Platinum Diverse Drivers of Demand

Platinum is one of the rarest metals in the world, with unique physical and catalytic properties making it highly valued across a number of diverse demand segments, including key technologies that make it a critical mineral for the energy transition.

There are four core segments of platinum demand:

*Minimum and maximum ranges over period 2020-2024

Automotive

Automotive demand for platinum is the single largest demand segment for platinum. It has been between 29-42% of total demand in the last five years.

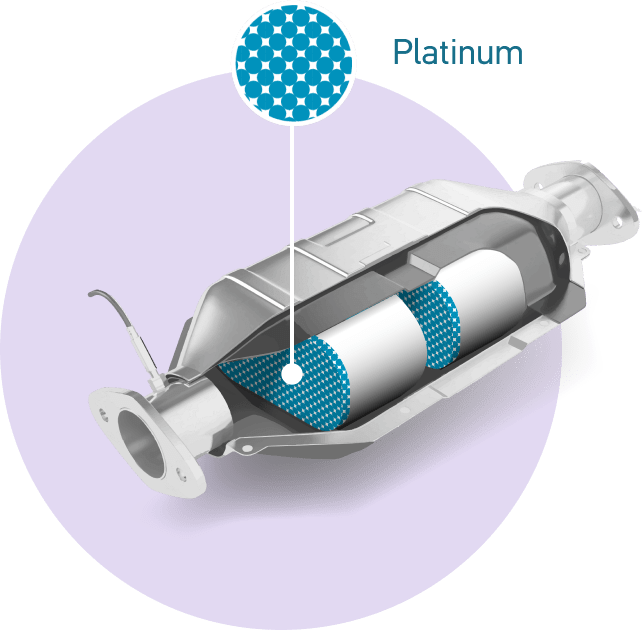

Autocatalysts

Platinum is central to reducing vehicle emissions in vehicles, which must comply with increasingly strict regulations in most countries around the world.

Autocatalyst demand for platinum is predicted to grow well into the decade, despite the ongoing electrification of transport. This is because more platinum per vehicle is needed to achieve lower emissions requirements.

Platinum already dominates the diesel autocatalyst market; its use in gasoline autocatalysts is growing as it substitutes for more costly palladium.

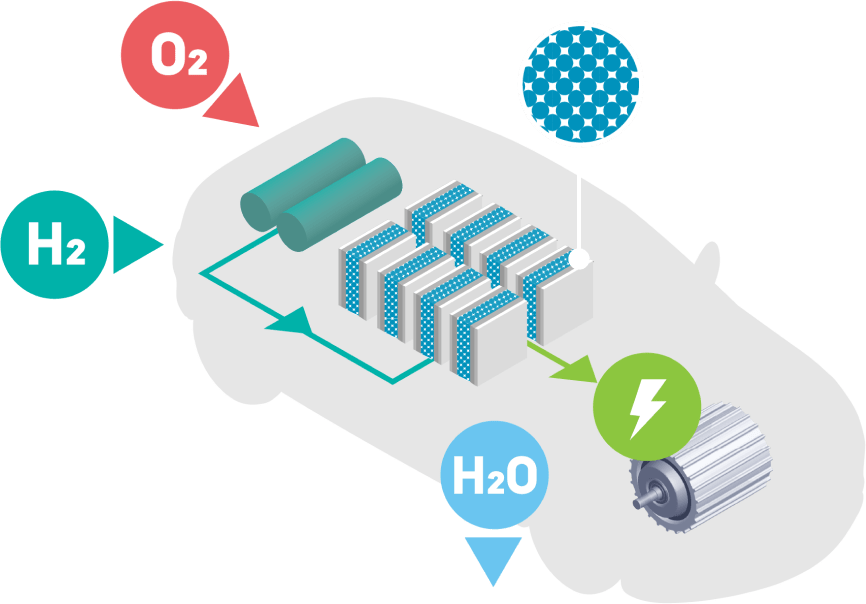

Fuel cell electric vehicles

In a fuel cell electric vehicle (FCEV) platinum’s superior catalytic and conductive properties turn hydrogen and air into water, producing electricity to power electric cars with zero emissions. FCEVs require no charging, refuel in three minutes and offer a range of c.600 km. Trucks, buses and other fleet vehicles are leading the growth in FCEVs and refuelling infrastructure is being developed.

As the decade progresses, platinum automotive demand from FCEVs will grow at an increasing pace.

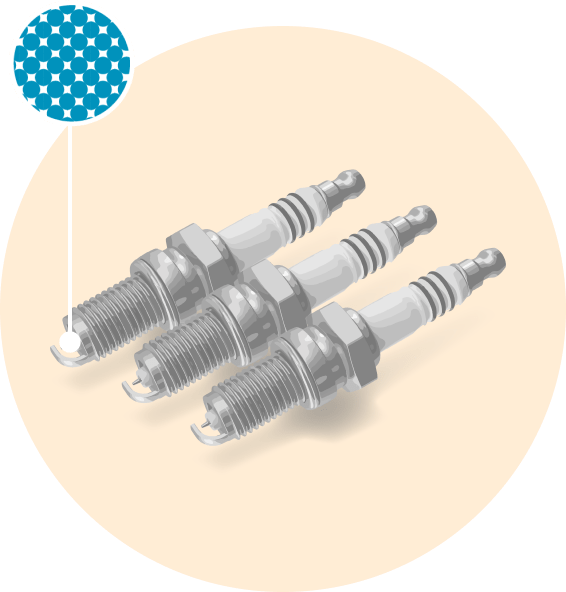

Spark Plugs

Platinum is also used to make other vehicle components, including spark plugs and sensors for temperature control, O2 monitoring to support more CO2-efficient engines, and airbags.

Industrial

Platinum’s diverse industrial uses make up the second largest demand segment, accounting for between 27-36% of total demand in the last five years.

Nitric acid

Platinum’s catalytic properties are used to make nitric acid for fertiliser and, in the petrochemical industry, to achieve a greater yield of high-octane fuel per barrel of oil.

Glass

Platinum’s high melting point, stability and non- corrosiveness are vital to the glass making industry, as it can withstand the high temperatures necessary without distortion or causing contamination. LED screens and glass fibre are produced using platinum.

Medical

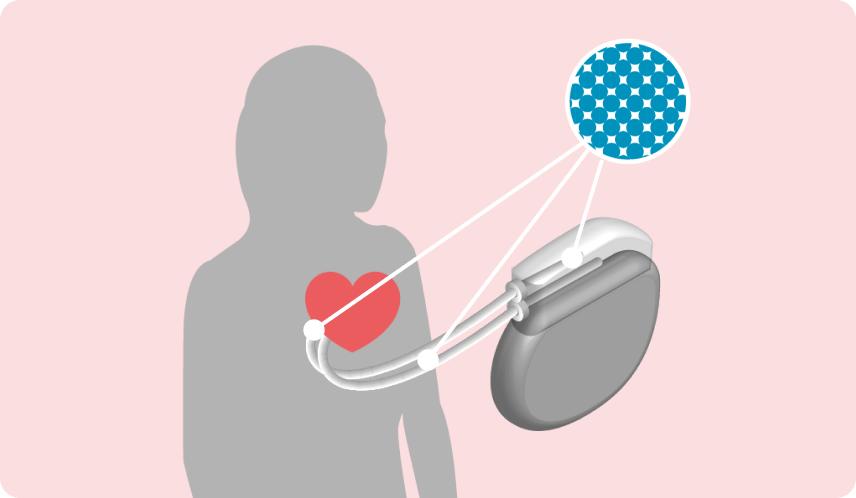

Biocompatible and well tolerated by the body, platinum is used in numerous established medical treatments and is at the forefront of many new ones. Compounds made from platinum are used in the treatment of cancers and pacemakers contain platinum electrodes.

Hydrogen

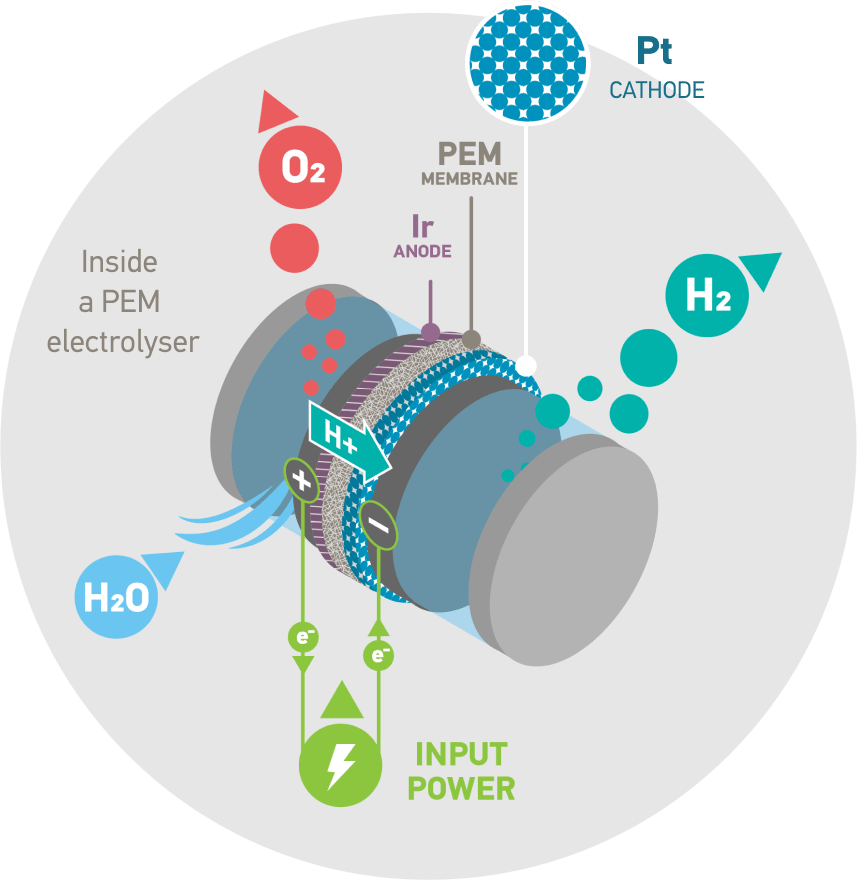

Platinum is unlocking the hydrogen economy, a new end-use demand driver for platinum. Proton exchange membrane (PEM) technology uses platinum catalysts in electrolysers to produce carbon-free green hydrogen from renewable energy.

Green hydrogen can be used in a wide range of applications to replace fossil fuels – power generation, heating, fertiliser production, steel making and as a sustainable aviation fuel, as well as powering FCEVs.

Jewellery

Global annual jewellery demand has been between 23-29% of total platinum demand over the last five years.

Global premier status

Platinum jewellery has achieved global premier status and a strong association with love. Market developed by Platinum Guild International since 1975. Platinum is also renowned for setting diamonds and gemstones securely.

China

In China, design innovation is broadening the appeal of platinum jewellery.

US & Japan

In the US, platinum is the preferred choice for engagement rings, while in Japan it is the favoured choice for generations of brides and grooms.

India

India is a driver of growth including a rising men’s jewellery market.

Investment

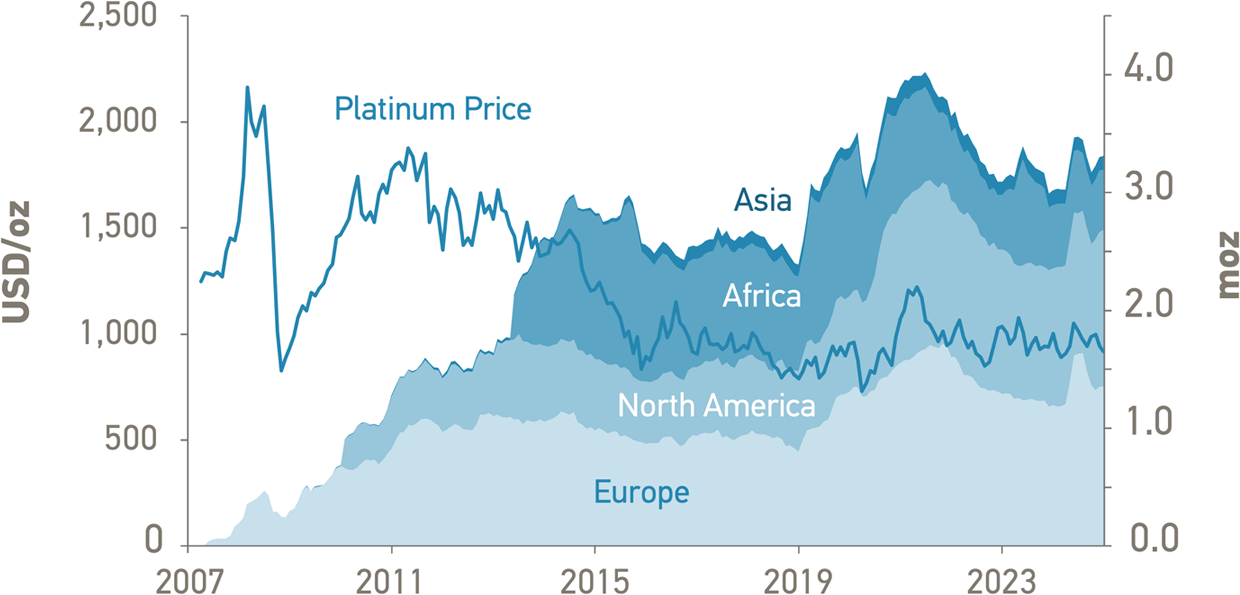

Investment has been the most variable segment over the past five years, ranging between -8% and 21% of total demand (net investment, excluding increases or decreases in above ground stocks).

Physical platinum ETFs

Physical platinum exchange traded funds (ETFs) have become firmly established in several regions.

Examples of investment products in different geographies

In North America and Australia, investors can include platinum bullion coins and bars in their retirement savings plans.

In China, a growing range of platinum bullion products is available to investors. The iconic platinum Panda coin has been reintroduced by the People’s Bank of China.

Private individual and institutional investment in vaulted bars.

Private individuals in Japan have been able to invest in platinum accumulation plans since the 1980s.