Jun‘25, Five-year supply/demand outlook; platinum deficits persist, despite a shifting economic landscape

19 June 2025

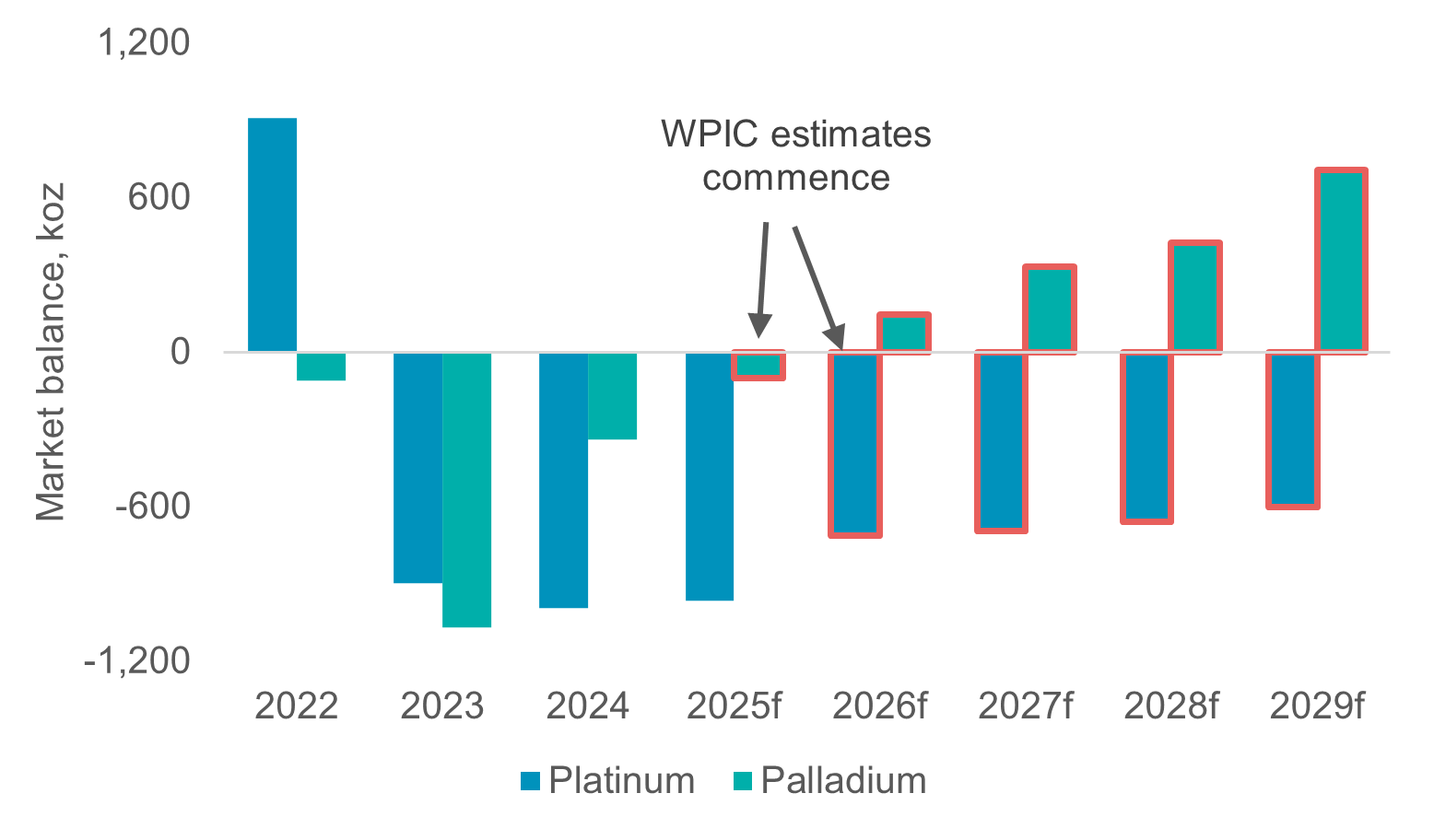

This Platinum Essentials leverages market developments seen through the first half of 2025 into our five-year forecasts for the platinum and palladium markets. The platinum investment case remains compelling, with the overriding feature being that the substantial market deficits of 2023 and 2024 are expected to persist throughout our forecast period to 2029f. Inclusive of 2025 forecasts which are provided by Metals Focus, we expect annual platinum deficits to average 727 koz from 2025f to 2029f, or 9% of average demand. The palladium market is expected to record a small deficit in 2025f, before transitioning to a small surplus in 2026f.

Economic uncertainty has increased since our previous five-year outlook, with US President Trump upending global trade norms. Whilst very little is finalised, global growth expectations have been downgraded. Nevertheless, platinum prices have increased by a third year-to-date. Rising platinum prices are a reaction to entrenched market deficits, depleting above ground stocks, geographic dislocations of physical metal supply and demand, and emerging demand growth from China’s jewellery market. Moreover, within an uncertain global macroeconomic environment, de-dollarisation trends that had initially supported gold prices and widening premiums to platinum and silver has caught investor interest in catch-up trades supporting the white metals.

While platinum prices may have broken out of their recent range of US$900 to US$1,100 per ounce to notch four-year highs of >US$1,250, we do not believe prices have changed the metal’s supply and demand fundamentals. Both platinum supply and demand are highly price inelastic over the short-term, which leaves our forecast five-year platinum market deficits from 2026f to 2029f broadly stable versus our previous forecasts. On average, our total platinum supply and total platinum demand estimates have both been revised by -0.9% respectively from 2026f to 2029f. Whilst the headline deficits are largely unchanged, it should be noted that this reflects a number of offsetting trends. For supply, we raised expectations for mine output, but this is offset by lower recycling supply expectations. For demand, jewellery was upgraded while automotive and industrial needs were downgraded.

Figure 1. Platinum and palladium market balances 2022 to 2029f

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.