Latest Russia sanctions unlikely to impact near-term PGM markets, but there may be longer term benefits

18 April 2024

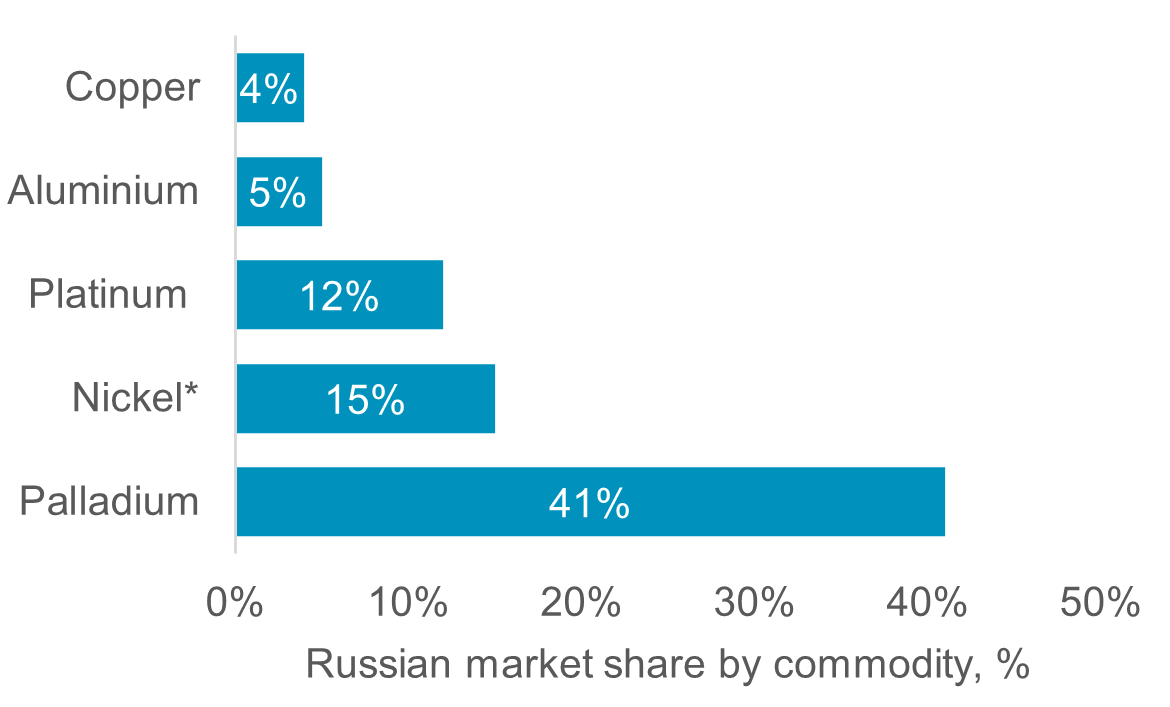

Russia’s ore bodies contain both base metals and byproduct platinum group metals (PGM). Russia accounted for 28% of primary 2E PGM supply in 2023. We see a limited impact from the latest round of base metal sanctions; like after the April 2022 sanctions by the London Platinum and Palladium Market, metal will continue flowing. However, in combination with other factors the sanctions probably eliminate previously anticipated supply growth from Russia, which given its importance to class 1 nickel markets may present another headwind to BEV growth rates and support higher for longer ICE PGM demand.

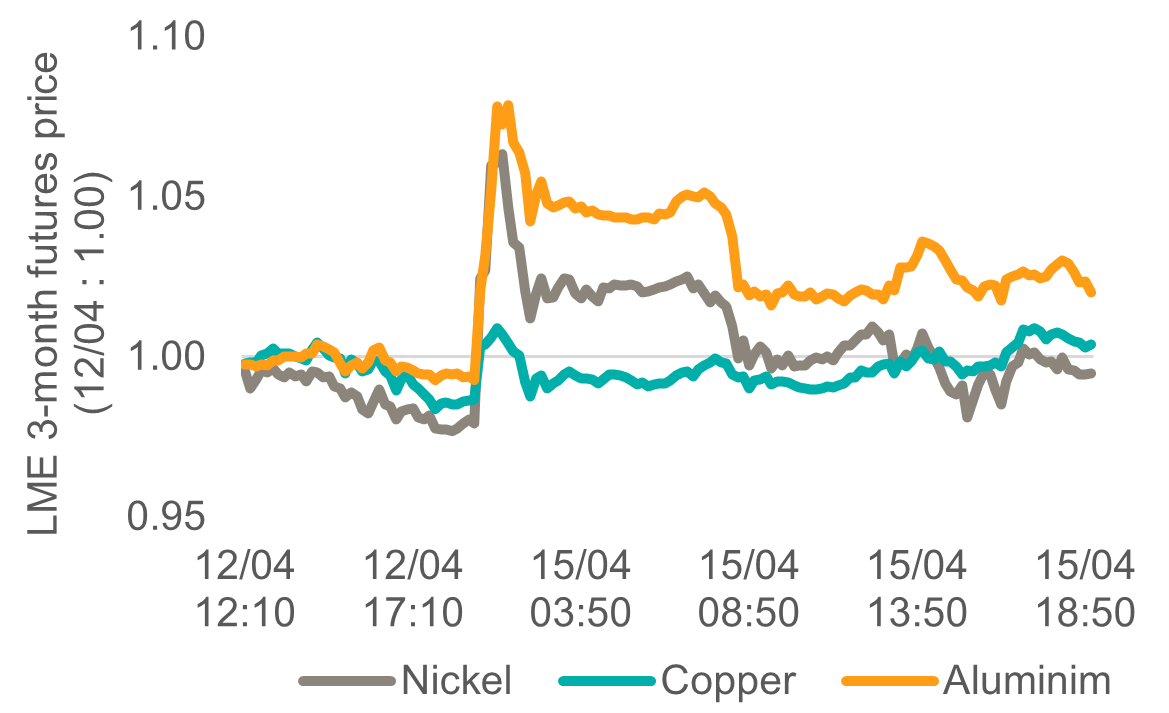

The US and UK have sanctioned Russian base metals exports, from 13 April 2024, delivered via the London Metals and Chicago Mercantile Exchanges. Although LME futures prices for aluminium and nickel initially responded strongly (Fig. 3) to sanctions, prices have subsequently pared gains. Banning metal delivered via exchange is unlikely to impact base metal fundamentals because most traded metal is not delivered to LME warehouses nor expected to be classed as LME deliverable. Moreover, prior to this ban the West had already begun self-sanctioning and reducing use of Russia’s class 1 nickel. This has resulted in higher metal flows to sanction agnostic regions such as China and India. While Nornickel noted that “it will remain a reliable supplier” despite sanctions, rising trade barriers and significant Indonesian nickel supply growth (which is also selling into China and India) likely suggests that Russian base metal production (and consequently PGM output) will not grow as was targeted prior to 2022.

Figure 1: Russia is a major source of important metals

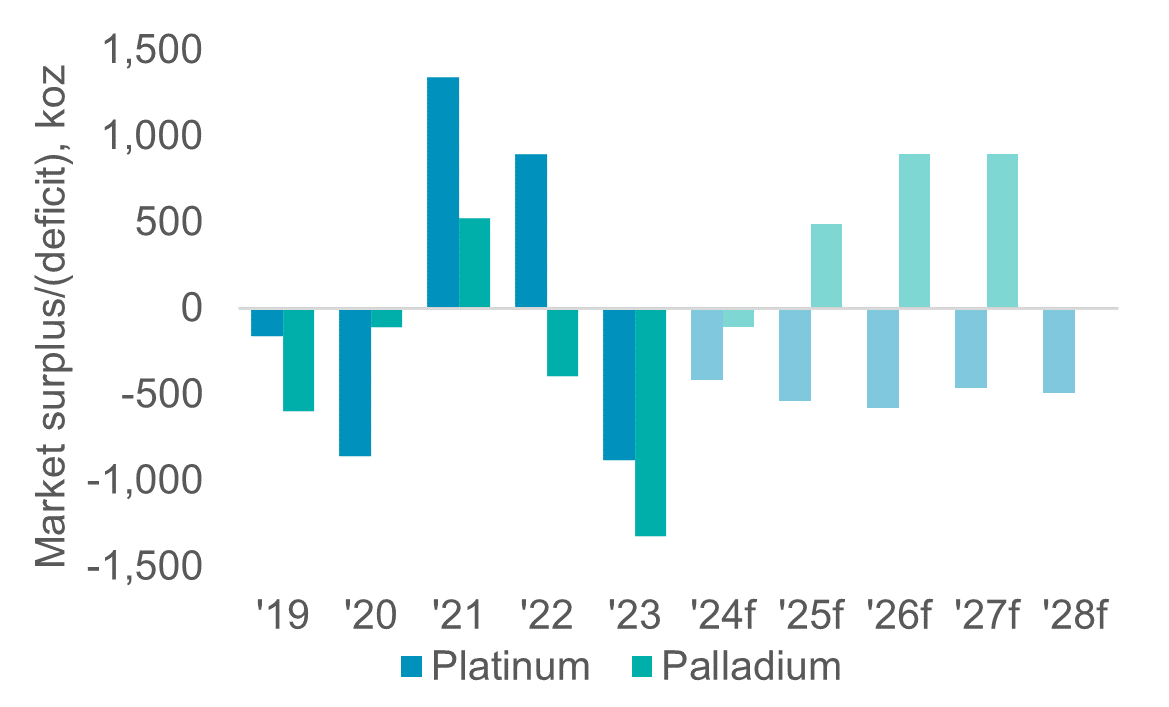

Figure 2: Palladium market deficits may extend longer

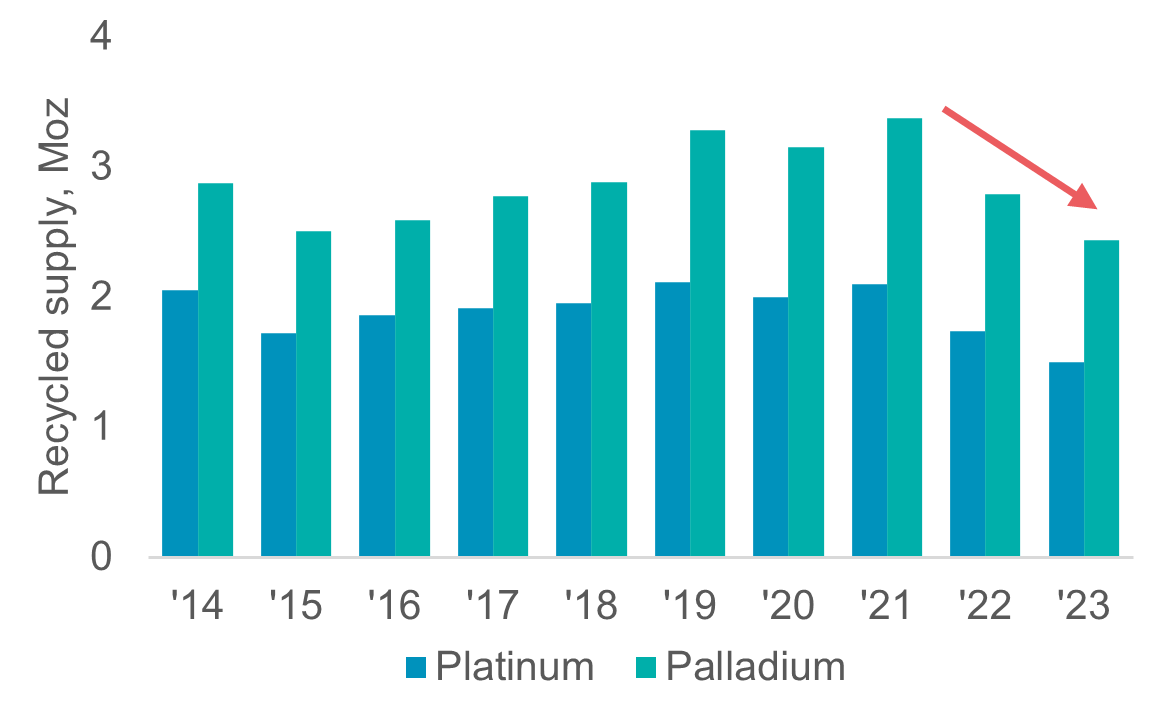

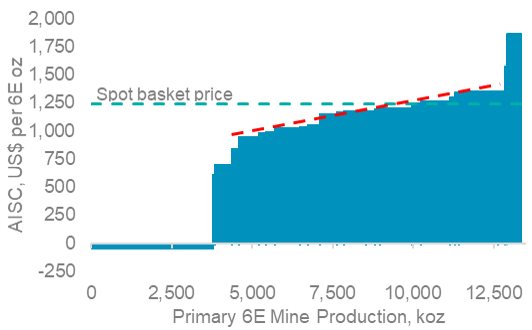

Notably, PGM supply risks already appear skewed to the downside, 1) low levels of profitability may lead to restructuring of several mines (Fig. 8), 2) recycled PGM supply has been depressed for two-years with growing uncertainty about ~1 Moz of incremental secondary supply growth by 2028f.

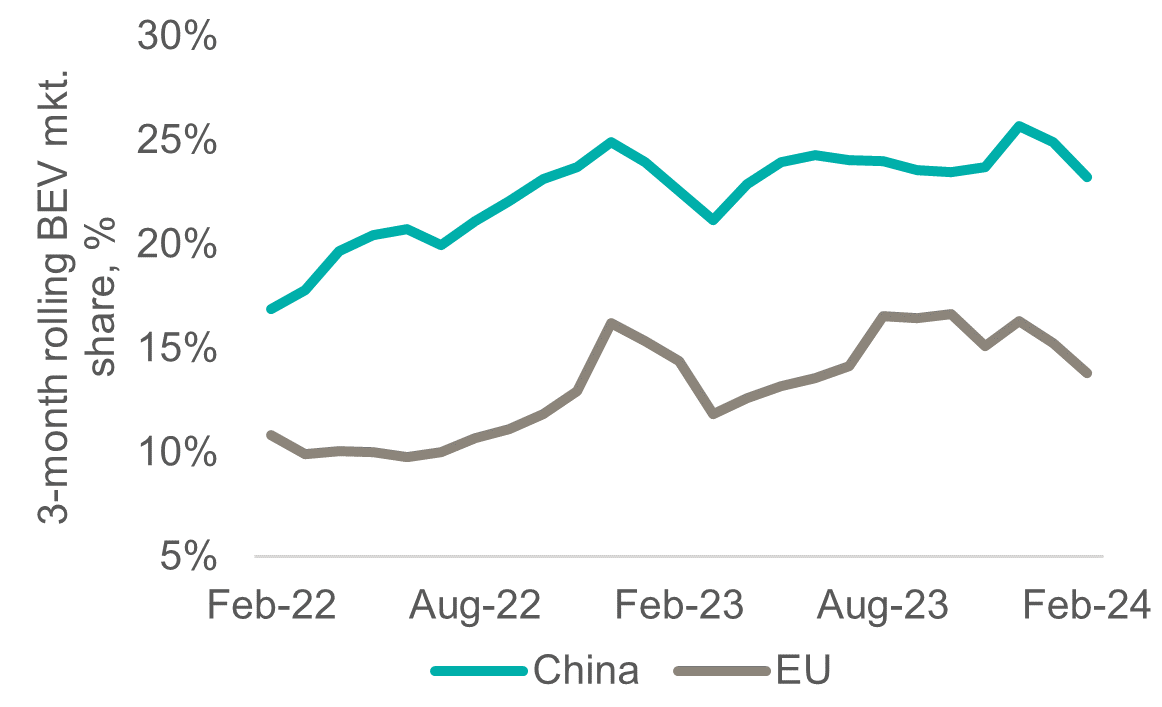

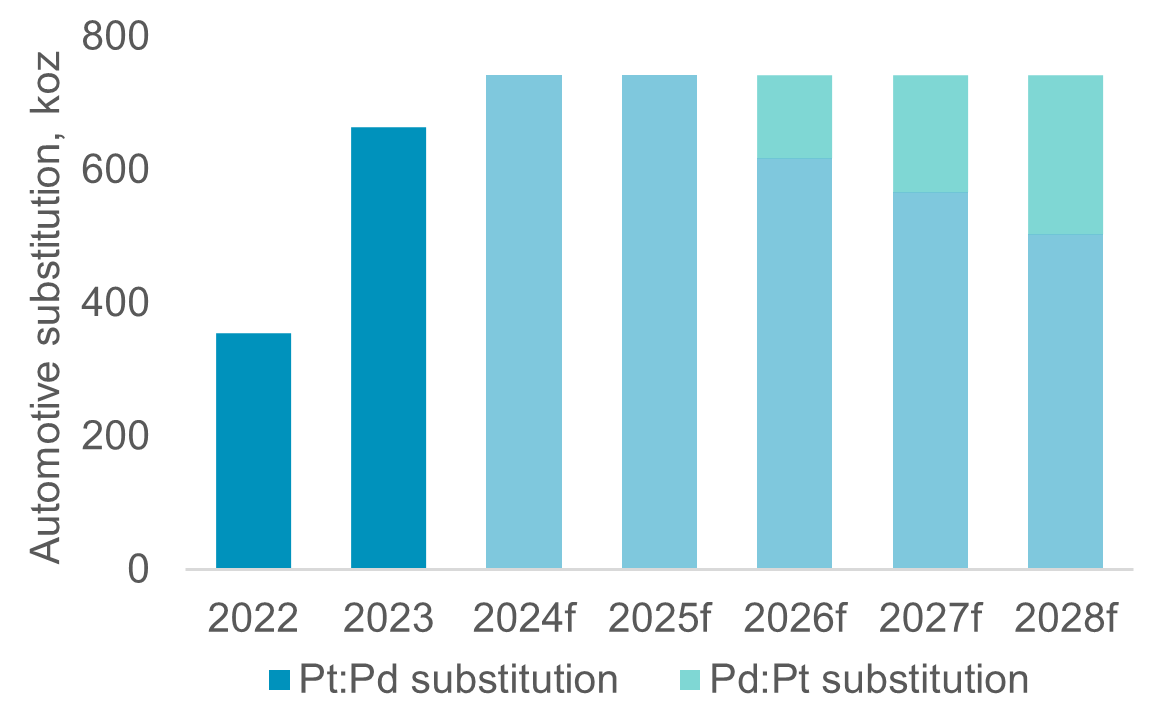

Considering the impacts of diversifying away from Russian nickel, the critical mineral supply chain for BEVs would deteriorate as OEMS are also aiming to avoid emission intensive Indonesian nickel. While BEVs will continue gaining market share, trade frictions may slow already moderating BEV market share gains (Fig. 5). Slower BEV growth could extend palladium market deficits (Fig. 2) ahead of reverse substitution from 2026f (Fig. 6). Ultimately, the combination of some heightened supply uncertainty and prospective automotive demand longevity should serve to bolster weak PGM sentiment most notably for palladium where prices declined by -39% in 2023 (-8% YTD) despite an estimated market deficit of 1.3 Moz (13% of demand). WPIC highlights that supply demand fundamentals are strong for platinum and improving in the short term for palladium and that markets are ignoring the challenges facing the drivetrain transition particularly within a heightened geopolitical risk environment.

Platinum’s attraction as an investment asset arises from:

- WPIC research indicates the platinum market entering a period of consecutive deficits from 2023.

- Platinum supply remains challenged, hampered by production challenges in South Africa and with recycling supplies.

- Automotive platinum demand growth should continue due principally to substitution in gasoline vehicles.

- Growing off a small base, hydrogen will be a major source of platinum demand in the future.

- The platinum price remains historically undervalued and significantly below both gold and palladium.

Figure 3: LME futures prices pared gains after an initial sharp response to US and UK sanctions on Russian base metals

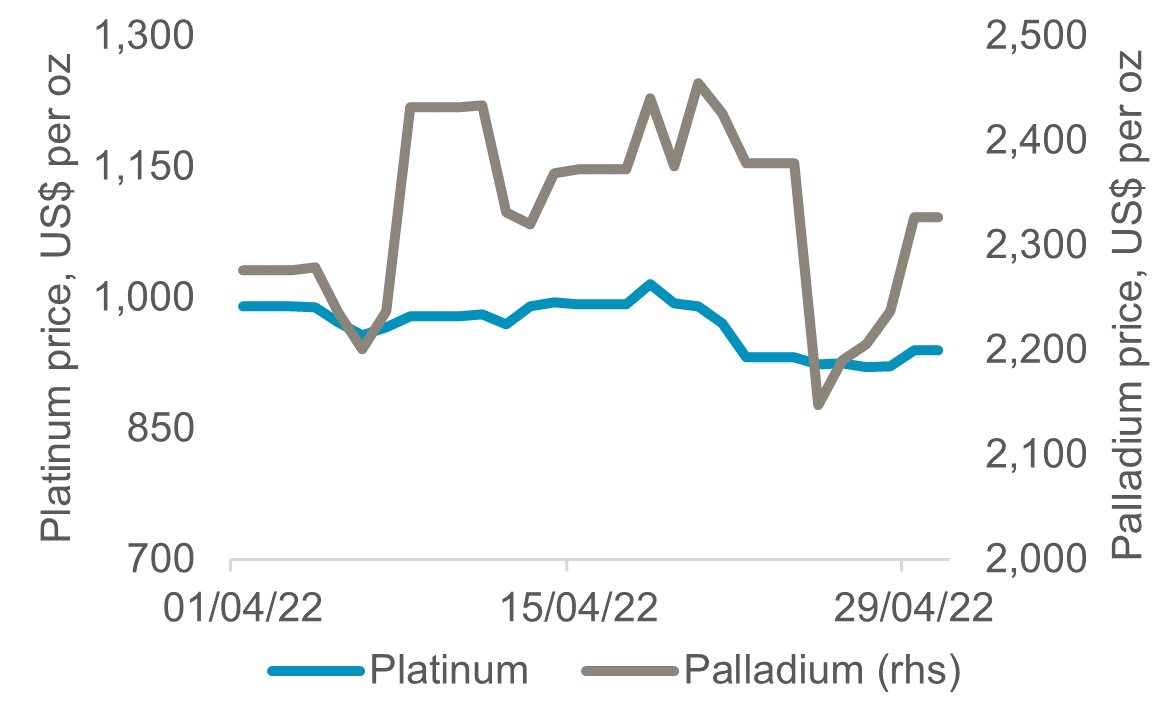

Figure 4: Similarly, LPPM sanctions on Russian PGMs did not result in sustained PGM price increases beyond the initial 8 April 2022 shock

Figure 5: The rate of light-duty BEV market share gains is slowing suggesting PGM containing ICE and hybrid vehicle demand will have a long-tail into the 2030s

Figure 6: Palladium for platinum automotive substitution is likely to drive net incremental palladium demand growth from 2026f

Figure 7: Recycled PGM supply has declined over the past two-years due to changing consumer habits, regulatory clampdowns, and profitability headwinds

Figure 8: The PGM all-in-sustaining-cost curve suggests a large minority of primary supply is loss making at spot basket prices

IMPORTANT NOTICE AND DISCLAIMER: This publication is general and solely for educational purposes. The publisher, The World Platinum Investment Council, has been formed by the world’s leading platinum producers to develop the market for platinum investment demand. Its mission is to stimulate investor demand for physical platinum through both actionable insights and targeted development: providing investors with the information to support informed decisions regarding platinum; working with financial institutions and market participants to develop products and channels that investors need.

This publication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. With this publication, the publisher does not intend to transmit any order for, arrange for, advise on, act as agent in relation to, or otherwise facilitate any transaction involving securities or commodities regardless of whether such are otherwise referenced in it. This publication is not intended to provide tax, legal, or investment advice and nothing in it should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. The publisher is not, and does not purport to be, a broker-dealer, a registered investment advisor, or otherwise registered under the laws of the United States or the United Kingdom, including under the Financial Services and Markets Act 2000 or Senior Managers and Certifications Regime or by the Financial Conduct Authority.

This publication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your investment objectives, financial circumstances and risk tolerance. You should consult your business, legal, tax or accounting advisors regarding your specific business, legal or tax situation or circumstances.

The information on which this publication is based is believed to be reliable. Nevertheless, the publisher cannot guarantee the accuracy or completeness of the information. This publication contains forward-looking statements, including statements regarding expected continual growth of the industry. The publisher notes that statements contained in the publication that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect actual results. The logos, services marks and trademarks of the World Platinum Investment Council are owned exclusively by it. All other trademarks used in this publication are the property of their respective trademark holders. The publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the publisher to any rights in any third-party trademarks

WPIC Research MiFID II Status

The World Platinum Investment Council -WPIC- has undertaken an internal and external review of its content and services for MiFID II. As a result, WPIC highlights the following to the recipients of its research services, and their Compliance/Legal departments:

WPIC research content falls clearly within the Minor Non-Monetary Benefit Category and can continue to be consumed by all asset managers free of charge. WPIC research can be freely shared across investment organisations.

- WPIC does not conduct any financial instrument execution business. WPIC does not have any market making, sales trading, trading or share dealing activity. (No possible inducement).

- WPIC content is disseminated widely and made available to all interested parties through a range of different channels, therefore qualifying as a “Minor Non-Monetary Benefit” under MiFID II (ESMA/FCA/AMF). WPIC research is made freely available through the WPIC website. WPIC does not have any permissioning requirements on research aggregation platforms.

- WPIC does not, and will not seek, any payment from consumers of our research services. WPIC makes it clear to institutional investors that it does not seek payment from them for our freely available content.

More detailed information is available on the WPIC website:

https://www.platinuminvestment.com/investment-research/mifid-ii

Contacts:

Edward Sterck, Research, [email protected]

Wade Napier, Research, [email protected]

Jacob Hayhurst-Worthington, Research, [email protected]

Brendan Clifford, Head of Institutional Distribution, [email protected]

WPIC does not provide investment advice.

Please see disclaimer for more information.