China’s demand for glass fibre continues to grow, supporting ongoing platinum industrial demand growth

27 September 2023

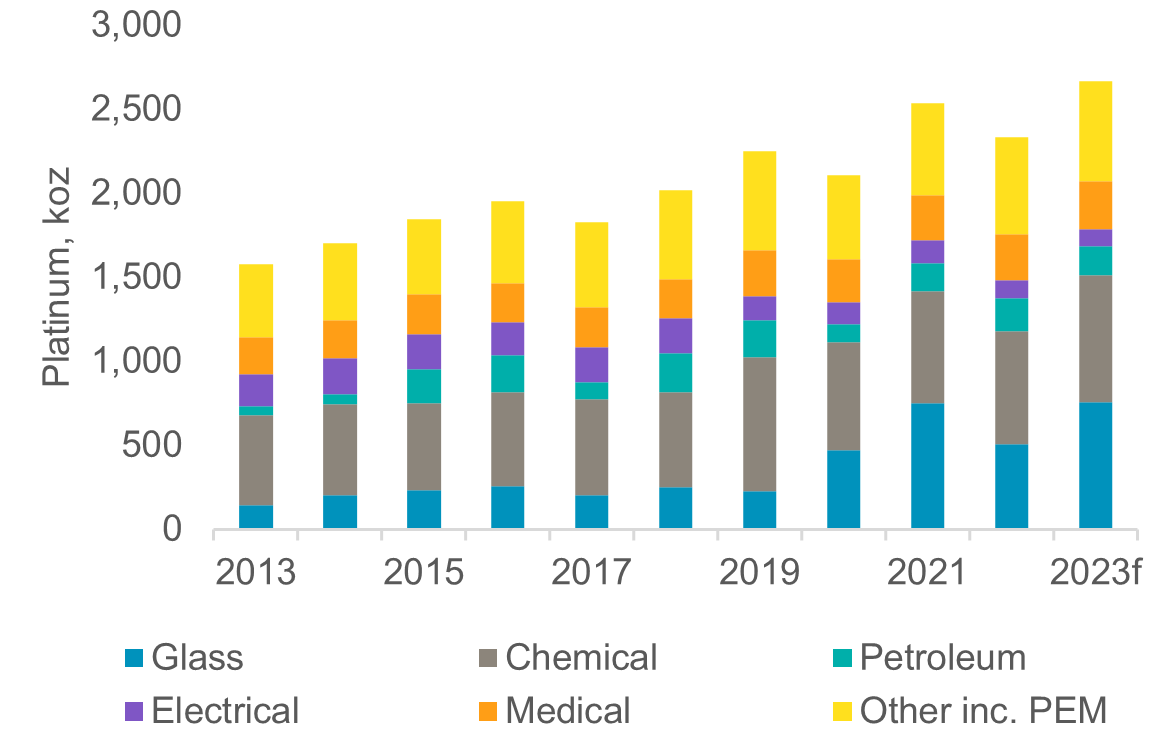

Strong growth in global glass and glass fibre demand has been a major factor behind platinum industrial demand growth of 5.4% CAGR over the last decade, double that of global GDP growth. Despite glass capacity growth being cyclical, our analysis suggests that ongoing growth in the renewable energy industry and automotive lightweighting will support sustained glass fibre demand growth and therefore industrial platinum demand growth.

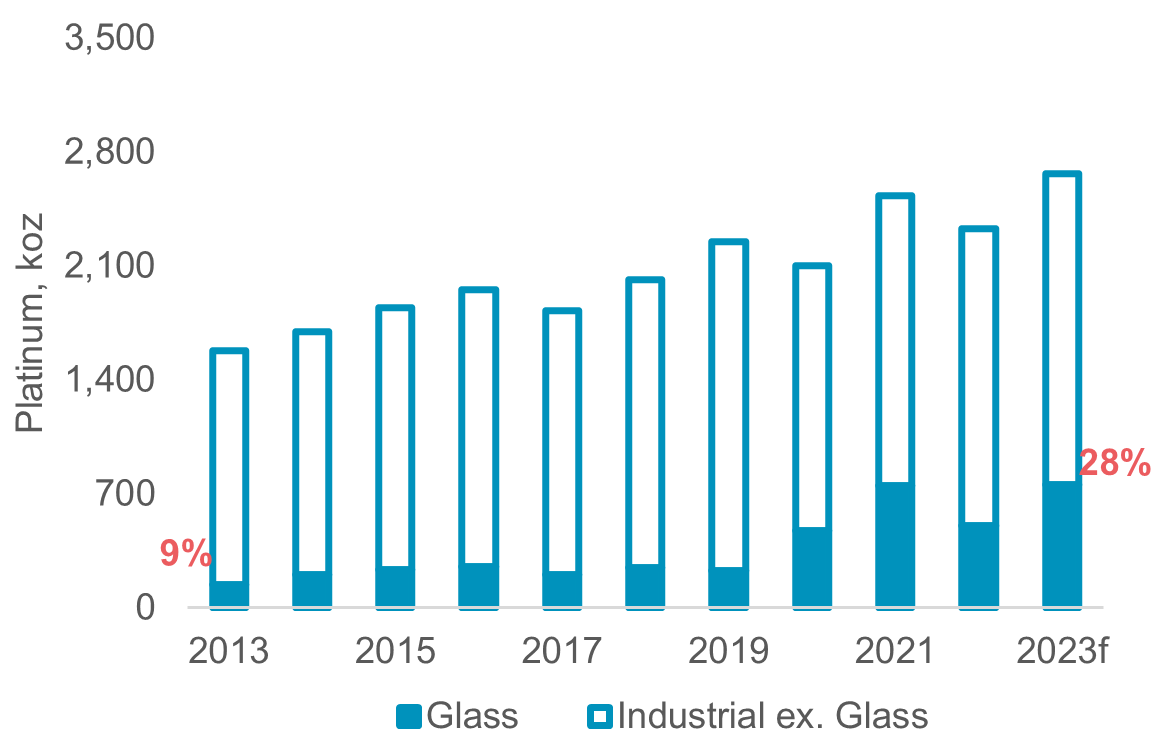

Despite their cost, platinum/rhodium alloys are the only metals that can withstand the heat and corrosive effects of drawing and casting high quality glass fibres and sheets. Prior to 2020, ~12% of industrial platinum demand was from glass end-uses, but this has stepped up to between 22% and 30% of industrial platinum demand (lefthand chart). This is a substantial increase and given the on/off nature of capacity additions, we should question if this is just part of a natural cycle of additions, followed by consolidation, or if this is a sustainable pattern of demand growth.

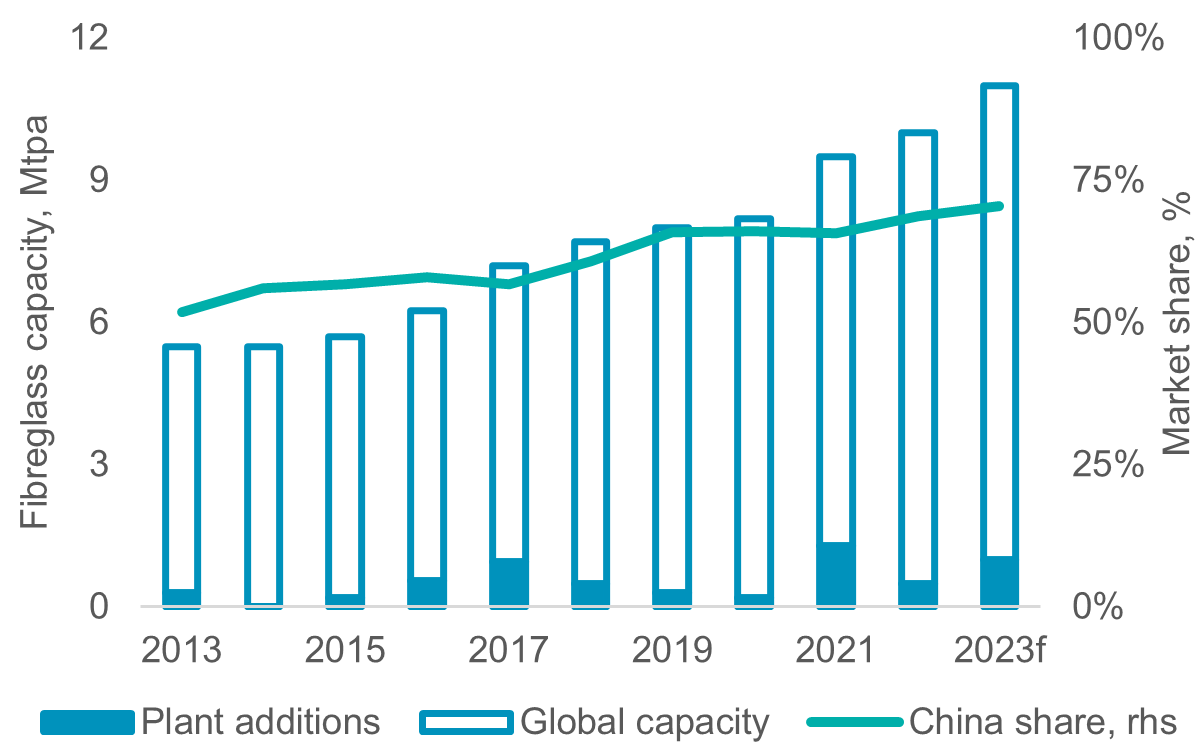

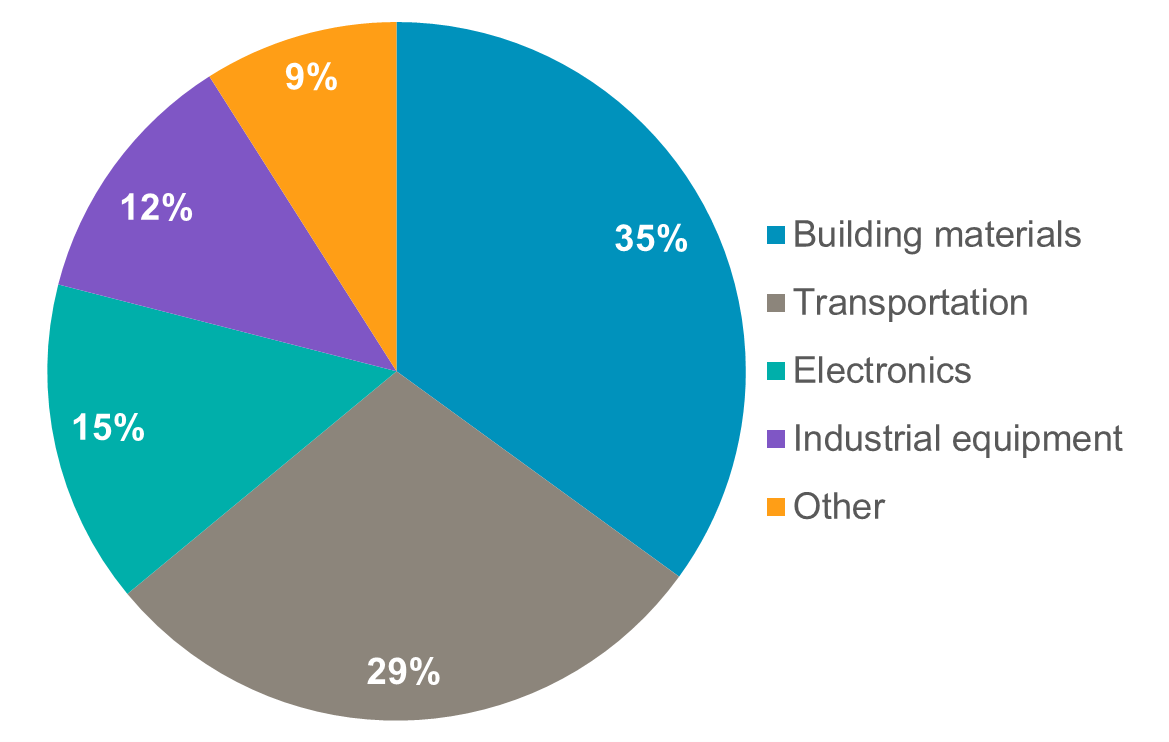

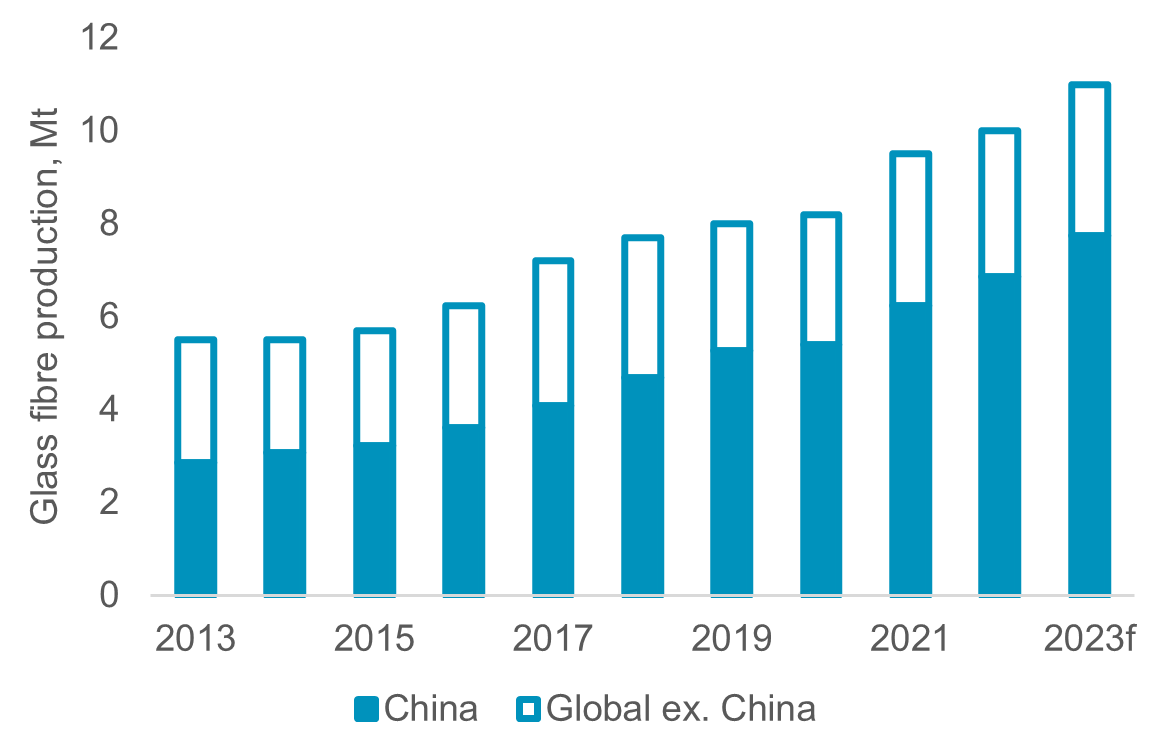

Global fibreglass capacity has increased by 6.9% CAGR since 2013, driven by China, who’s global market share has increased from 50% to 70% (righthand chart). This growth has been driven by growth in downstream demand for glass fibre and high-quality screens for personal electronics. While we believe that glass demand from personal electronics might ease in the wake of the COVID induced boom, and the market for insulation in domestic construction is challenged, glass fibre demand is likely to continue to grow, particularly for renewable energy applications.

Glass drove a step change in platinum demand

China is driving global glass fibre production growth

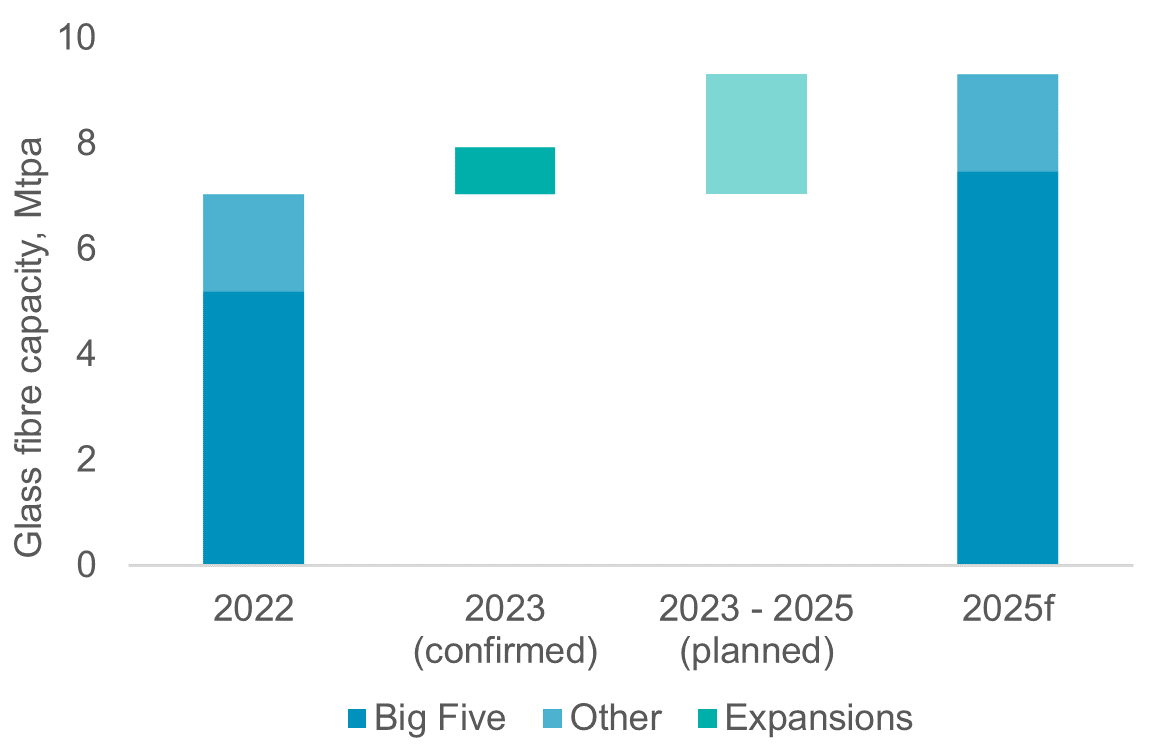

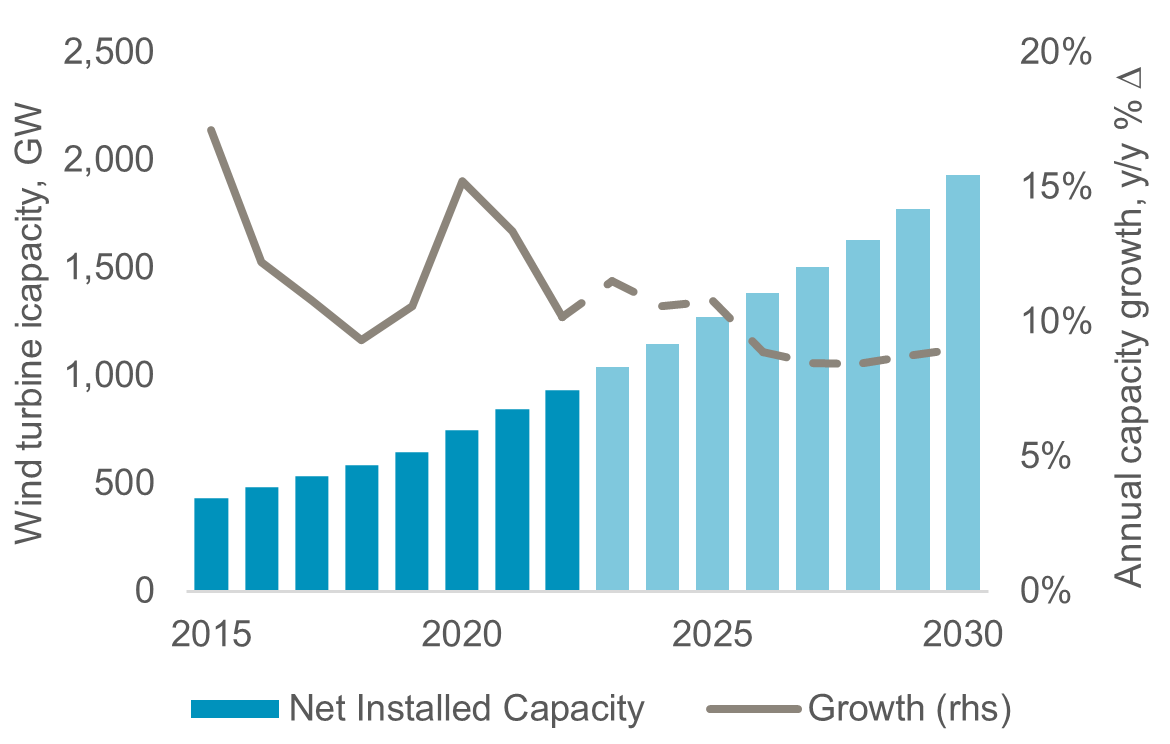

The case for continued growth in glass capacity is strong. China is the most significant producer of glass fibre globally (70% market share in 2023), and has a robust capacity expansion pipeline to 2025f. China’s five largest fibreglass producers have a cumulative 2.2 Mtpa of capacity additions between 2023 and 2025 (equivalent to 20% of existing global capacity). Project anouncements imply Chinese capacity growth of 32% to 2025, with 0.8 Mtpa slated for 2023 and the remaining 1.4 Mtpa expected in 2024 and 2025 (Fig. 4, overleaf). While capacity additions can be at risk of deferrals, production capacity is required for renewable energy markets. Specifically wind turbine capacity is expected to increase by 9.5% CAGR between 2022 and 2030 (Fig. 5). Fibreglass composites used in the manufacture of turbines are superior to traditional buidling materials.

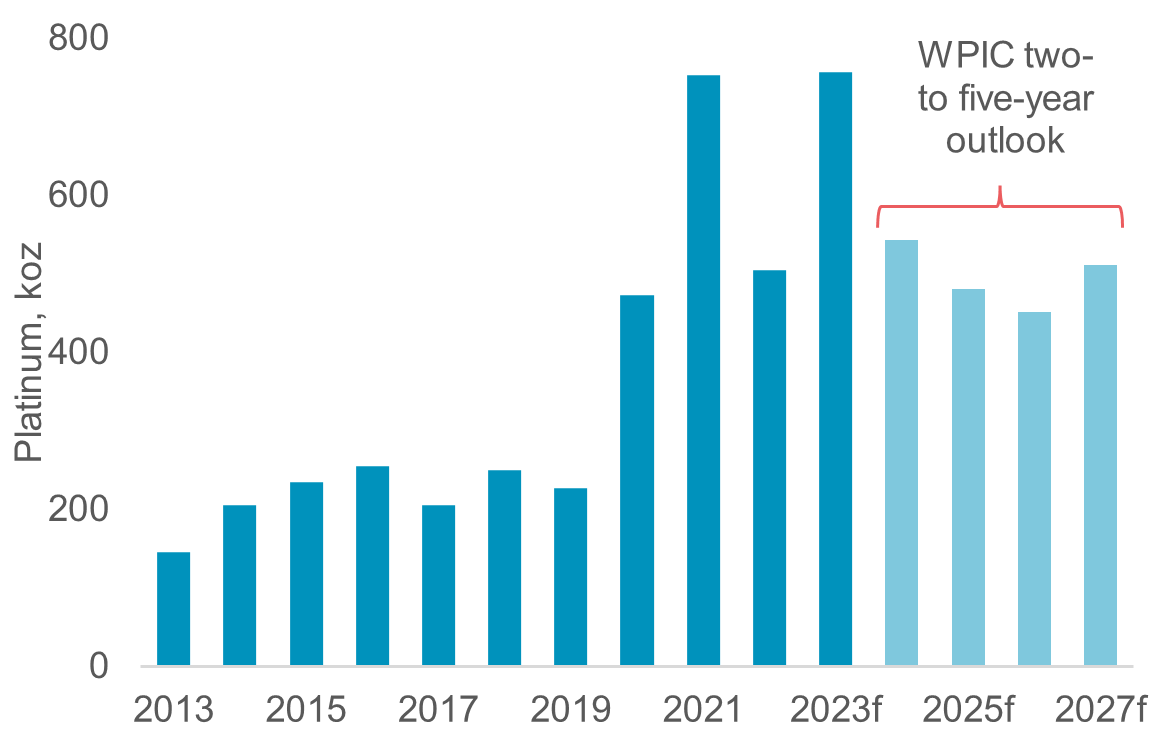

Given government support for renewable power generation is likely to continue through any period of economic uncertainty, we believe this will promote continued growth in glass capacity additions, which should result in glass platinum demand remaining at around 500 koz p.a. through 2027f, 280 koz above pre-2020 levels (see fig 6).

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market entering a period of consecutive deficits from 2023.

- Platinum can be considered a proxy for investing in the growing hydrogen economy given its use in electrolysers and fuel cells.

- Platinum supply remains challenged, hampered by electricity shortages in South Africa and sanctions against Russia

- Automotive platinum demand growth should continue due principally to substitution in gasoline vehicles.

- The platinum price remains historically undervalued and significantly below both gold and palladium.

Figure 1: Glass platinum demand has been the fastest growing, but most volatile sub-segment of industrial platinum demand since 2013

Figure 2: Glass fibre is used in end-markets, with the infrastructure related requirements accounting for the largest constituent of demand

Figure 3: China has driven the majority of global fibreglass capacity growth in the past decade

Figure 4: China’s big-five glass producers plan to grow capacity by 32% over three years

Figure 5: Decarbonising the grid is underpinning sustained renewable energy demand growth supporting wind turbine capacity

Figure 6: Platinum glass demand should prove resilient through 2027f due to near-term capacity additions and long-term demand growth expectations

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Jacob Hayhurst-Worthington, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.