January 2026 five-year supply/demand outlook; market deficits to narrow compared to the past three years

22 January 2026

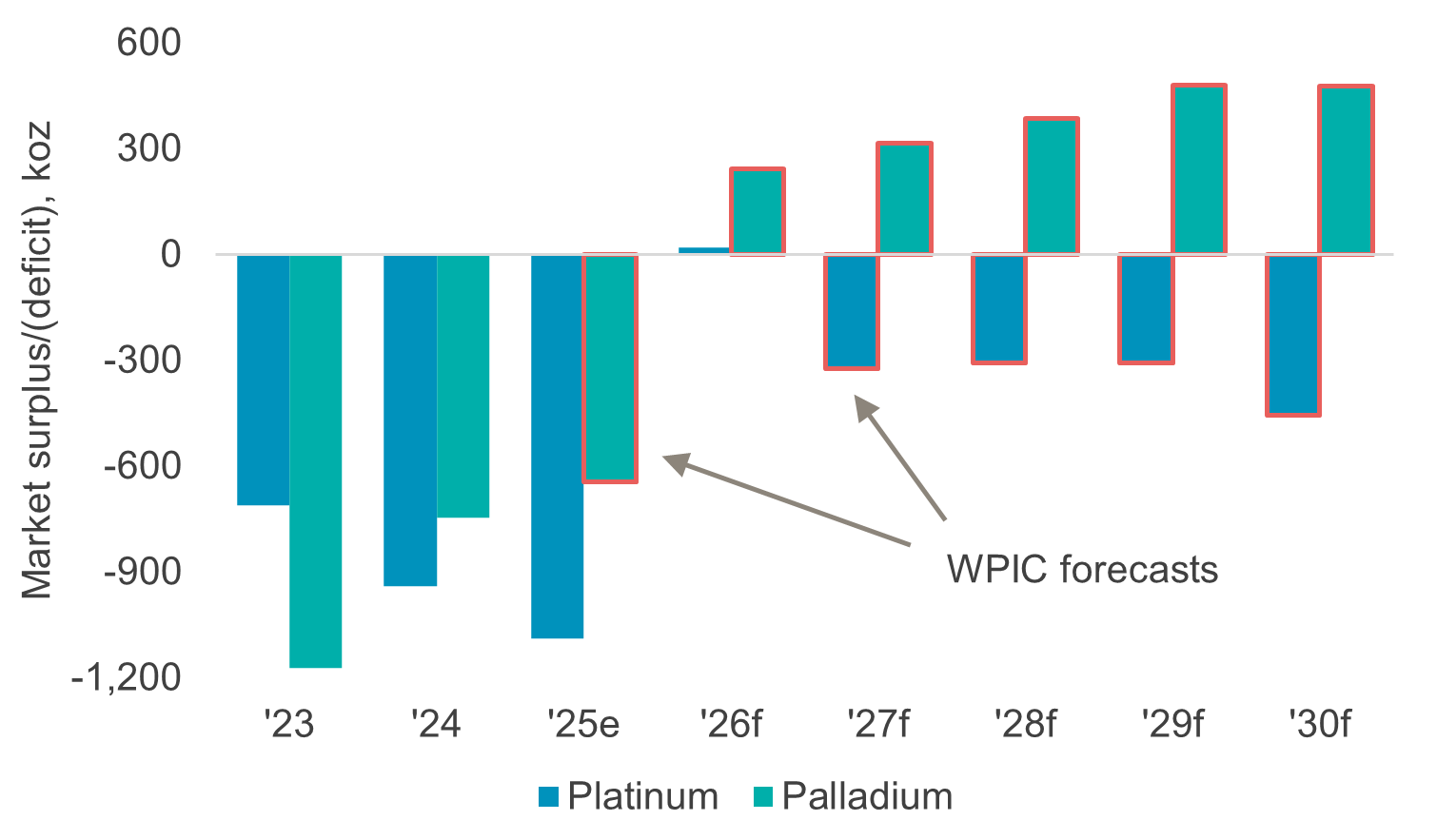

Five-year supply/demand outlook; market deficits to narrow compared to the past three years. This Platinum Essentials leverages market developments seen during 2025 into our medium-term supply/demand outlook while including a first forecast for 2030f for the platinum and palladium markets.

The challenge in producing a longer-term outlook is balancing how current market dynamics may impact later supply and demand forecasts. This is particularly acute at present given the macropolitical landscape, with significant uncertainties and fractious international relations creating a highly supportive environment for the broader precious metals complex. In combination with multi-year deficits eroding platinum’s above ground stocks by 49% since 2022, this supported platinum’s significant price rally from less than US$1,000/oz in May 2025 to over US$2,400/oz today.

Precious metals (including platinum) will continue to serve as defensive assets in 2026 since external shocks are continuing to occur. However, platinum’s price increase, as well as the other PGMs’, will have some bearing on the longer-term supply demand outlook by supporting supply, particularly recycling, and eroding some demand at the margins.

Incorporating these factors, we now expect platinum market deficits to average 348 koz from 2027f to 2030f, which equates to ~4% of demand, reduced from the ~8% previously forecast. We continue to expect palladium to trend towards a surplus, supported by growing recycling supply.

Figure 1. Platinum and palladium market balances 2023 to 2030f

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.