Trump’s policies and the PGM markets Part 3: Rolling back environmental commitments and ‘Drill, baby, drill!’

7 February 2025

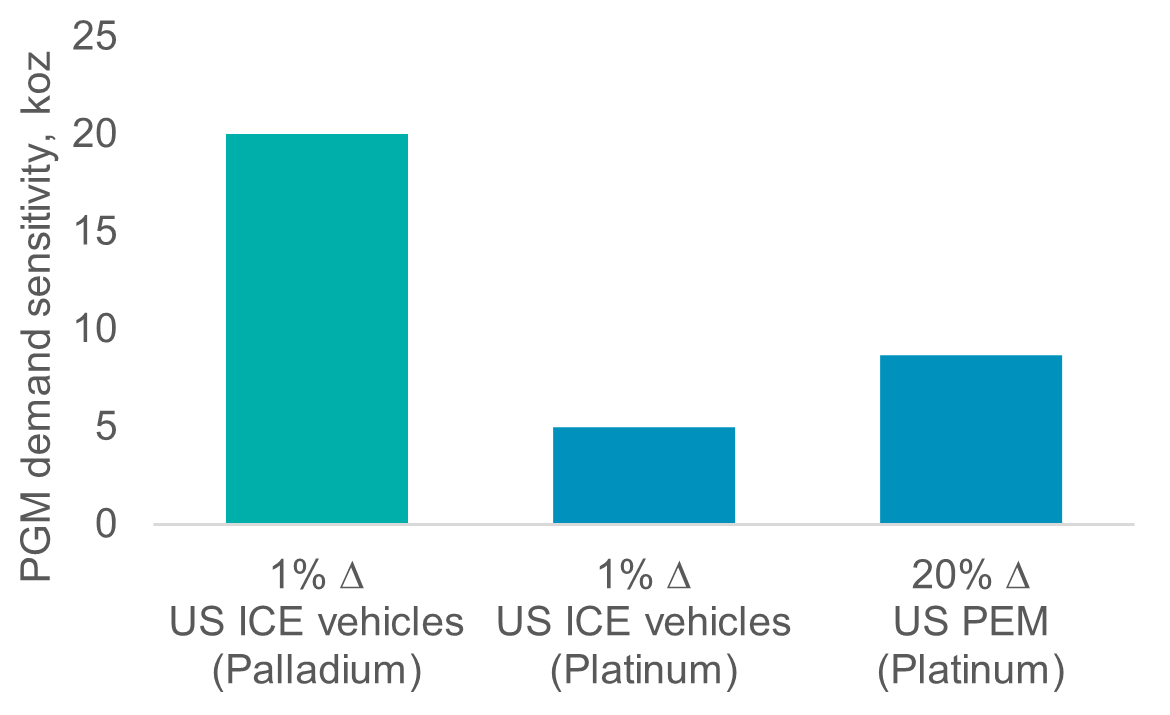

Notwithstanding the hyperbolic headlines, Trump’s rolling-back of the US’s environmental commitments and “green” incentives is expected to be modestly net positive for PGM demand. Slower US BEV adoption increases PGM demand; each 1% reduction in US BEV market share increases 2E PGM demand by 25 koz (Fig. 1), which should more than offset any platinum demand lost from the US’s hydrogen plans. This is the third Platinum Perspectives discussing the effects of Trump’s policies on PGM demand, with the first having addressed tariffs and the second considering the broader economic impacts.

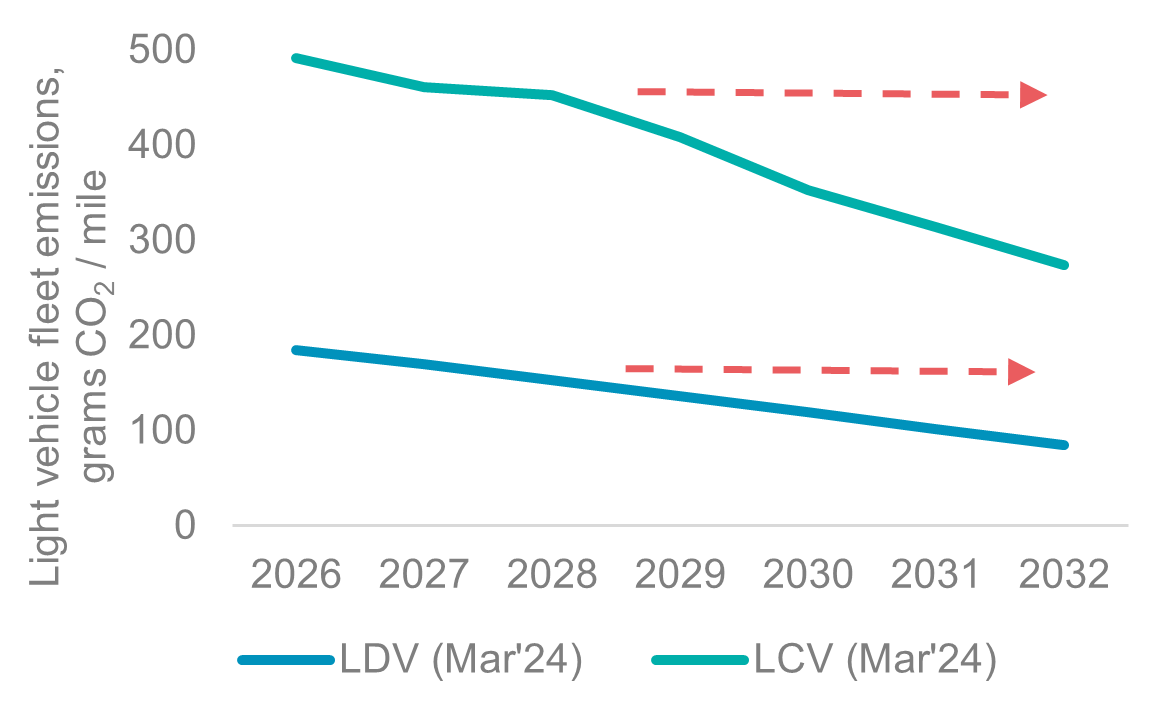

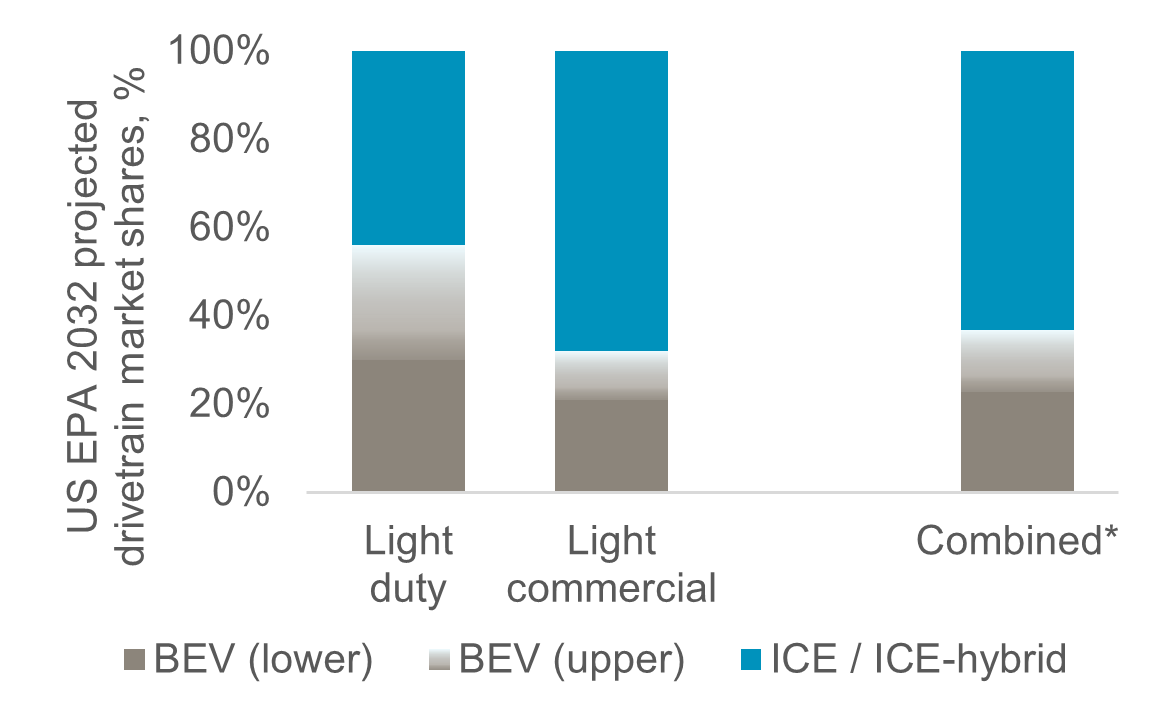

Trump has long been a climate change sceptic and has once again withdrawn the US from the Paris Agreement. The president has enacted policies to encourage domestic oil and gas drilling while calling on OPEC to increase supply to reduce energy prices. Furthermore, Trump has halted environmental spending packages within the Inflation Reduction Act (IRA) and is positioning for a walking back of emission legislation. In our view, the US’s ability to meet its passenger vehicle emission reduction targets are tied to support measures from the IRA, which includes BEV purchase subsidies and investment support into critical infrastructure (such as charging or EV industrial capabilities). While it remains unclear what Trump is proposing in terms of emission standards, the Environmental Protection Agency’s (EPA) current legislation requires CO2 emission reductions of -56% for LDVs and -44% for LCVs respectively from 2026 and 2032 (Fig. 2).

Figure 1. Downside risk to BEV penetration supports PGMs

Figure 2. CO2 reduction targets of 44%-56% could be reduced

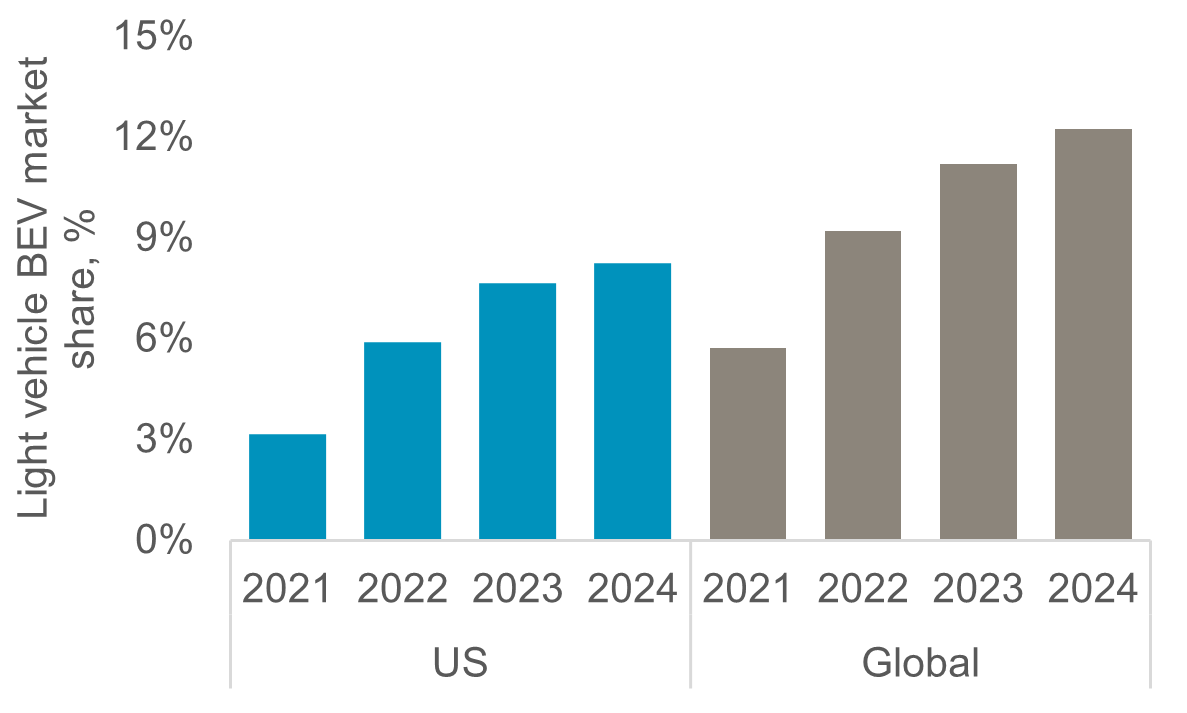

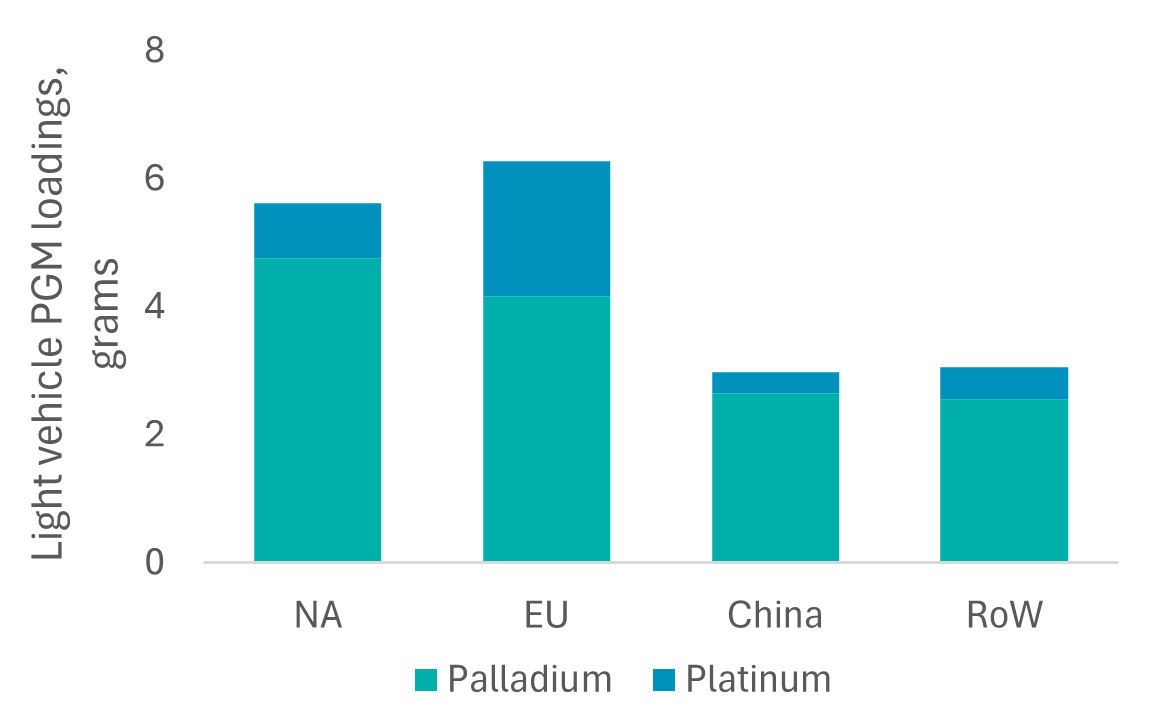

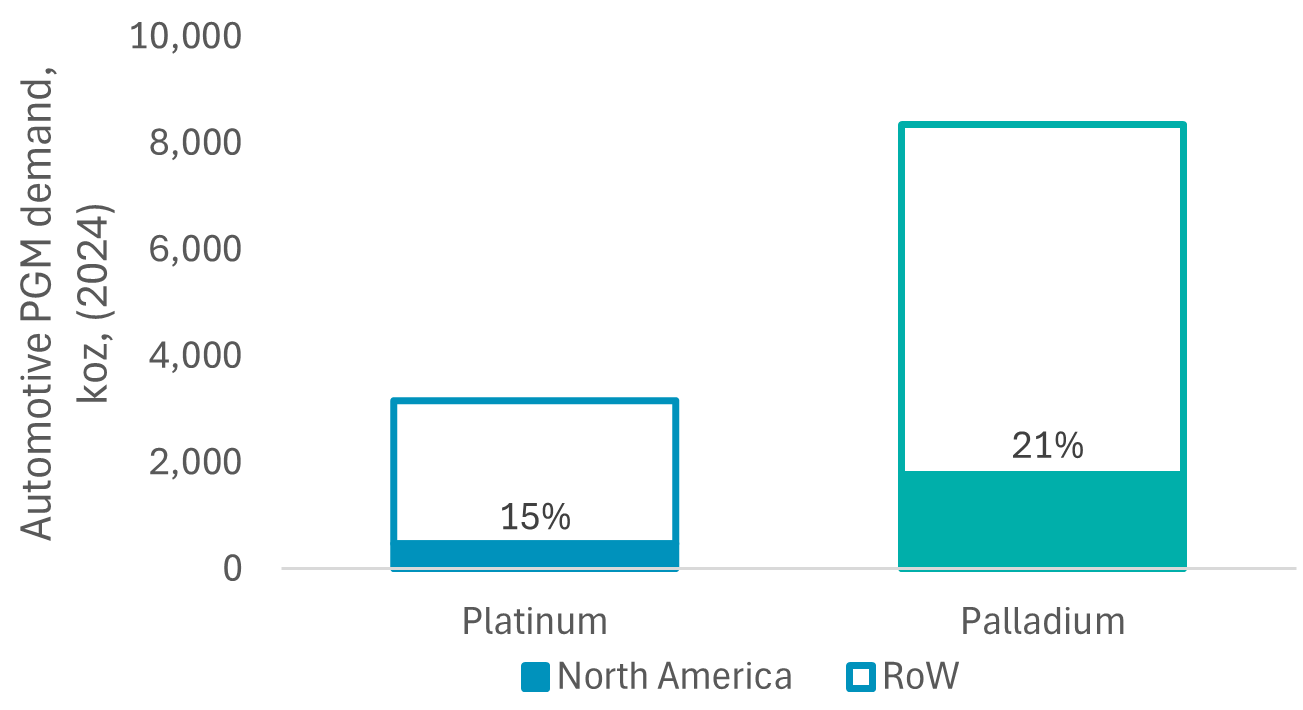

The EPA estimates that by 2032, US BEV market share will need to range between 30% and 56% for LDV and between 20% and 32% for LCV to meet emission targets (Fig. 6). PGM demand and particularly palladium would be a major beneficiary of reducing BEV support packages (Fig. 5). We note that, on average, the US has the highest per vehicle palladium loadings of any geography in the world due to consumer preference for large vehicles and pick-up trucks (Fig. 3). We estimate 2E PGM loadings average 5.6 grams per vehicle in the US with palladium accounting for ~80%. Accordingly, a 1% increase in ICE and ICE-hybrid light vehicle market share is equivalent to c.5 koz and c.20 koz higher platinum and palladium demand respectively.

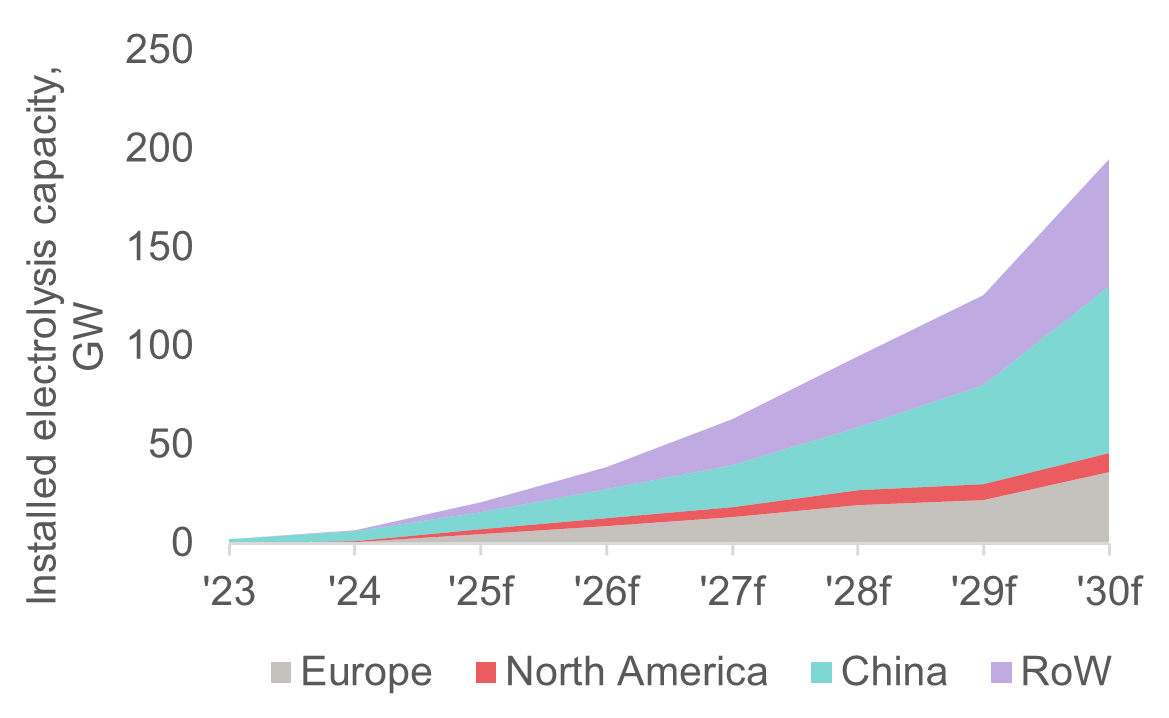

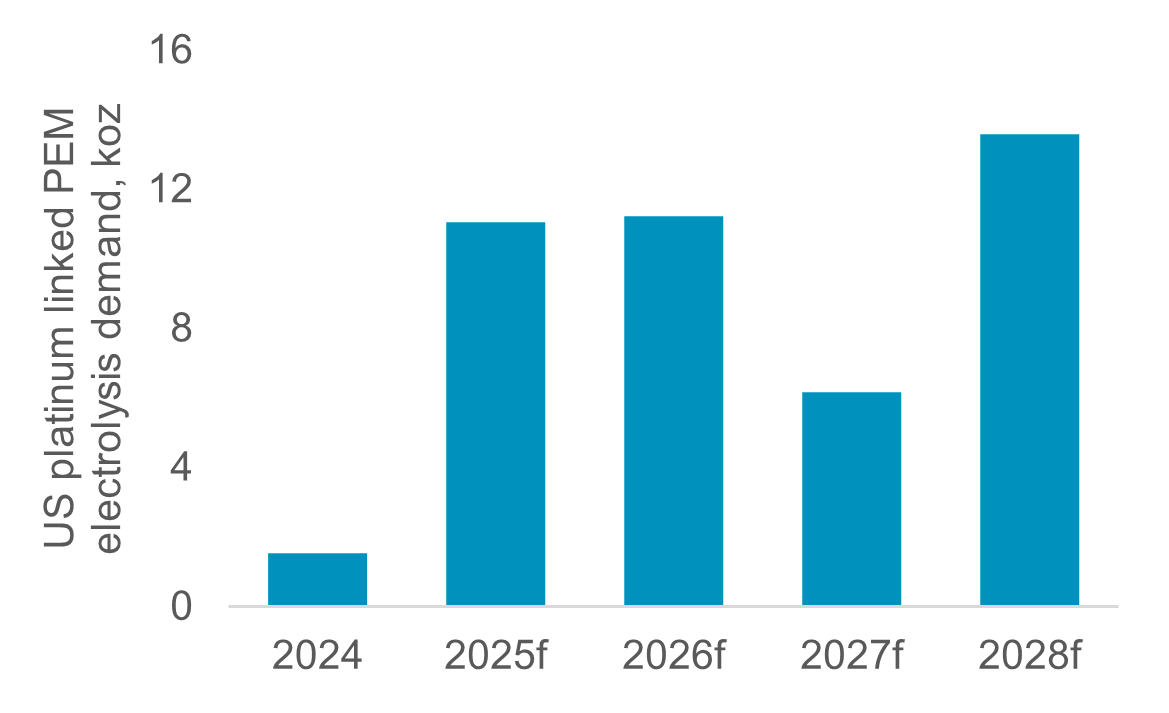

As well as the IRA being a key legislative tool enabling the EV market, curtailing it could also have negative consequences for ramping up the US’s hydrogen economy. Section 45V offers a clean hydrogen production credit of up to US$3/kg. We have long argued that the additionality, geographical and hourly correlation requirements of section 45V were too onerous and would constrain US green hydrogen growth versus other geographies (Fig. 7). Removing clean hydrogen credits will negatively impact our US electrolysis outlook where we currently expect ~5GW of PEM capacity by 2028f, equivalent to 44 koz of cumulative platinum demand (Fig. 8).

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates that the platinum market entered a period of consecutive supply deficits from 2023 and these are expected to fully deplete above ground stocks by 2028f.

- Platinum supply remains challenged, both in terms of primary mining and secondary recycling supply.

- Platinum demand is benefitting from its use across a diverse set of end markets.

- Platinum is a critical mineral in the global energy transition underpinning a key role in the hydrogen economy.

- The platinum price remains historically undervalued and significantly below the price of gold.

Figure 3: US BEV adoption is lagging the global average due to consumers’ preference for large gasoline vehicles

Figure 4: North American vehicles have, on average, the highest average palladium loadings due to consumers preference for larger gasoline vehicles

Figure 5: North America accounts for a combined 20% of automotive 2E PGM demand, with consumption skewed towards palladium

Figure 6: Current legislation imputes that by 2032, annual BEV market share must be between 23% and 37% for combined light vehicles

Figure 7: The US is only likely to account for 5% of global electrolysis capacity by 2030f

Figure 8: Expected platinum demand from proton exchange membrane electrolysis in the US is modest

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.