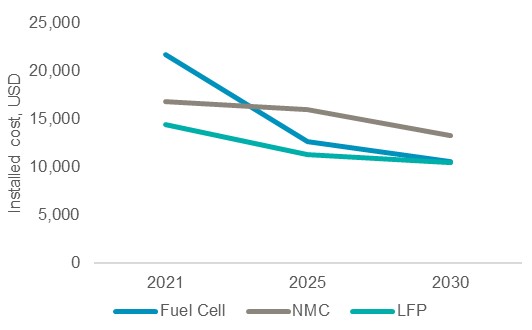

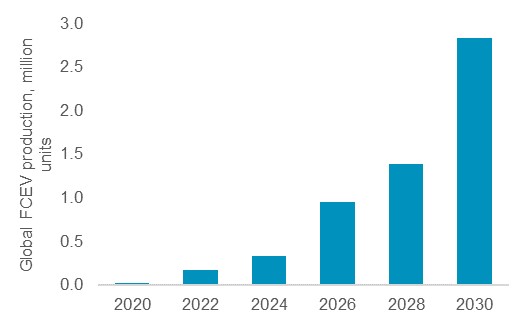

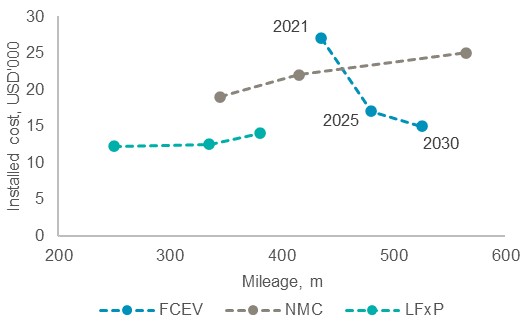

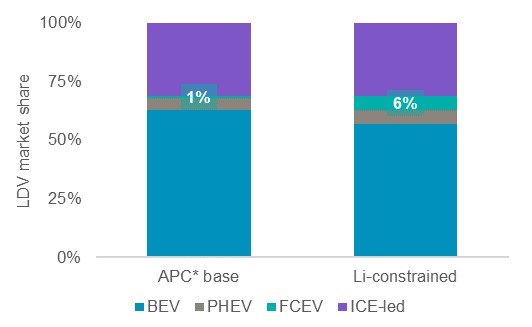

The UK’s Advanced Propulsion Centre (APC) presented a cost study on battery (LFP and NMC) and fuel cell drivetrains for large SUVs and Vans. APC expects a 300-mile fuel cell system to reduce installed costs by ~50% to 2030 (inset, left), while battery costs are expected to decrease between 21% and 27%. APC determined fuel cells’ cost per mile economics are viable for “premium” SUVs and commercial vans. APC forecasts FCEV production (excl. HDV) to reach 1.4 million by 2035f, but concurrently noted rising BEV penetration will cause lithium supply constraints (link). In a lithium constrained market, APC suggests FCEV production could reach 5.9 million vehicles by 2035f. The WPIC forecasts LV and LCV fuel cell penetration of 3.2% in 2035f (link). WPIC’s forecast aligns aggregated regional hydrogen roadmaps (Fig. 1, overleaf), and is between APC’s FCEV market share forecasts of 1% to 6% (Fig. 4).

Fuel cell cost competitiveness improves to 2030

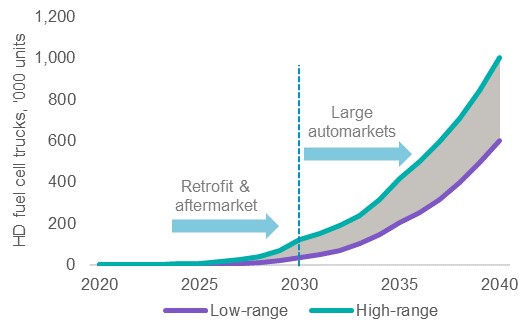

Aftermarket OEMs are facilitating early HD FCEV adoption

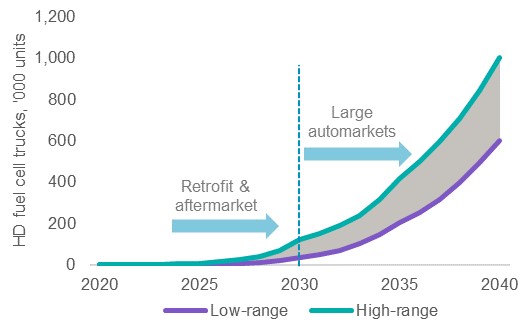

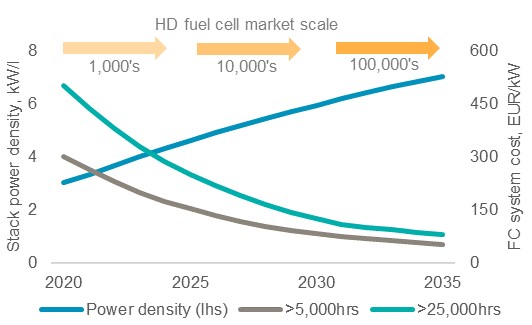

AVL presented developments in heavy duty transport where fleet owners want the benefits of a diesel truck without the emission penalties. Notably, the technology provider is witnessing rapid growth amongst the after-market and retrofit players. Aftermarket firms offer more flexibility to meet customer specific needs whilst heavy-duty fuel cell mobility remains nascent. As heavy-duty demand scales beyond 100,000 units annually from 2030, AVL expects to see larger automakers enter the market as they are better placed to drive efficiencies through standardisation (inset, right). With economies of scale and improved power densities, AVL expects fuel cell system costs to decrease ~EUR300 per kW to ~EUR80 per kW in the next decade (Fig. 6) reinforcing further demand growth and a high-single digit implied HD fuel cell penetration rate by 2035f (WPIC: 10%).

The ongoing development across the hydrogen value chain seen at the Hydrogen Tech Expo reinforced our forecasts that hydrogen could account for up to 20% of total platinum demand by 2030.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market entering a period of consecutive deficits from 2023.

- Platinum can be considered a proxy for investing in the growing hydrogen economy given its use in electrolysers and fuel cells.

- Platinum supply remains challenged, hampered by electricity shortages in South Africa and sanctions against Russia

- Automotive platinum demand growth should continue due principally to substitution in gasoline vehicles.

- The platinum price remains historically undervalued and significantly below both gold and palladium.

Figure 1: The aggregation of regional hydrogen roadmaps suggests on-road FCEV production is expected to scale during the second half of the decade

Figure 2: From current production levels of ~1mtpa, the clean hydrogen* market is expected to grow exponentially in the coming decades

Figure 3: FCEV’s cost per mile economics benefits from increasing milage requirements suggesting a use case in premium SUV and LCV markets

Figure 4: The UK’s Advance Propulsion Centre expects single digit LDV and LCV fuel cell penetration rates by 2035

Figure 5: The retrofitting market is servicing first movers adopting fuel cell drivetrains in heavy duty transport

Figure 6: Improving power densities are expected to lower fuel cell system costs, driving increased market adoption

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.