Some exchange stock unwinding possible on US S232 carrot before stick approach, although trade risks persist

15 January 2026

A US presidential review of the Section 232 (S232) investigation into critical minerals concludes that action is needed to protect national security. Reversing the approach taken with previous actions, President Trump has elected to commence with a 180-day period of negotiations to secure critical mineral supplies (the carrot) whilst retaining the option to apply import quotas, tariffs or other actions at any time (the stick). This may present a window of opportunity to unwind some of the ~400 koz of excess CME platinum warehouse inventories to take advantage of the international market tightness. However, the capricious nature of the current US administration and uncertain timeline means assuming future metal imports will be unencumbered comes with risks.

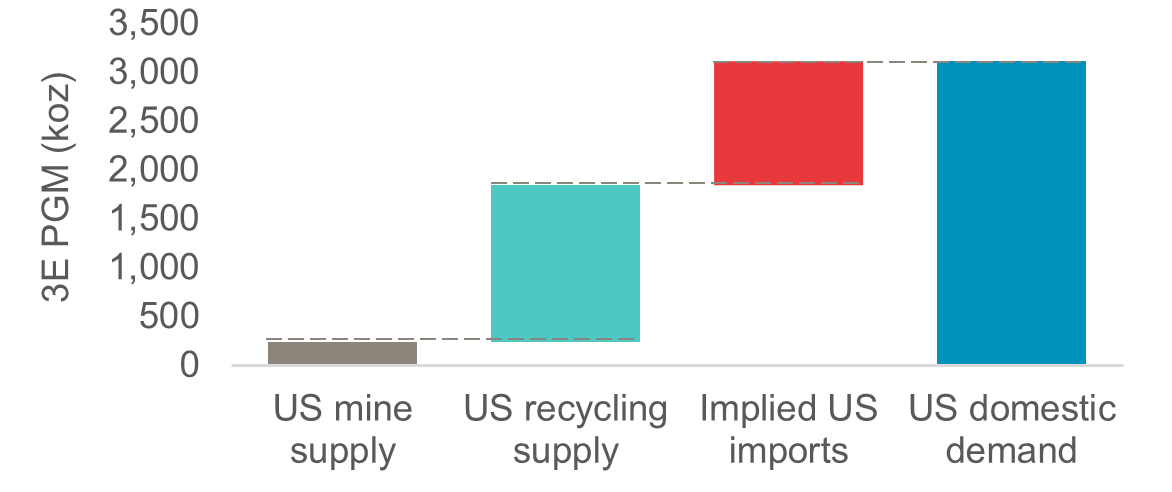

President Trump has reviewed the S232 critical minerals report and agrees that imports of these minerals and derivative products pose a threat to US national security. The report advises action to secure the US critical mineral supply chains and sufficient domestic mining and processing capacity to reduce reliance on imports. The report recommends negotiated agreements with foreign nations to ensure the US has adequate critical mineral supplies and to quickly mitigate supply chain vulnerabilities. A further recommendation is that it may be appropriate to impose import restrictions, such as tariffs, if satisfactory agreements are not reached in a timely manner. President Trump has decreed a 180-day period of negotiations with international allies to secure critical mineral supplies, to diversify global supply chains and reduce dependence on ‘adversarial nations’.

Figure 1. With limited domestic mine supply, the US is highly dependent on PGM imports (3E)

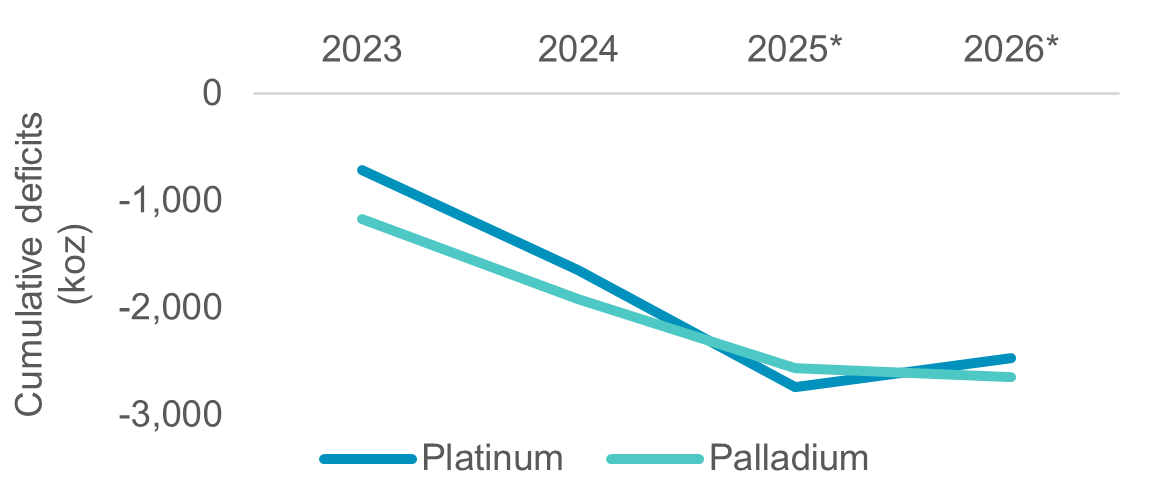

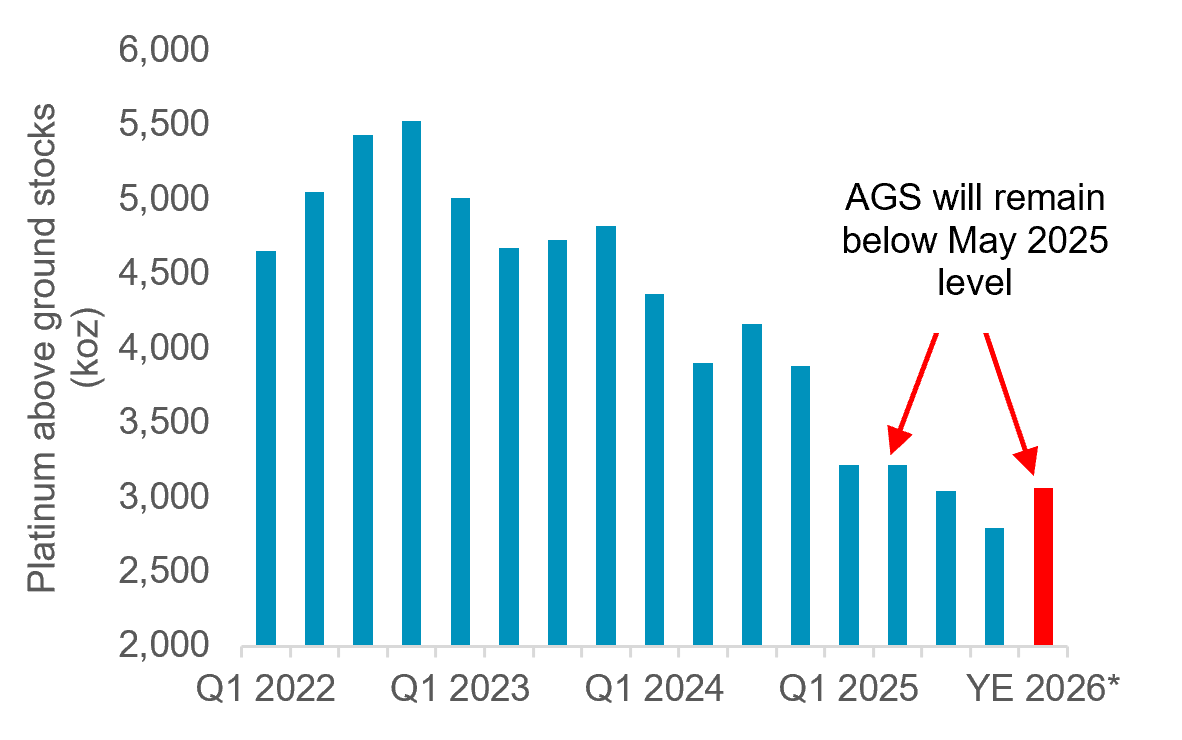

Figure 2. Releasing exchange stocks does not significantly offset three years of sustained market deficits

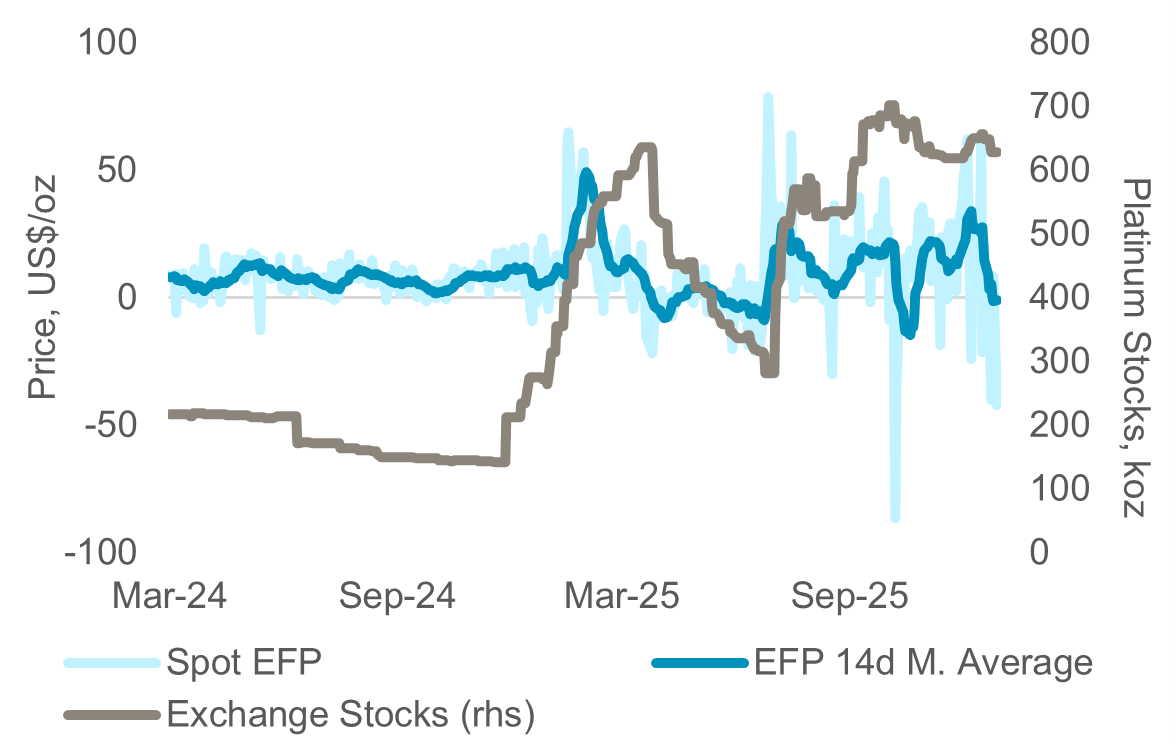

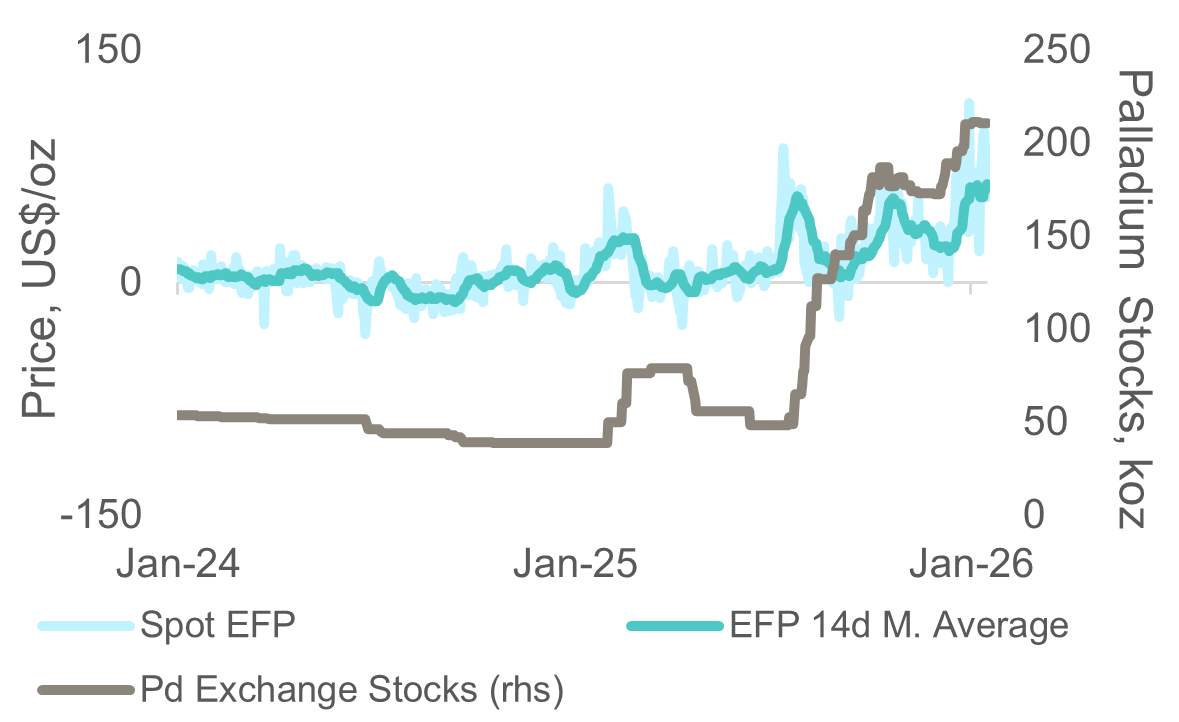

Tariff fears and trade barrier uncertainties related to the S232 outcome and the unconnected USITC investigation into alleged dumping of Russian origin palladium have resulted in significant US onshoring of PGMs by end users and speculators. The visible portion of this is CME warehoused inventories which are currently sitting at about 400 koz above normalised platinum and 150 koz above normalised palladium levels (figs 3 and 4).

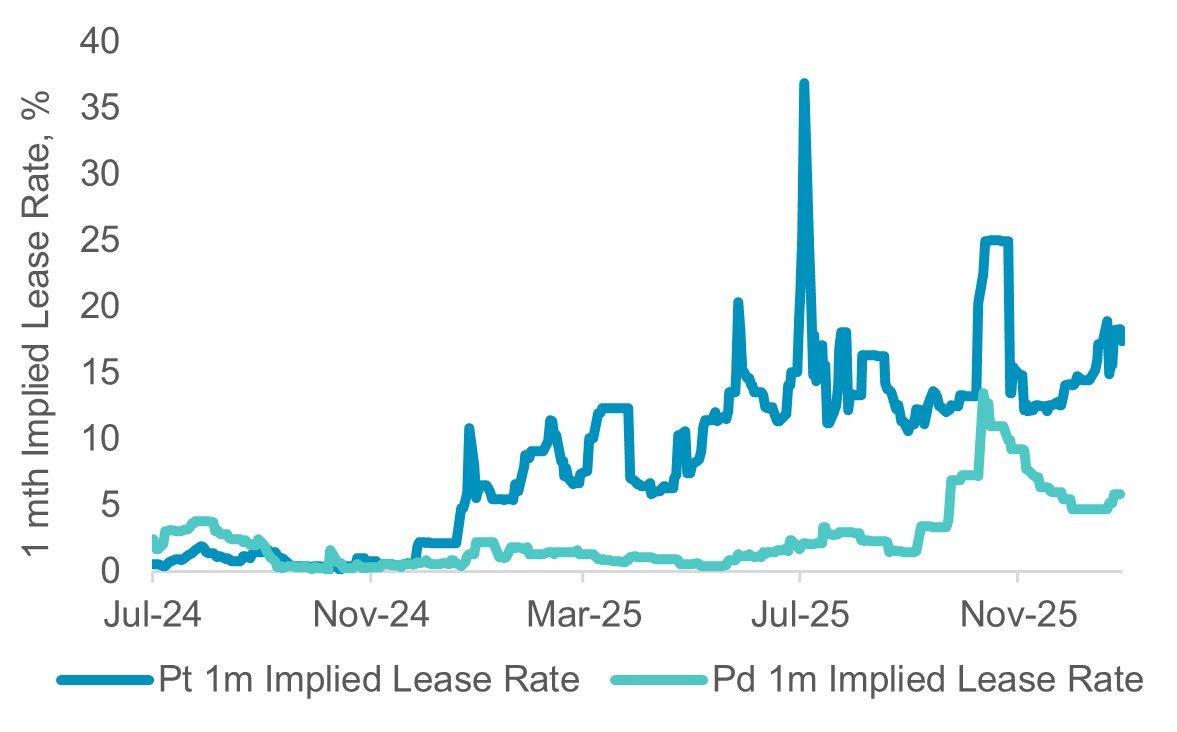

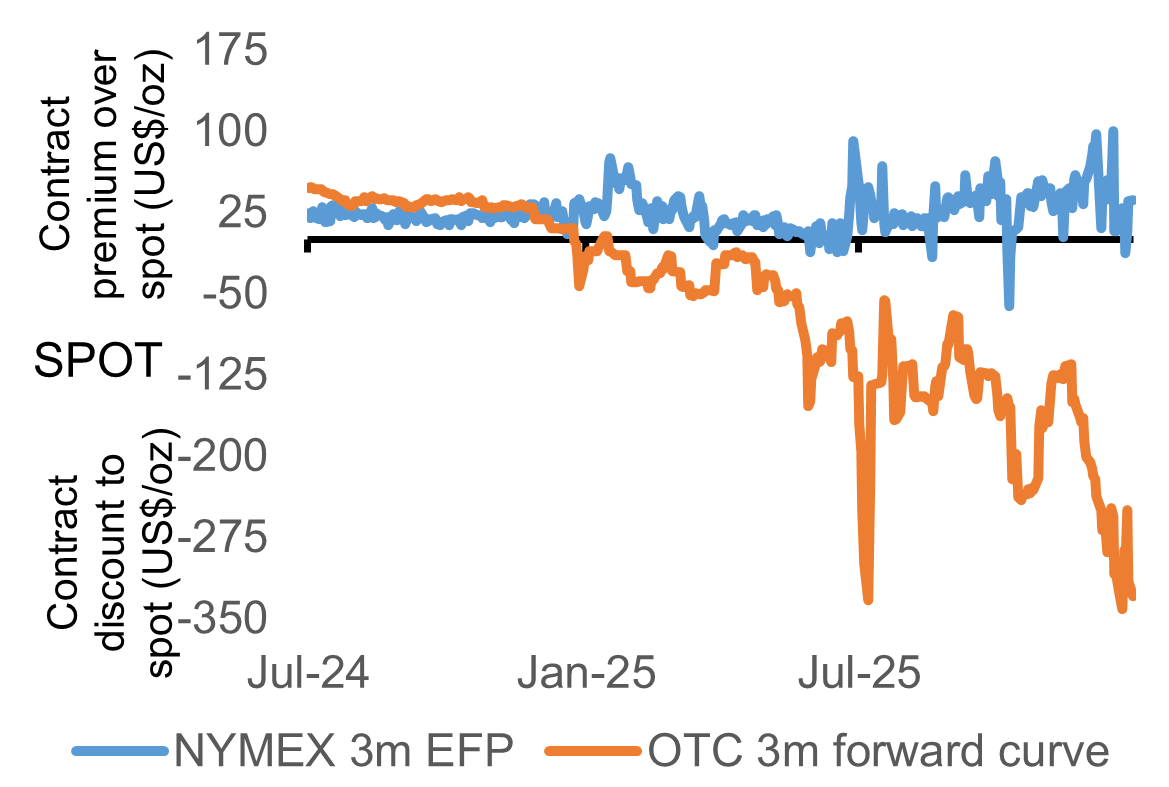

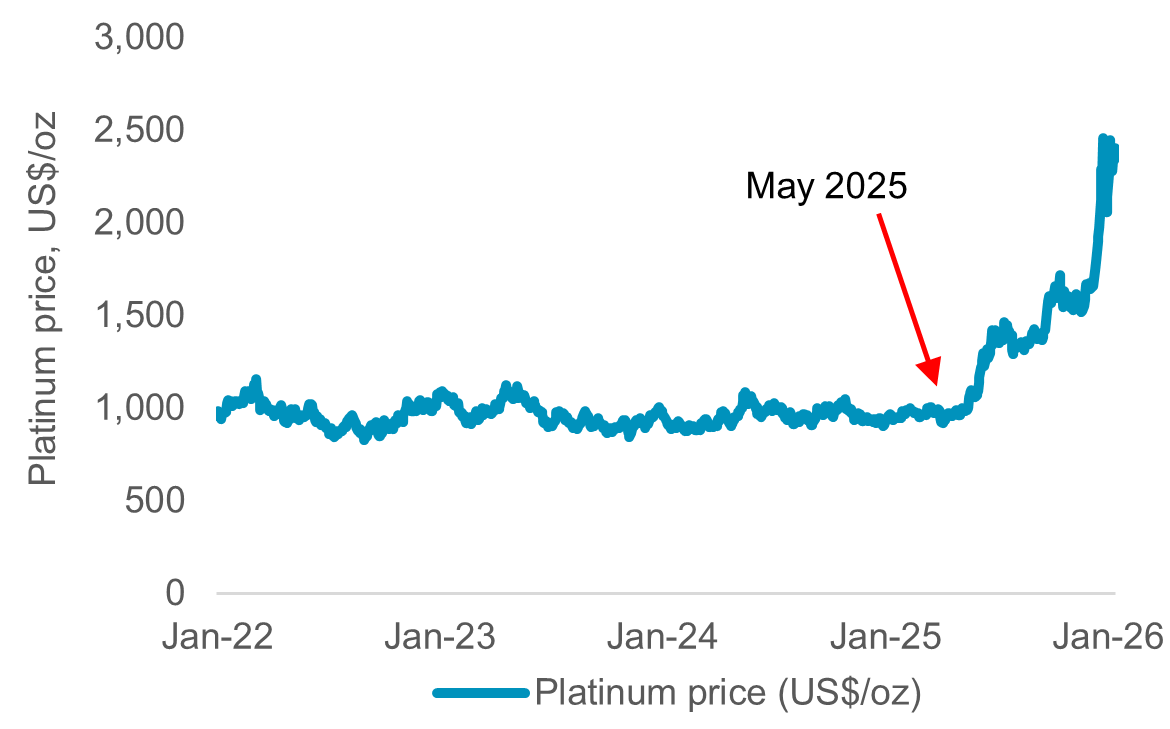

As seen briefly after ‘Liberation Day’, when PGMs avoided tariffs, there are strong incentives to export metal from the US to take advantage of historically elevated lease rates (fig 5) and strong forward curve backwardation in the London OTC market (fig 6). Whilst these conditions have been in place for over 12 months now, the perceived risks around exporting and reimporting metal from and into the US has kept metal locked up since July 2025. It is possible that this 180-day negotiating window, ending 13 July, may present an opportunity to reshore metal in Europe. An unwinding of CME warehouse inventories could provide some temporary respite to current market tightness. As a note of caution, however, the 180-day window does not preclude import quotas or tariffs being enacted sooner and for platinum and palladium, the dominance of South Africa and Russia in global supply chains raises questions as to whether the White House would categorise them as allies or adversarial nations.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates that the platinum market entered a period of consecutive supply deficits from 2023, although a balanced market is forecast in 2026 it is not expected to alleviate current market tightness

- Higher prices are supportive of supply, but there is limited scope to flex supply higher in the short term

- Diversity of end uses and a lack of lower priced alternatives are supportive of platinum demand despite the price increase

- Elevated lease rates and OTC London backwardation highlight tight market conditions

- The platinum price remains significantly below the price of gold with macropolitical uncertainty supporting the whole precious metals complex

Figure 3: As a result of tariff fears and a positive EFP, CME platinum exchange stocks are currently ~400koz above normalised levels

Figure 4: Palladium stocks are also elevated by about 150 koz, further supported by the ongoing US anti-dumping investigation into Russian palladium

Figure 5: US demand for metal has contributed to the global shortage that has resulted in elevated lease rates

Figure 6: A shortage of metal in the London market has resulted in persistently strong OTC backwardation

Figure 7: Even unwinding 400 koz from CME exchange stocks is insufficient to rebuild above ground stocks…

Figure 8: …which would remain below the level reached in May 2025 that prompted the start of the platinum price rally

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.