Sep‘25, Five-year supply/demand outlook; current price levels unlikely to shift fundamentals away from deficits

30 September 2025

September 2025 Platinum Essentials: Five-year supply/demand outlook; current price levels unlikely to shift fundamentals away from deficits. This Platinum Essentials leverages market developments seen during 2025 into our five-year forecasts for the platinum and palladium markets.

Since our previous five-year outlook, platinum prices have consolidated the strong increase which commenced in May 2025. Year-to-date, the platinum price has increased by 52%, with very pronounced geographic competition for metal given the broader geopolitical backdrop. In China, there were strong notable increases for jewellery fabrication and investment demand respectively during Q2 2025. In general, however, we have opted for restrained revisions to China’s outlook and focussed on the potential impact that current price levels could have on supply and demand fundamentals.

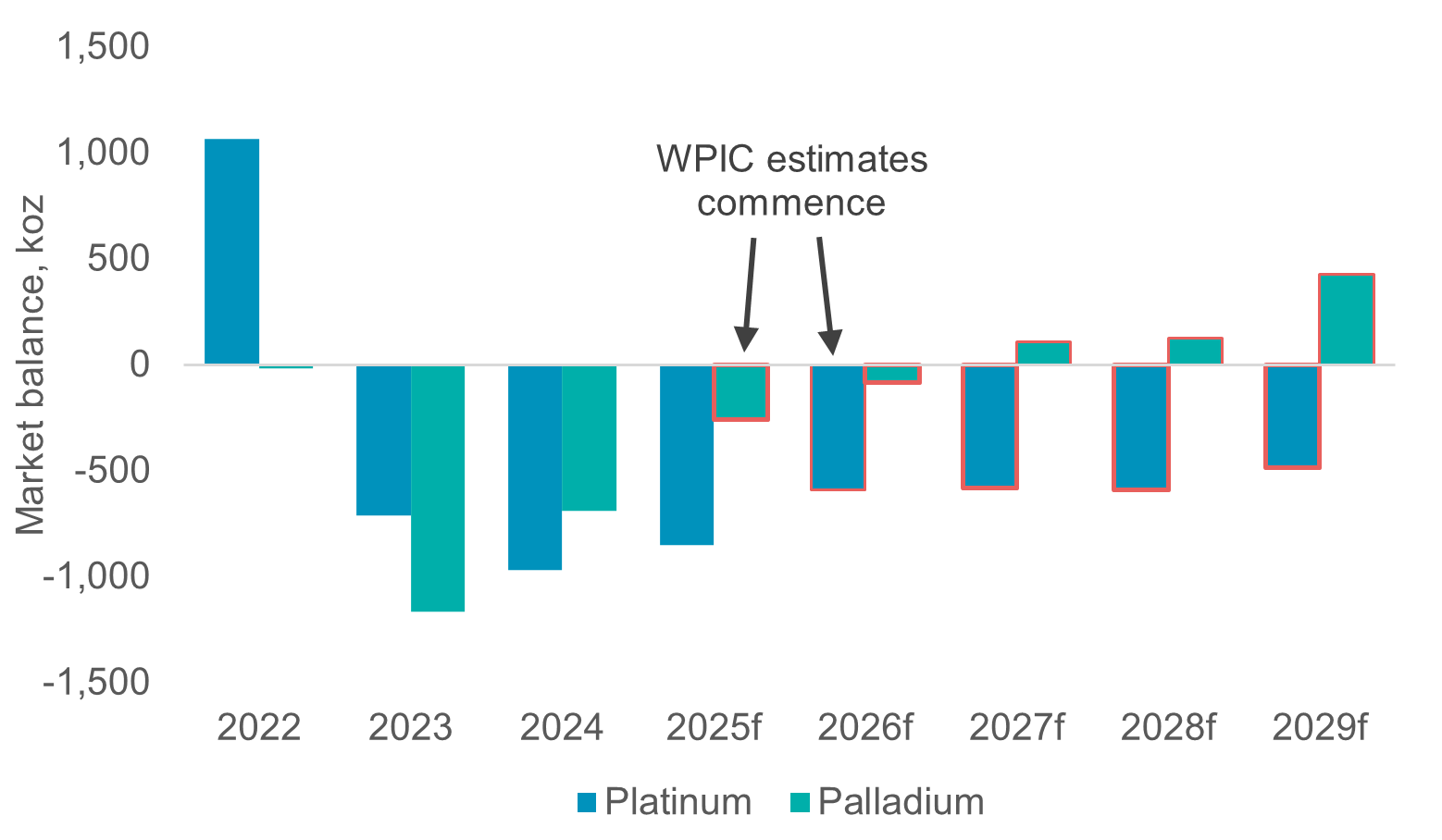

Whilst there are multiple changes to the details of our forecast, revisions to platinum’s supply demand forecasts are relatively minor, with recent supply and demand trends expected to prevail. In line with previous estimate, we therefore expect ongoing annual platinum deficits to average 620 koz from 2025f to 2029f, or 8% of average demand. The palladium market is expected to record a deficit in 2025f and 2026f, before transitioning towards surpluses from 2027f which only become material from 2029f.

Figure 1. Platinum and palladium market balances 2022 to 2029f

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Kaitlin Fitzpatrick-Spacey, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.