US trade action on Russian palladium aims to protect domestic producers but may tighten supply and lift prices

17 October 2025

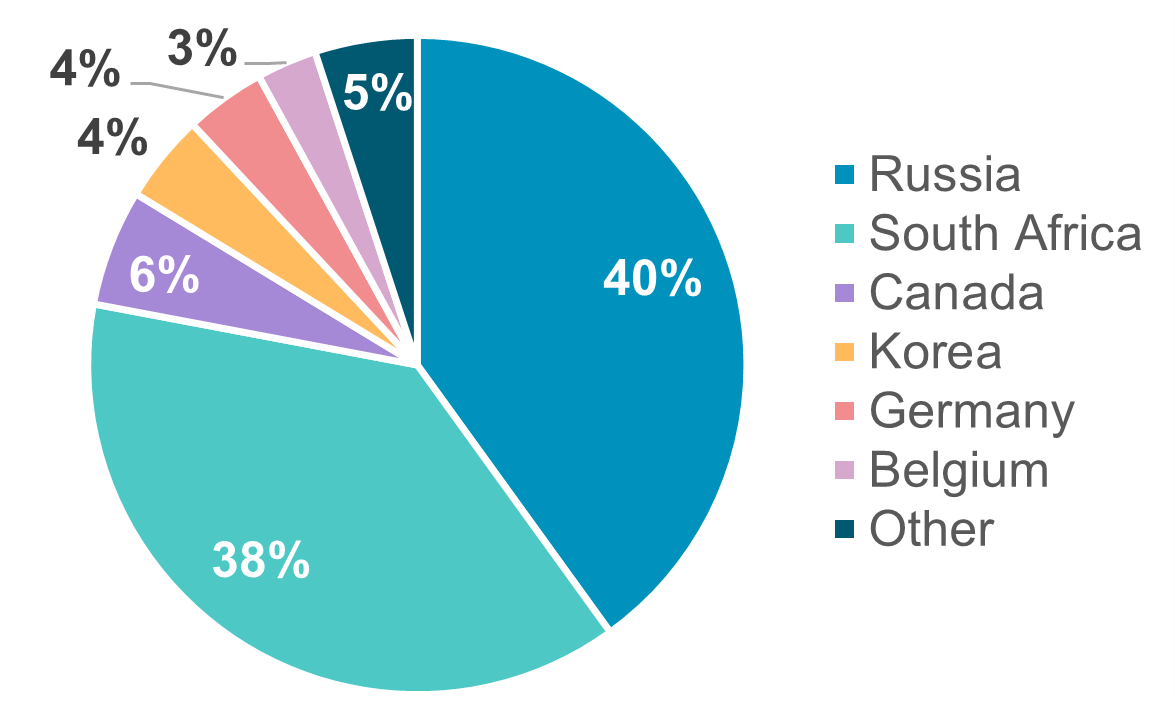

Sibanye-Stillwater and the United Steelworkers union have filed antidumping (AD) and countervailing duty (CVD) petitions against Russian unwrought palladium imports. Russia accounted for 40% of US palladium imports in 2024, but only 20% of implied domestic demand. The palladium price showed little initial response to the filings but have since increased by 25%. Prices accelerated toward the end of August following the release of the US Geological Survey’s (GS) report assessing commodity supply chain disruptions in combination with a broader rally in precious metals within a “debasement” trade.

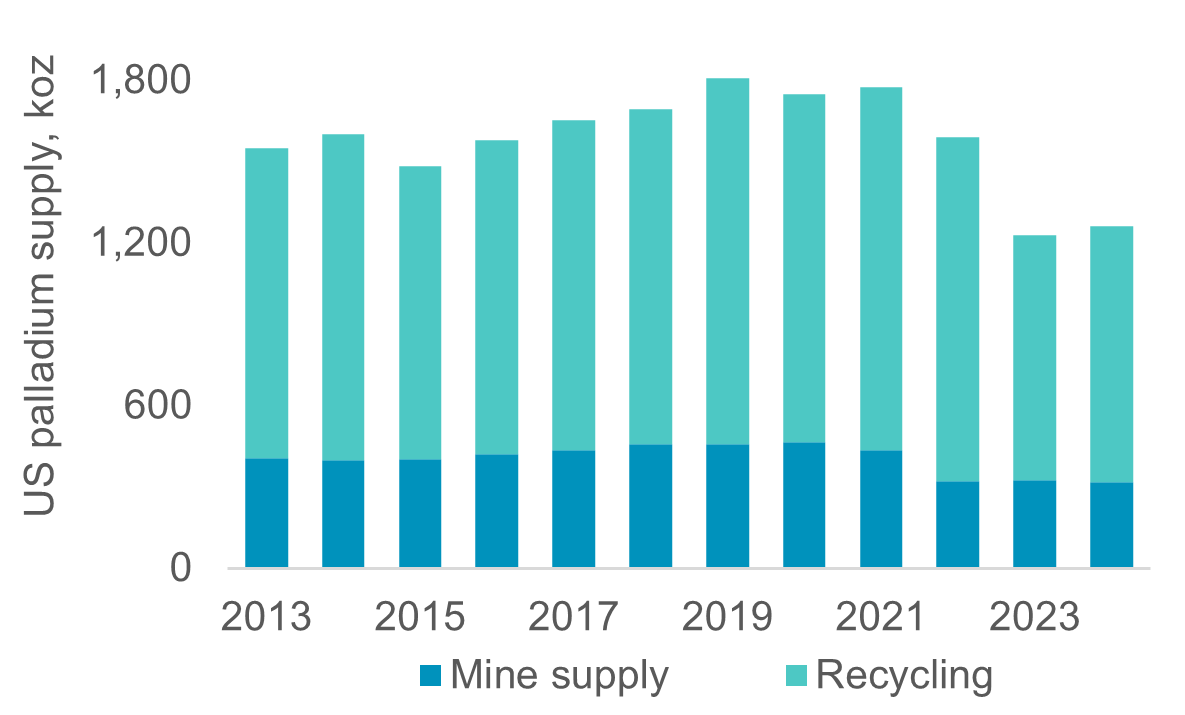

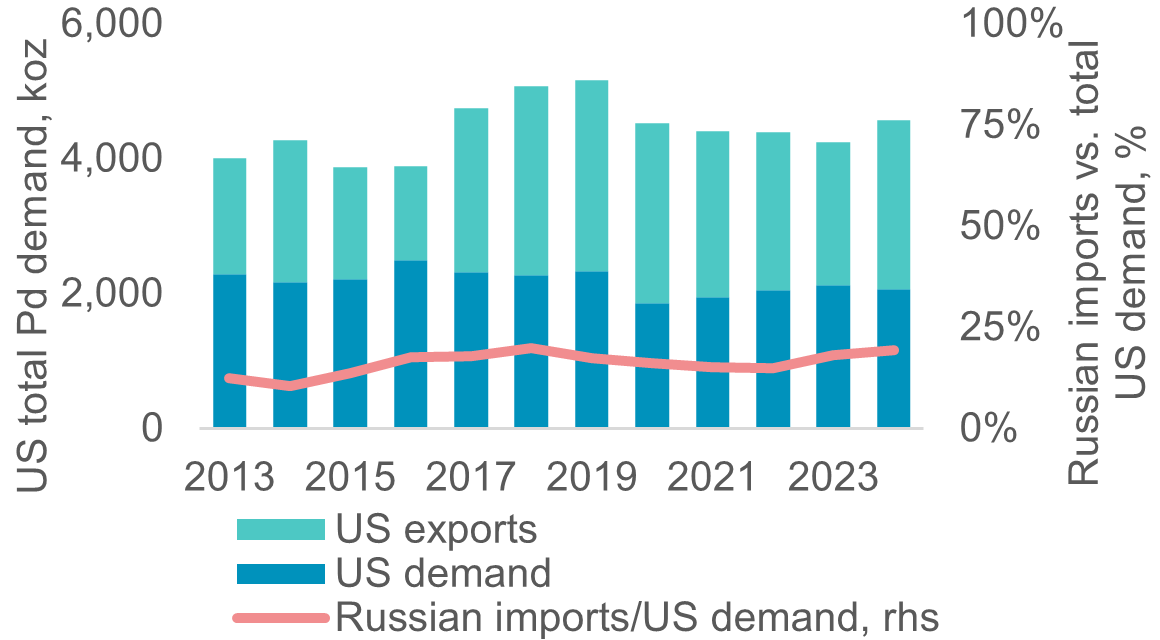

In July 2025, AD and CVD petitions were filed to the US Department of Commerce (DOC) and the US International Trade Commission (ITC). Filings claim that Russian unwrought palladium is being sold below market related prices (aided by state subsidies) which is said to be harming domestic PGM producers. Over the three years from 2021 to 2024, US palladium supply from mining has declined by 27% and recycling supply has declined by 30% (Fig. 1). Over the same period, US palladium imports from Russia have increased by 34% (Fig. 2), with imports in 2025 up a further 30% YTD.

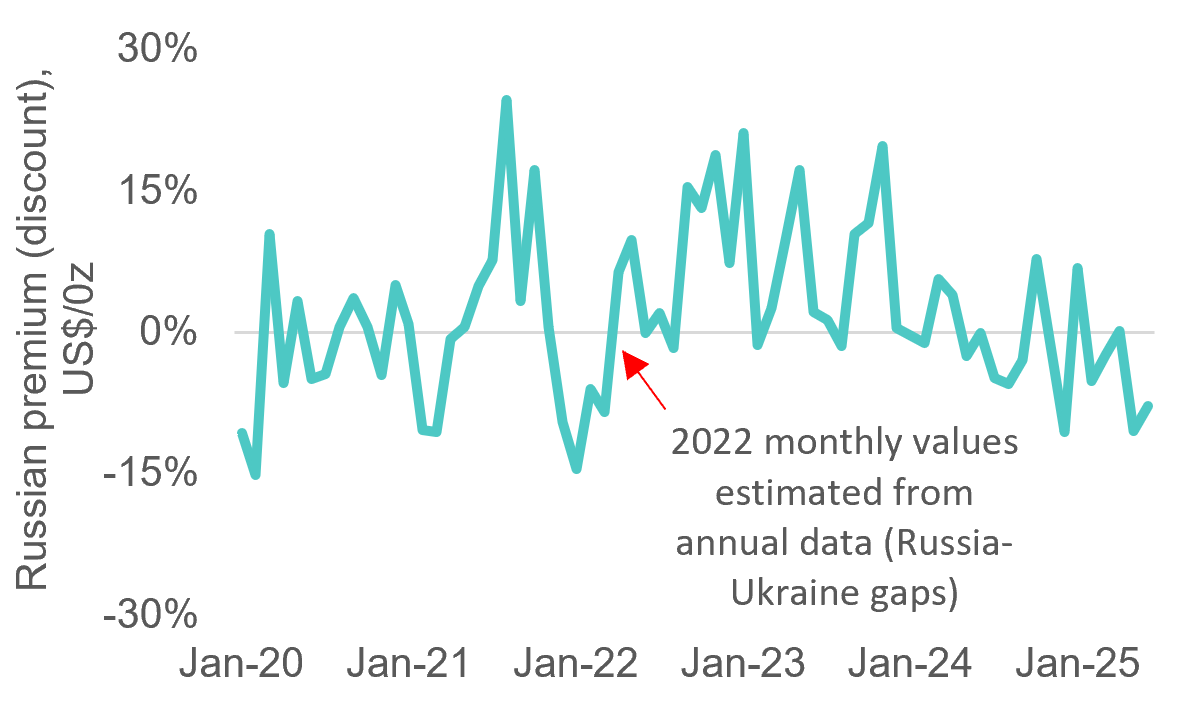

Preliminary findings by ITC have already established a reasonable indication of material injury. Assuming the US government shutdown is resolved, an initial CVD determination is due in December 2025 and AD determinations are expected in January 2026. We note that backing out the implied value (per ounce) of Russian palladium imports from US trade data does not appear to show that import prices are materially or consistently below market prices (Fig. 5). However, material injury classifications are based on Russia’s Factor of Production, which reflects estimated input costs relative to the US.

Figure 1. US Pd supply has declined 30% since 2021

Figure 2. Russian Pd imports have increased 34% since 2021

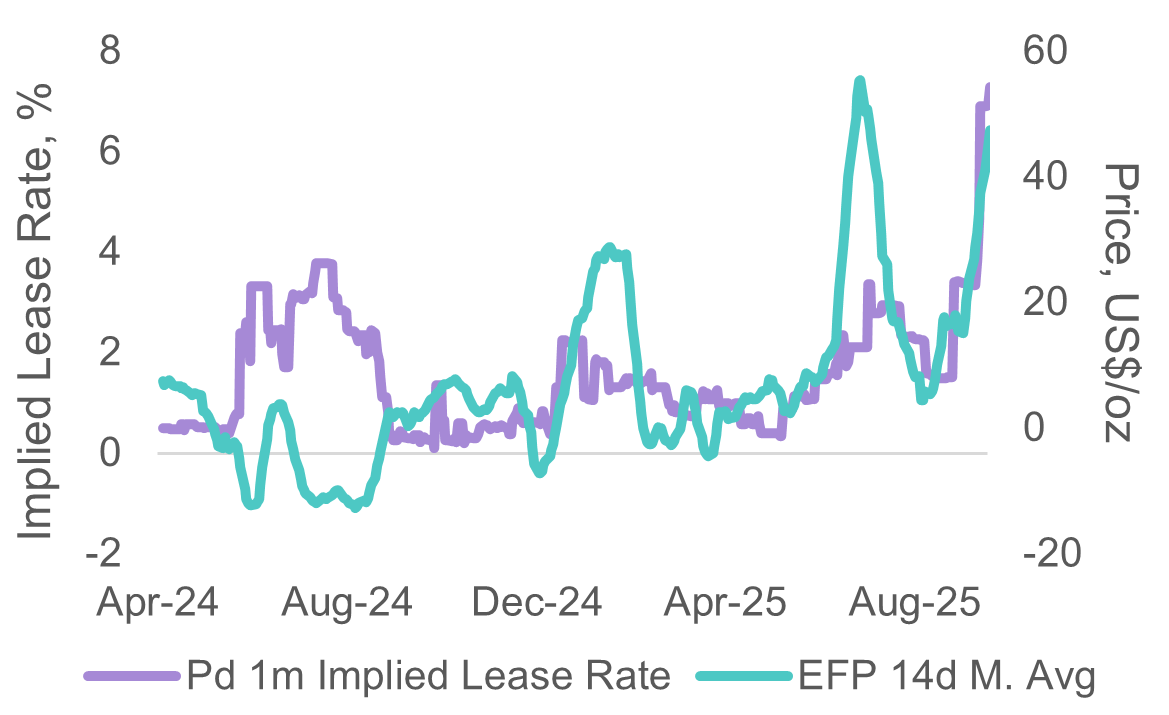

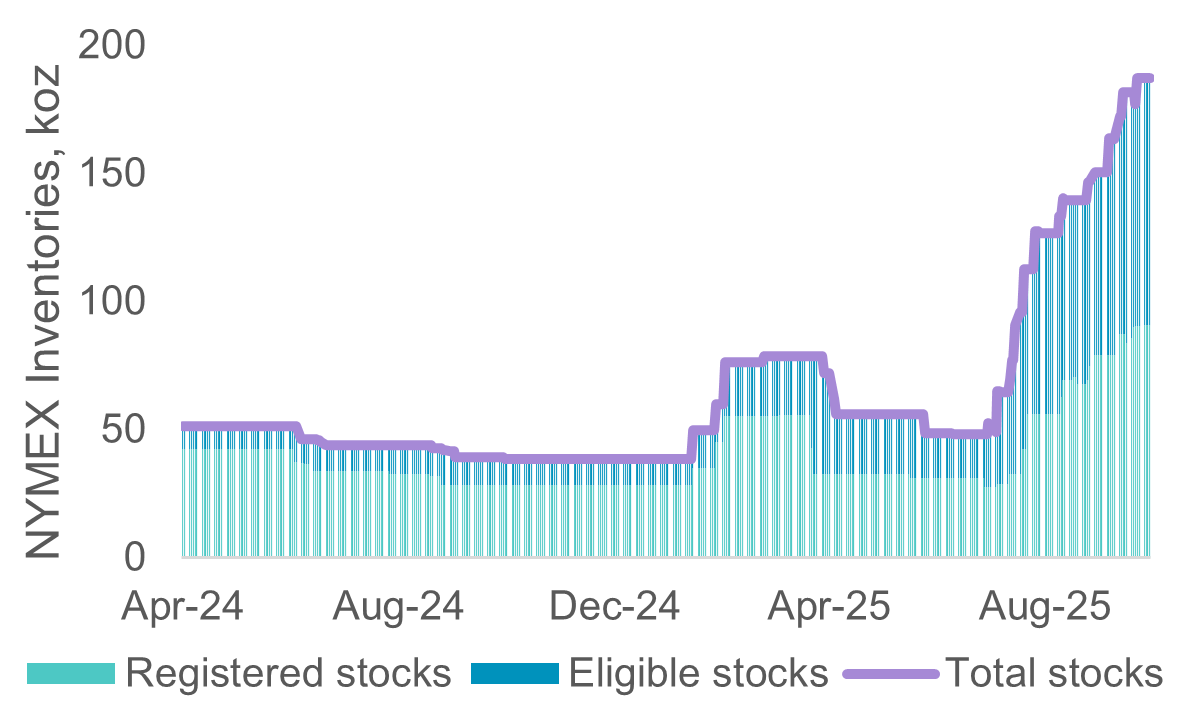

The DOC has determined an estimated dumping margin of 828% on Russia’s unwrought palladium imports. If duties are applied, these would fall on the importer to pay, likely cutting Russian exports to the US. From a supply perspective, a recovery in domestic PGM recycling and re-routing of trade should allow the US to displace most of the c.900 koz of Russian Pd imports recorded in 2024. So, while NYMEX stocks have increased by 169% (Fig. 7) since the filing of AD and CVD petitions, market indicators such as lease rates and EFPs (Fig. 6) have shown a muted response.

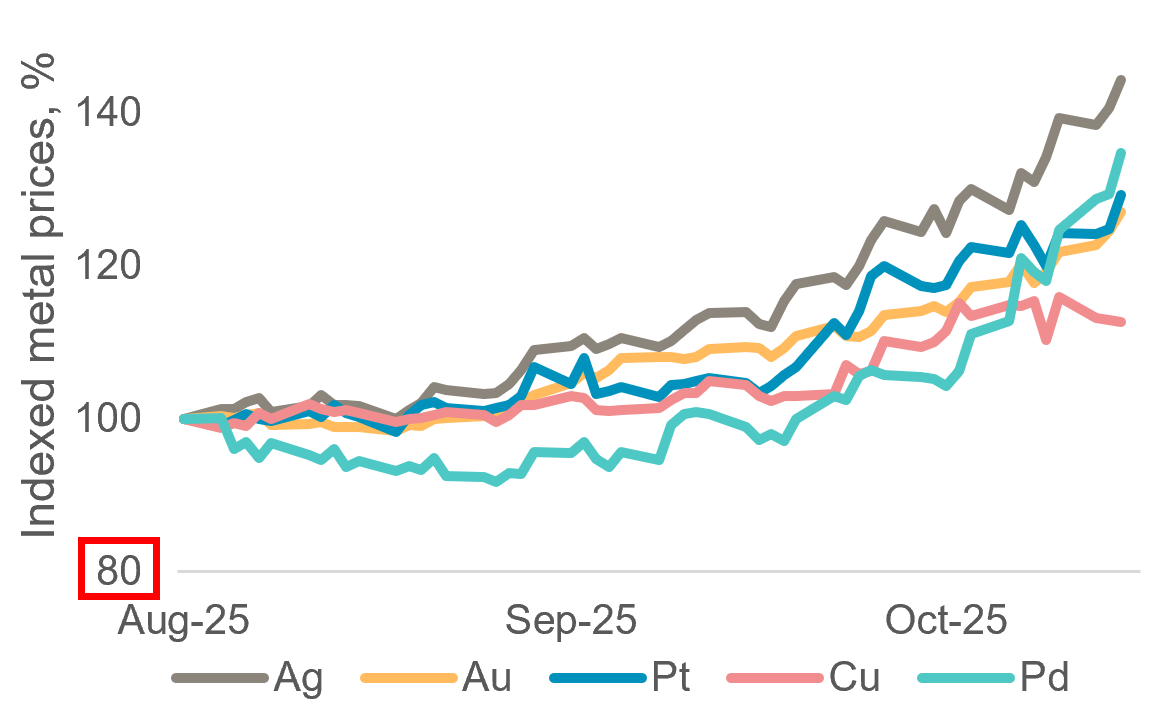

Increasing recycling supply and re-routing trade are likely to be multi-year efforts and thus ADs or CVDs should tighten markets and may place upward pressure on Pd prices. Notably, Pd prices declined in August despite the AD and CVD risks. However, price momentum strengthened after the USGS estimated that a complete loss of Russian Pd supply could lift domestic prices by up to 24%. Furthermore, Pd has benefitted along with other precious metals from an ongoing debasement trade and so the metal is largely performing in-line with peers over the past three-months.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates that the platinum market entered a period of consecutive supply deficits from 2023 and these are expected to fully deplete above ground stocks by 2029f

- Platinum supply remains challenged, both in terms of primary mining and secondary recycling supply

- Although US tariffs present some downside risks to demand, these are likely offset by tailwinds to jewellery demand and Chinese investment demand

- Elevated lease rates and OTC London backwardation highlight tight market conditions

- The platinum price remains significantly below the price of gold

Figure 3: The US imports ~40% of its palladium imports from Russia, closely followed by South Africa at ~38%, broadly reflecting their share of global mine production

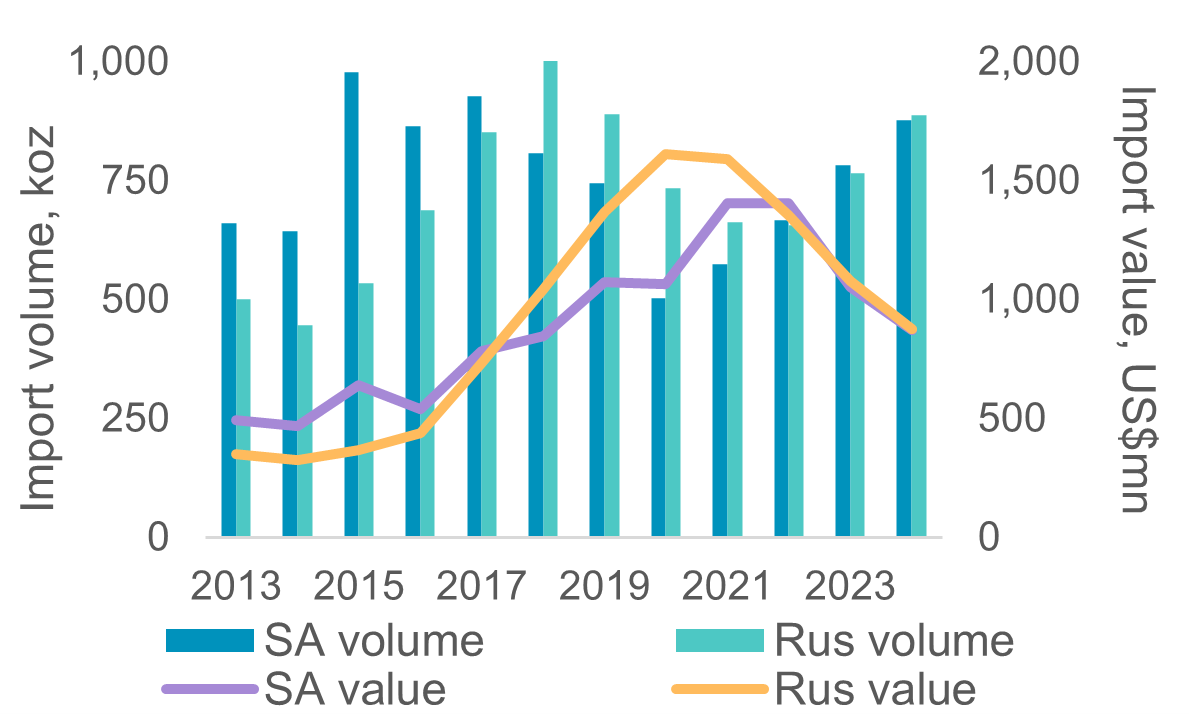

Figure 4: Both Russian and South African imports into the US have increased, suggesting a broader market response to declining US domestic palladium supply

Figure 5: Implied Russian import prices vary between premiums and discounts, with no clear evidence of below market pricing (we cannot account for timing differences)

Figure 6: Forward-physical Pd spreads and lease rates spiked after the AD and CVD petitions announcement on 30 July, signalling tighter availability and market stress

Figure 7: NYMEX palladium stocks have surged ~170% since late July, reflecting constrained physical supply and elevated demand pressures in the US market

Figure 8: After lagging other precious metals, palladium has started to catch up with the broader bull market, gaining 25% since the anti-dumping legislation filing

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.