South Korea’s H2 plans support future platinum demand

19 December 2023

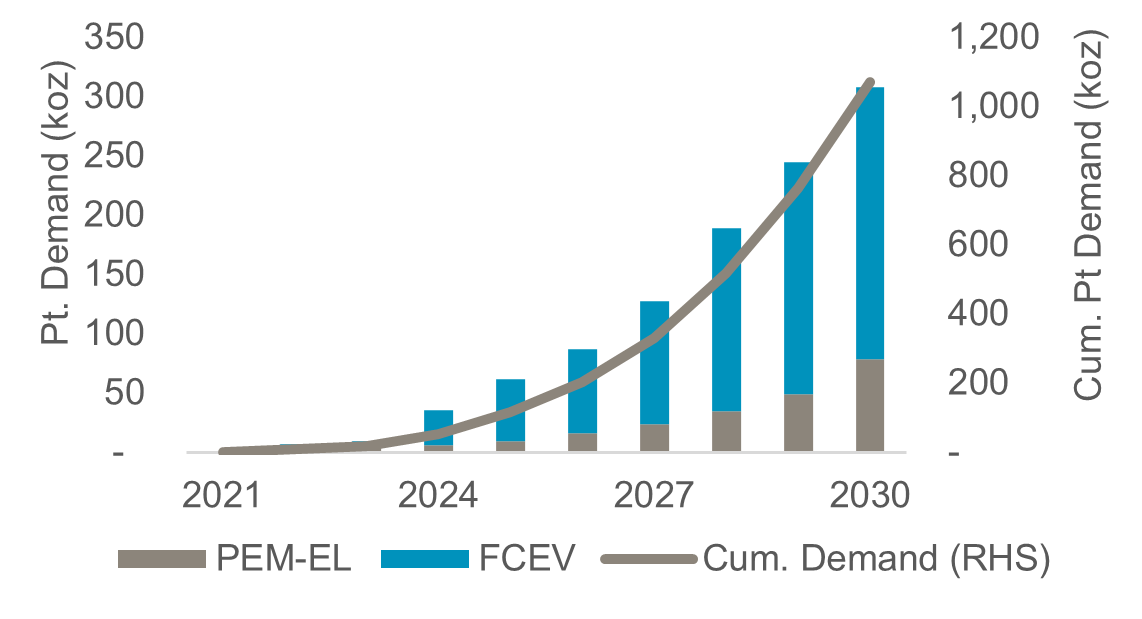

South Korea’s strategy to decarbonise its highly industrialised economy relies heavily on using green hydrogen which will result in it becoming a significant platinum demand hub, reaching 300 koz p.a. by 2030, from use in electrolysers to produce green hydrogen (40 koz pa) through to Fuel Cell Electric Vehicles (FCEVs) (230 koz p.a.).

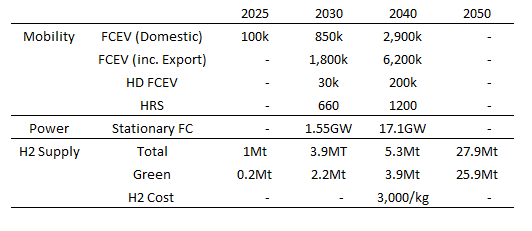

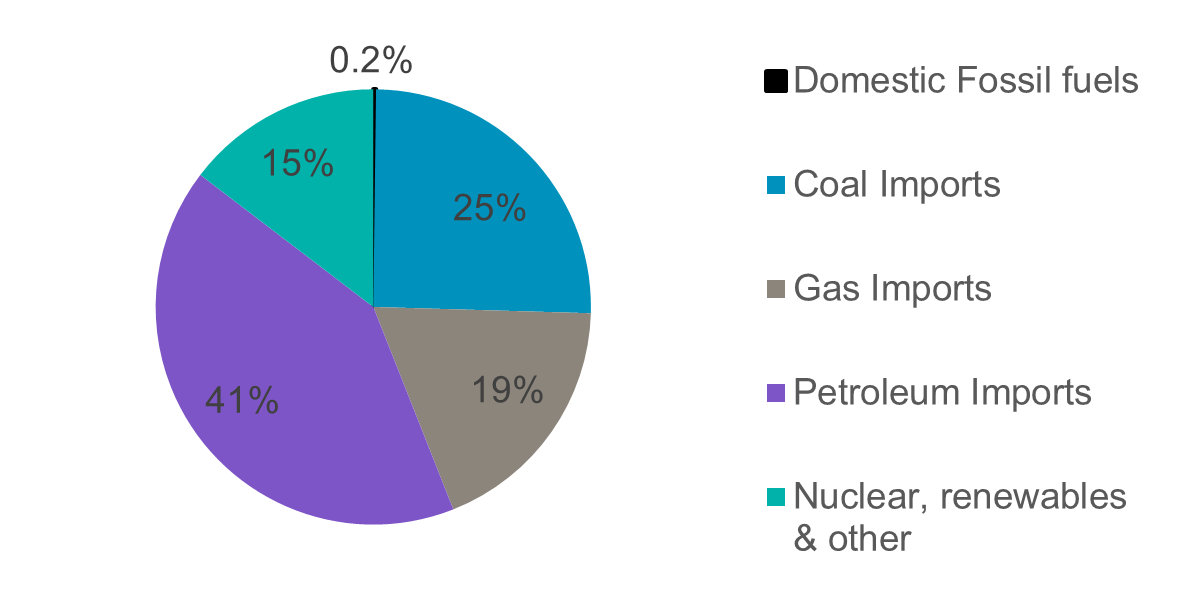

South Korea’s disproportionate reliance on imported fossil fuels for ~85% of its energy consumption, poses security concerns and maintains high carbon intensity in industries such as auto-manufacturing, shipbuilding, and steelmaking. To tackle this, increasing investment—over US$40 billion— is earmarked through public-private partnerships to harness hydrogen (H2) technologies across the entire value chain. This will result in platinum demand increasing by up to 300 koz p.a. by 2030, due to the manufacturing and installation of platinum containing PEM electrolysers and in fuel cells in South Korean-supported projects both domestically and overseas.

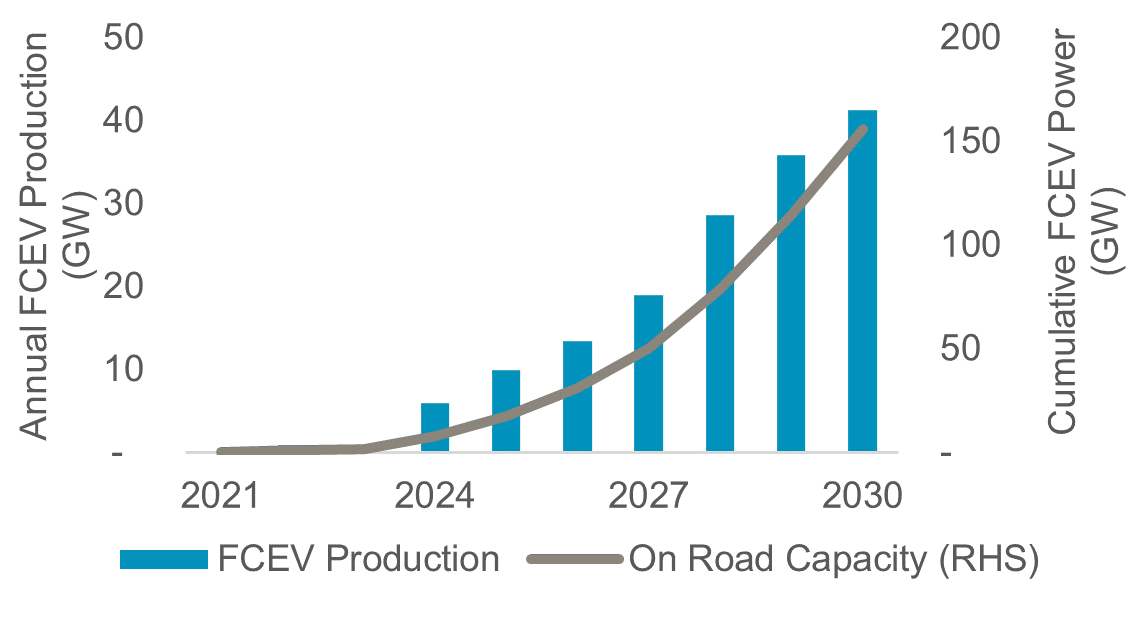

Platinum’s largest demand growth will come from fuel cell production with South Korea targeting up to 1.8 million light-duty (LD) and 30,000 heavy-duty (HD) FCEVs by 2030 (Fig 3). Battery Electric Vehicles (BEVs) are currently the preferred technology route for LD vehicles ahead of FCEV, as recharging infrastructure is already developing. While South Korea’s LD target seems challenging to deliver, the strong market emerging for light-commercial and HD FCEVs, where quick refuelling, high capacity-utilisation-rates, and long-distance travel favour FC technology, should assist. Additionally, stationary power and nascent mobility applications such as marine and off-road are gaining traction. Because fuel cell stacks can be used in LD, HD, and off-road FCEV applications, using single or multiple units, and based on market preference, this provides manufacturers with flexibility to build stack capacity at lower overall risk. This is highlighted by Hyundai’s US$1.1 billion commitment to expand their annual Incheon fuel cell stack production capacity to 123,000 stacks (12 GW). We believe Hyundai’s growth and the entry of other players could lift South Korea’s FCEV stack capacity to 160 GW by 2030, increasing platinum demand to 230 koz p.a.

Figure 1: Over $40Bn has been earmarked to assist in meeting South Korea’s 2019 Hydrogen road map targets

_393448.png)

Figure 2: 300 Koz p.a. of Pt demand by 2030 (43% CAGR, 2024 – 2030) by reaching 180 GW FC & PEM-EL capacity

_440099.png)

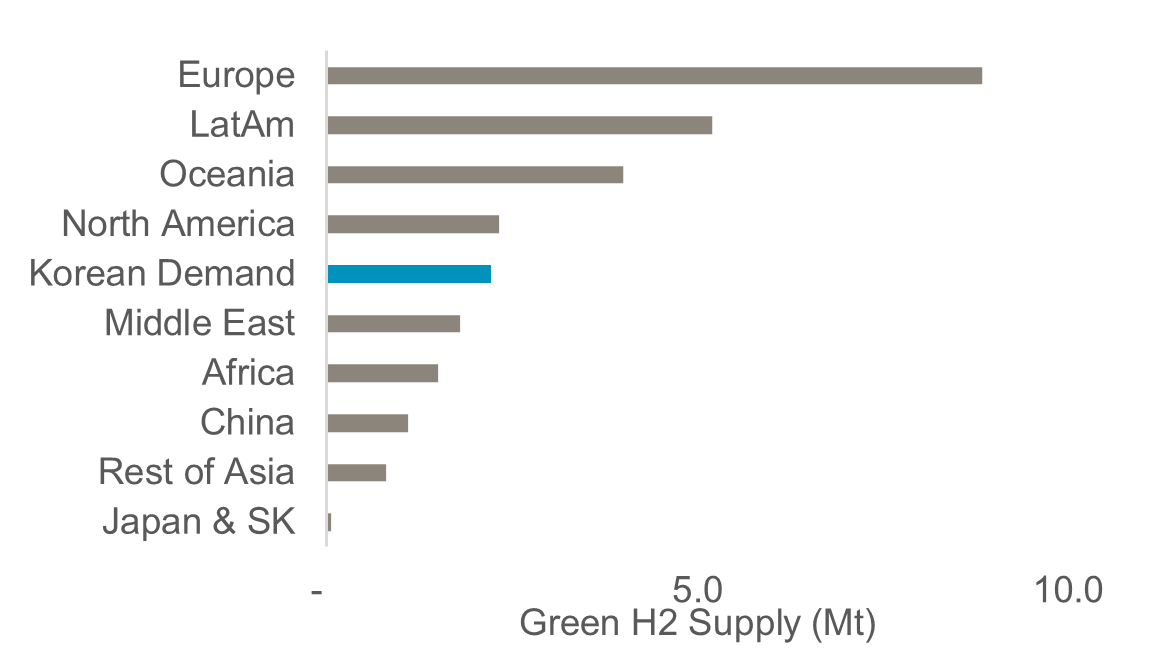

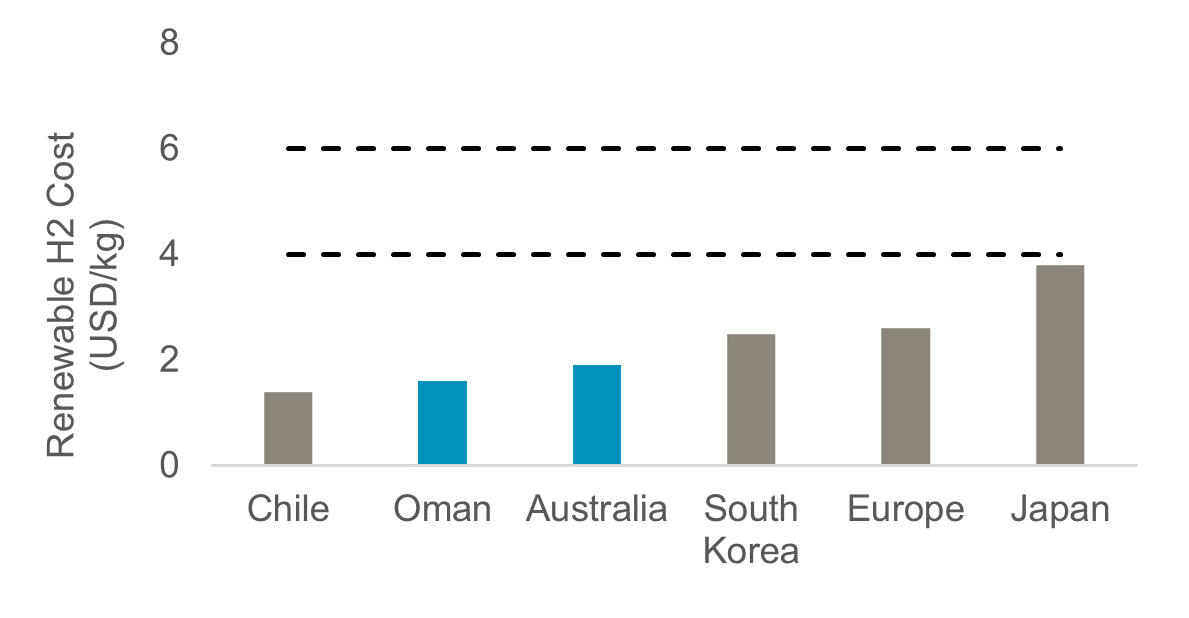

Additionally, platinum containing PEM electrolysers are a key enabler to produce green H2 to decarbonise transport, power generation and industrial applications. South Korea has already issued tender RFPs and set up global project partnerships, including the world’s first H2 power generation contracts which grow from 4 TWh to 13 TWh with an obligated grey to green H2 ratio moving from 6:1 to 1:1 by 2030. This requires 18 GW of electrolyser capacity to meet South Korea’s total green H2 demand of 2.2 Mt by 2030. Assuming only a conservative 30% PEM market share would add 80 koz of annual global demand by 2030. Combined South Korean platinum demand from PEM electrolysers and fuel cells could grow at a CAGR of 43% (2024 – 2030) and exceed 300 koz p.a. by 2030.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market entering a period of consecutive deficits from 2023.

- Platinum can be considered a proxy for investing in the growing hydrogen economy given its use in electrolysers and fuel cells.

- Platinum supply remains challenged, hampered by electricity shortages in South Africa and sanctions against Russia.

- Automotive platinum demand growth should continue due principally to substitution in gasoline vehicles.

- The platinum price remains historically undervalued and significantly below both gold and palladium.

Figure 3: The Korean government released the hydrogen road map in 2019 to revolutionise the country's energy system, reduce its heavy reliance on imported fossil fuels and create growth opportunities through hydrogen

Figure 4: 85% of South Korea’s energy is imported fossil fuels creating potential energy security issues and a high carbon intensity for its traditional industries such as auto-manufacturing, shipbuilding and steelmaking

Figure 5: Whilst initially focusing on cost effective grey hydrogen, Korea’s 2030 green H2 target represents 9% of announced global supply as it looks to develop new and decarbonise existing industries

Figure 6: Korean projects, based in areas with some of the lowest future renewable hydrogen production costs, will bring down the cost of operating green steel plants within 10% of conventional met coal operations (EU Parliament)

Figure 7: Low-cost hydrogen access will facilitate increased FCEV demand. Korea targets 850k passenger vehicles on the road and up to 1.8 M including exports by 2030, equating to 160 GW of fuel cell power

Figure 8: Platinum demand from Korean attributed electrolysers, stationary fuel cells and FCEVs can reach 300 koz p.a.

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.