Shanghai Platinum Week 2024: Key take aways from China’s dynamic platinum market

18 July 2024

The WPIC co-hosted the fourth annual Shanghai Platinum Week (SPW) last week. This report highlights details of the conference and site visits, as well as some key take aways from the presentations.

SPW overview: The conference was held over two days with two further days allocated to site visits. The conference was attended by more than 500 delegates with an aggregate of over 770 thousand online viewers, who watched 42 presentations and panel discussions. Topics ranged from the challenges facing PGM supply (mining and recycling) to current and future demand drivers (autocatalysts, green hydrogen and future technologies). SPW reiterated platinum’s strong investment case as challenges weigh on supply while demand finds support across a diverse number of end-uses. Our key take aways are highlighted below, which emphasise some of the dynamic trends within the local PGM market, and our research team is available to discuss these and other findings in more detail.

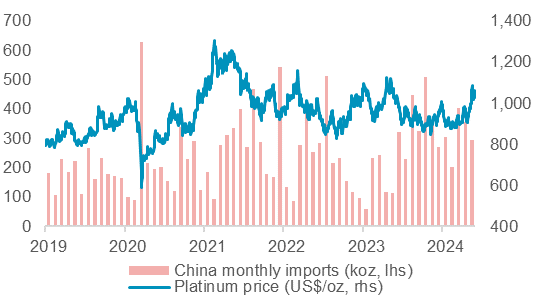

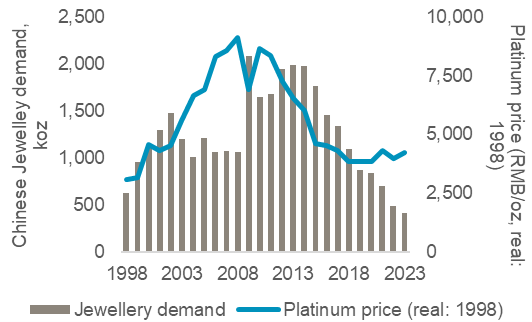

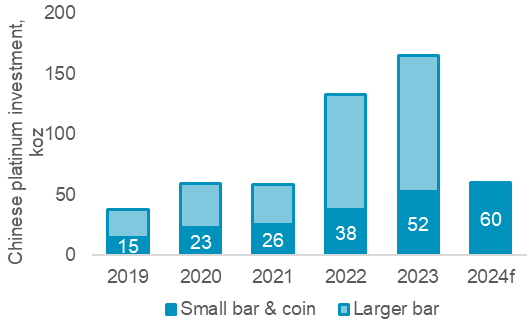

The Guangzhou Futures Exchange announced contract details for China’s first platinum and palladium futures contracts. These RMB derivatives will enable domestic users to manage price risk. Notably, China’s prior inability to locally manage price risks led to volatile platinum import volumes that were inversely correlated to prices (Fig. 1). WPIC expects Chinese platinum jewellery and investment demand to benefit from fabricator price risk management, which will allow for reduced sales premiums and buy-back discounts, likely to help consumers regain confidence in platinum products versus gold alternatives (Fig. 3).

Figure 1: China’s platinum purchasers are price sensitive

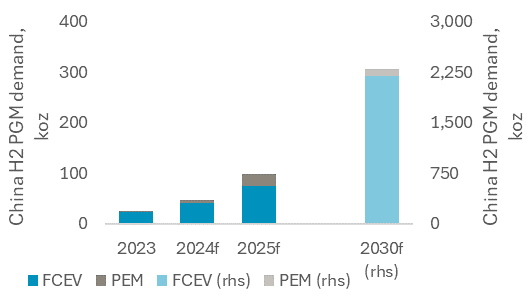

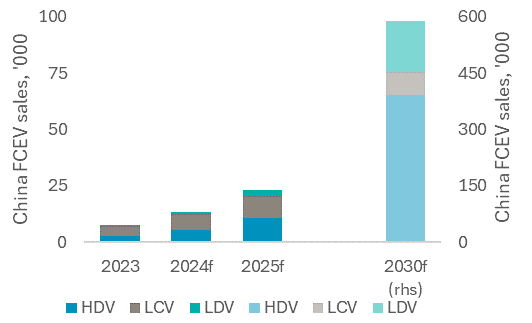

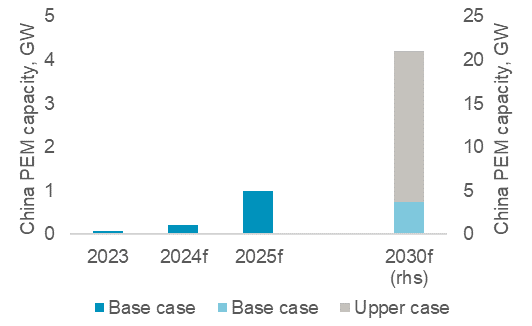

Figure 2: China’s hydrogen economy could rapidly scale

China looks set to lead the global hydrogen economy push with a March 2024 Government report calling to expedite the technology. SPW visited several firms in the hydrogen value chain which have shown strong growth. However, there were signs of underutilised plants as the nascent sector ramps up. The Orange Group forecasts that declining costs will drive future scaling. It expects cumulative China hydrogen PGM demand of ~2.3 Moz by 2030f (Fig. 2) as total domestic fuel cell and PEM electrolyser markets reach 1.2m units and 3.8 GW respectively (WPIC: ~1.2 Moz).

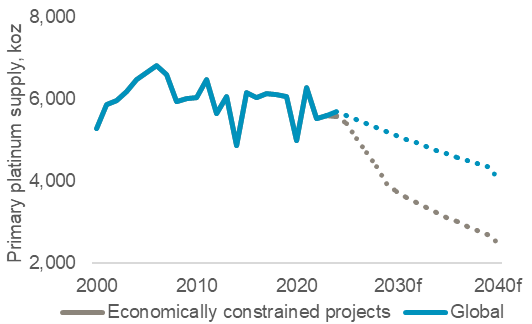

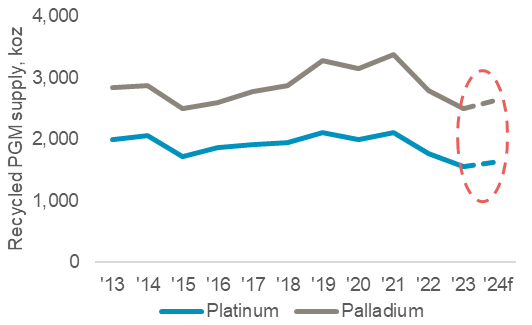

Headwinds to both primary and secondary platinum supply were discussed at SPW. The key challenge faced by PGM miners is the weak basket price, which is pushing them to cut costs to minimise losses but will likely increase the risk of lower mine supply over the medium-term (Fig. 7). In terms of recycling supply from China, tax experts discussed China’s new reverse invoicing policy which aims to generate tax from a historically cash based transaction between upstream scrap collectors and recycling enterprises. Industry participants cited the 3% tax as onerous on a sector typically operating at <1% margins and suggested it will result in downward pressure to recycling PGM supply.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market is in a period of sustained deficits from 2023.

- Platinum supply remains challenged, hampered by production challenges in South Africa and with recycling supplies.

- Higher-for-longer ICE and hybrid vehicle production will support automotive demand for platinum.

- Growing off a small base, hydrogen will be a major source of platinum demand in the future.

- The platinum price remains historically undervalued and significantly below that of gold.

Figure 3: Platinum jewellery fabricators are exposed to increased price risk in a falling price environment, requiring higher premiums that negatively impacts demand

Figure 4: Chinese bar and coin investment demand could benefit with lower premiums and sellback discounts, as allowed for with the availability of price risk management through derivatives

Figure 5: Chinese fuel cell demand is forecast for exponential growth reaching annual sales of ~500k units by 2030f

Figure 6: China’s PEM electrolyser installed capacity is forecast to increase by 62% CAGR between 2024 to 2030, with upside if Iridium thrifting efforts are successful

Figure 7: Low prices are forcing producers to cut costs to minimise losses which may reduce mine development and weigh on the mine supply outlook

Figure 8: The forecast recovery to 2024f PGM recycling supply faces risks due to overcapacity, regulatory headwinds, a feedstock shortage, and hoarding

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.